Long Trade Idea

Enter a long position between 840.03 (the lower band of its horizontal support zone) and 873.07 (the upper band of its horizontal support zone).

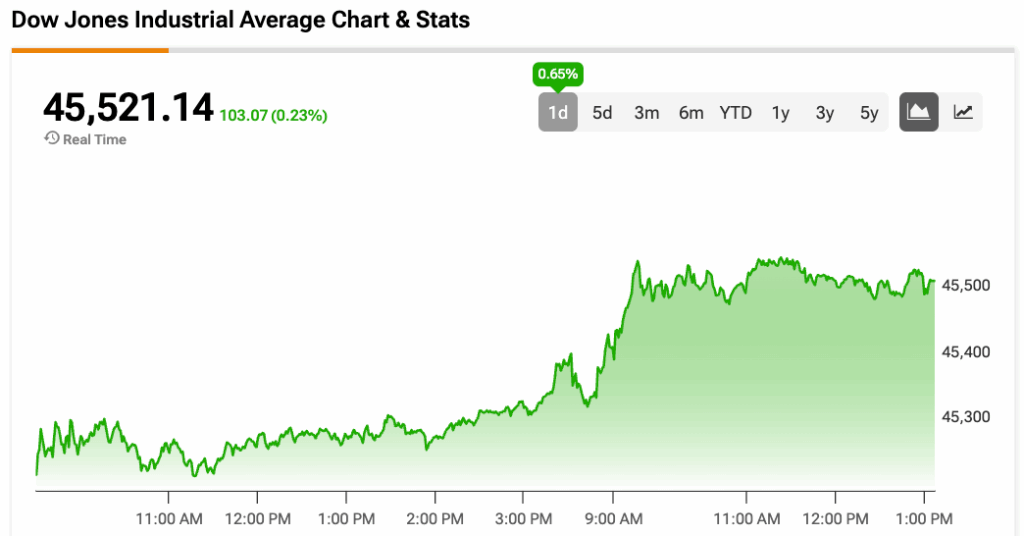

Market Index Analysis

- ServiceNow (NOW) is a member of the S&P 100 and the S&P 500 Indices.

- Both indices hover near record highs, but bearish conditions continue to accumulate.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Equity markets brushed off President Trump’s bid to remove Fed Governor Cook and dismissed his renewed tariff threats as another episode of the TACO (Trump always chickens out) trade. Following yesterday’s positive session, futures suggest more upside amid hopes for NVIDIA earnings due after the bell to confirm the AI trade remains intact. Concerns over an AI bubble began to surface this month, but hopes for an interest rate cut next month have limited the downside. New tariffs on India kicked in today, but investors eagerly await Friday’s US inflation data.

ServiceNow Fundamental Analysis

ServiceNow is a cloud computing software company. It offers the creation and management of automated business workflows. NOW has an active acquisition strategy and is a core player in the AI sector.

So, why am I bullish on NOW despite the sell-off?

NOW has excellent partnerships, including with NVIDIA and ChatGPT. Its recent deal with the German Bundesliga, one of the top three global soccer leagues, could open the door to more sports partnerships. I like its acquisition strategy, which continues to improve its overall business offer. It also announced a statewide training and certification program with SENAI-SP, Latin America’s largest technical education institution. I think NOW is due for a significant price reversal.

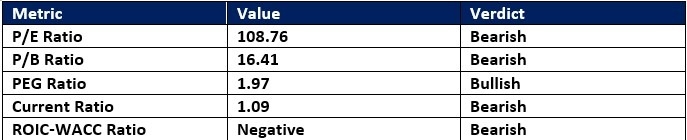

ServiceNow Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 108.76 makes NOW an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.72.

The average analyst price target for NOW is 1,141.44. It suggests excellent upside potential with limited downside risks from current levels.

ServiceNow Technical Analysis

Today’s NOW Signal

ServiceNow Price Chart

- The NOW D1 chart shows price action inside its horizontal support zone.

- It also shows price action challenging its descending 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline and approaching a bullish crossover.

- The latest increase in bearish trading volumes could signal a wash-out of bears and clear the path for a breakout.

- NOW corrected as the S&P 500 moving higher but has more bullish catalysts forming to spark a price action reversal.

My Call on ServiceNow

I am taking a long position in NOW between 840.03 and 873.07. The recent correction has created an excellent entry opportunity. While valuations remain sky-high, the PEG ratio suggests significant upside potential ahead.

- NOW Entry Level: Between 840.03 and 873.07

- NOW Take Profit: Between 1,005.75 and 1,057.39

- NOW Stop Loss: Between 776.63 and 807.00

- Risk/Reward Ratio: 2.61

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.