Short sellers betting against some of the market’s leading AI stocks potentially made billions as markets slid this week and investors moved away from some of the year’s hottest tech trades.

On Wednesday, tech stocks stumbled for a second day, with the tech-heavy Nasdaq Composite’s (^IXIC) 0.7% drop leading declines in the major averages as concerns over the sustainability of the AI boom mounted. The Nasdaq fell 1.5%.

Short sellers, who bet on a company’s stock price going down, have made out handsomely on wagers against a basket of AI-linked companies, reaping $5.6 billion on their positions in the past two trading sessions, according to data from S3 Partners.

It’s been a bit of a rough week for AI stocks.

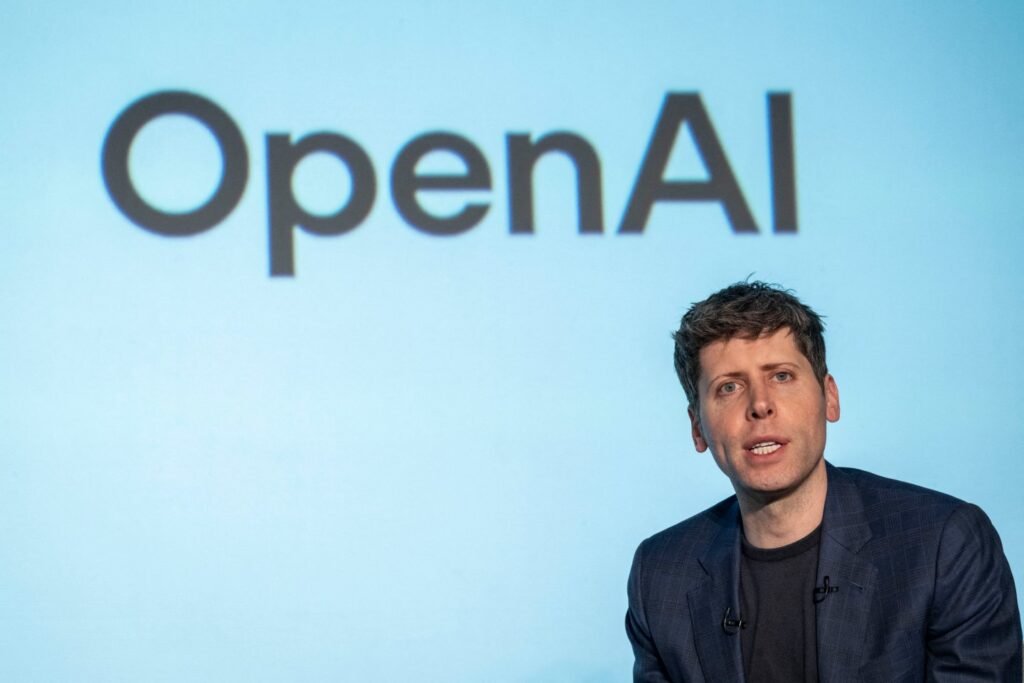

In comments published Friday by the Verge, OpenAI (OPAI.PVT) chief executive Sam Altman said that, while AI is “the most important thing to happen in a very long time,” the technology could be in a bubble similar to the turn-of-the-century dot-com boom that knocked out more than 80% of the Nasdaq’s value when it popped in the early 2000s.

On Monday, researchers for MIT’s Project NANDA released a report saying 95% of companies it studied are getting no return on AI. The findings of the report were first detailed by Fortune on Monday.

Among the Magnificent Seven Big Tech stocks, Meta (META) has taken the biggest hit, dropping 4% over the past five trading sessions, while Nvidia (NVDA) shares are off 3.8% over that period.

Microsoft (MSFT) and Apple (AAPL) shares have lost nearly 3%, while Google (GOOG) shares shed 1%. Short bets on those five companies produced more than $2.8 billion for investors over the past two days.

Outside these tech giants, the losses have been sharper.

Chipmaker Advanced Micro Devices (AMD) has seen its stock fall over 10% over the last five trading sessions, while Broadcom (AVGO) and Micron (MU) shares are off more than 5%.

CoreWeave (CRWV), the AI data center company that rents computing power to Microsoft and Meta — making it essentially an AI pure play — has dropped 24% over that period.

As Meta has doubled and tripled down on its AI investments, the company has in the past few months alone spent billions on acquisitions and handed out nine-figure paychecks to researchers for its Meta Superintelligence Labs.

Nevertheless, investors put $4.7 billion into short positions on Meta in the last seven days as the Facebook and Instagram parent is reportedly looking to downsize its AI division. The short positions have made those investors more than $1.1 billion in the past two days.

One of the biggest losers of the last few days’ rotation has been intelligence technology provider Palantir (PLTR).