It’s a new week, and a new historical high. The S&P 500 index reached a new all-time high on Friday, marking the third time this week and the sixth time in July that the record has been broken. The market continues to ignore the ongoing tariff escalations (30% tariffs on Mexico and the EU), the emerging price pressures indicated in the latest CPI data, and the latest farce of attempting to remove Federal Reserve Chairman Powell “for cause.”

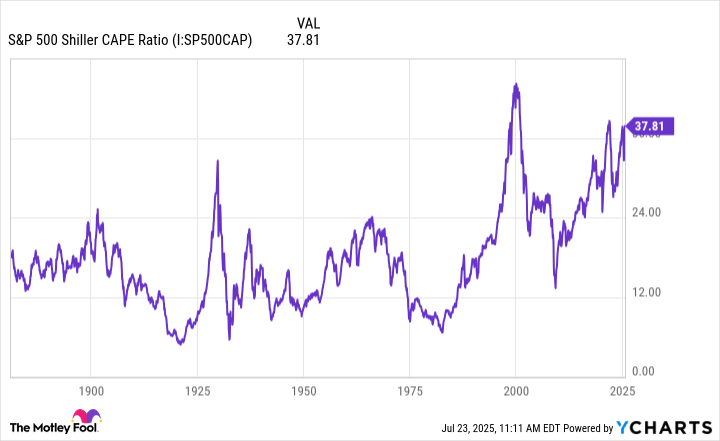

The recent surge has pushed the S&P 500 index’s price-to-earnings ratio close to its own historical peak, coinciding with the upcoming second-quarter earnings season, where investors are paying a high price for any form of equity exposure.

Meanwhile, encouraged by the stock market performance, President Trump has reignited his tariff escalation efforts and is planning to increase tariffs on specific industries based on existing tariffs on certain countries, reportedly to be implemented within two weeks. The initial target industries will be pharmaceuticals and semiconductors, aiming to cover the entire spectrum of U.S. imports.

Despite facing new threats, the market has largely ignored this round of tariff escalations, with “tariff-sensitive” sectors continuing to underperform the benchmark index. Whether due to expectations of an eventual “TACO” moment (indicating a de-escalation of trade tensions), a reduction in targeted attacks on major trading partners (with the anticipated Xi-Trump meeting in South Korea), or confidence in the private sector’s ability to withstand shocks, the market is likely to remain deaf to trade conflicts until further notice.

Speaking of policy, the Trump administration has stirred up a new round of controversy regarding the Federal Reserve, with reports suggesting that Chairman Powell could be dismissed due to significant budget overruns on building renovations. Yes, you read that right!

Some renovations at the Federal Reserve’s Washington headquarters, costing about $2.5 billion, have put Powell in hot water due to project management issues, with costs exceeding initial estimates by about $600 million. When asked on Tuesday whether the expensive renovations constituted grounds for dismissal, Trump said, “I think to some extent they do.” — The Hill

After this absurd claim was leaked, Trump quickly retracted his threat, and the market overwhelmingly agrees that Powell will complete his term until 2026.

Meanwhile, Fed Governor Waller took a somewhat unconventional step by expressing “dissent” in advance, publicly stating that he favors a rate cut at the July meeting, arguing that “the private sector is not performing as well as everyone thinks,” and that the U.S. labor market is “on the edge,” as most jobs are concentrated in the public sector.

With the Fed’s rhetoric turning dovish and the stock market continuing to hit new highs, is it surprising that the market is currently in the same risk appetite mode as the past two months? Or is the market pricing in a dovish Fed in advance, thus getting ahead of the upcoming rate cuts and leading to the narrative of a “Goldilocks economy”?

In any case, inflation expectations have quietly returned, global long-term yields remain high, and the inflation breakeven points have climbed to their highest levels in years, while financial conditions remain loose.

Data from the past week has also cooperated well, with the University of Michigan reporting a slight improvement in consumer confidence regarding current conditions and future expectations, while one-year inflation expectations have dropped to pre-tariff implementation levels (4.4% vs. previous 5.0%).

This week, the earnings season will reach its peak, with Tesla and Google’s parent company Alphabet set to announce their earnings on Wednesday. According to Bloomberg, of the 498 S&P 500 constituents, 58 have reported earnings, exceeding expectations by 7.8%. Even as earnings grow, the price-to-sales (P/S) and price-to-earnings (P/E) ratios of U.S. and global stocks have risen to or above historical highs, with investors paying “full price” for increased risk exposure at this moment.

Surprisingly, despite the continuous market rise, we have not seen extreme sentiment readings in traditional momentum indicators: the American Association of Individual Investors bull-bear ratio remains near the midpoint of its range, and search engine queries for “surge” stories remain at historical lows.

Have the macro doomsayers finally been completely extinguished? Has everyone accepted the creed that “the stock market only goes up”? Don’t short against the trend…

The cryptocurrency space has certainly not missed its own “fear of missing out” moment. Ethereum has performed exceptionally well, nearing the $4,000 mark (up 22% over five trading days), and some major altcoins have also recorded double-digit gains this week. Bitcoin has also reached its own all-time high, breaking $118,000, although the excitement is somewhat restrained. Before further notice, it feels like good times are back.

The ETH/BTC ratio has temporarily revived from the grave, improving to its best level since the first quarter. Some attribute this to the focus on stablecoins/real-world assets benefiting proof-of-stake networks, while others see Ethereum’s new treasury strategy as a catalyst for the rise. We personally believe this is just a classic risk appetite spillover, as most of the funds from mainstream traditional finance have been fully allocated to Bitcoin over the past seven months.

As a positive milestone, Congress did indeed pass landmark stablecoin legislation last week, exchanging stricter federal and state regulations for more stablecoin payment channels. This may bring some structural tailwinds, as evidenced by the record inflows into Ethereum ETFs over the past two weeks, with total inflows in July exceeding $3 billion, and daily inflows (ranging from $300 million to $500 million) trending 5 to 10 times higher than daily inflows in the first half of this year.

Risking a repetition of most of the summaries from the past eight weeks… never short against a dull market, enjoy the good times rolling in. As we step into the sweltering summer heat, I wish all friends good luck and successful trading!

ChainCatcher reminds readers to view blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice. If you find sensitive information in the content, please click “Report”, and we will handle it promptly.