Shanghai stocks closed at a 10-year high on Friday, capping their best week in two months, as chip-making and artificial intelligence (AI) stocks jumped after Beijing vowed to focus on technological self-sufficiency.

Policymakers’ pledge to “resolutely” achieve economic targets this year also injected optimism into a market clouded by tariff uncertainty as Chinese and U.S. leaders plan to meet next week in South Korea to defuse trade tensions.

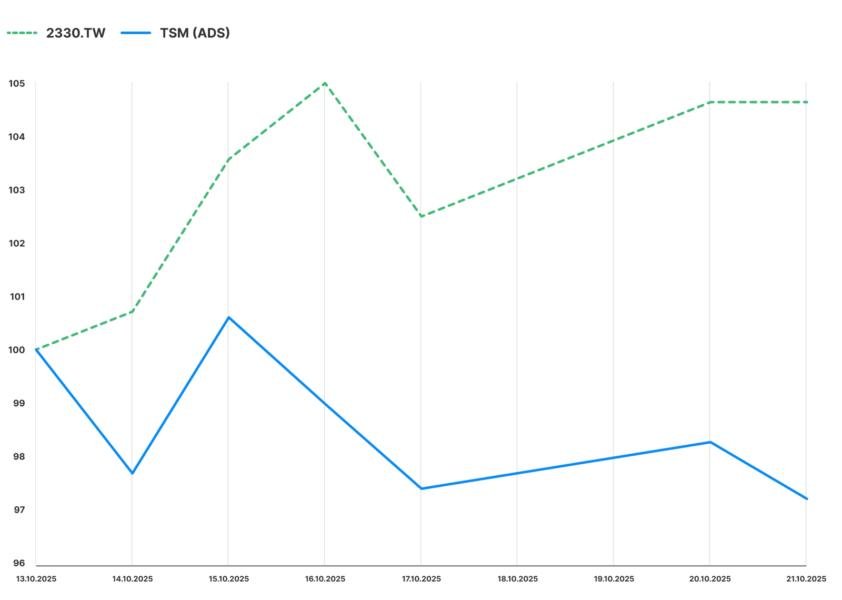

The Shanghai Composite Index 000001 ended a volatile week up 0.7%, hitting its highest level since August 2015. The blue-chip CSI300 Index 3399300 climbed 1.2%.

In Hong Kong, benchmark Hang Seng Index HSI gained 0.7%.

On Thursday, China’s Communist Party elite pledged more efforts to achieve technological self-reliance at the end of a four-day closed-door meeting known as a plenum.

Goldman Sachs said that setting technology and security as top priorities for China’s growth strategy over 2026-30 reflects Beijing’s long-term pursuit for “high-quality growth” and “high-level security”.

China’s chipmakers (.STARCHIP) and AI stocks (.CSI931071) – key in China’s power rivalry with the U.S.- surged in response. The tech-focused STAR 50 Index 0000688 shot up 4.4%.

“We are constructive in what is potentially just the beginning of a longer-term trend in China,” Megan Ie, senior equity analyst at GIB Asset Management said, referring to China’s tech sector.

“This is a development that is underwritten from the top … the demand and the trend is real.”

She added that China’s highly digitalised economy means the country is one of the most ready to have a meaningful application of AI across a range of industries.

The market was also buoyed by expectations of fresh stimulus.

“We reckon that, after the 4th Plenum this week, policy focus might be once again shifted to ensuring short-term growth stability and ending deflation,” Nomura said in a note.

“Fiscal expansion will likely be stepped up, policy rates could be moderately cut, and arrears might be further cleared.”

But consumer stocks 0000932 dropped as investors expect few forceful measures to boost domestic demand. Financial (.CSI932075) and real estate shares (.CSI000948) also declined as the sectors were hardly mentioned in China’s five-year plan.