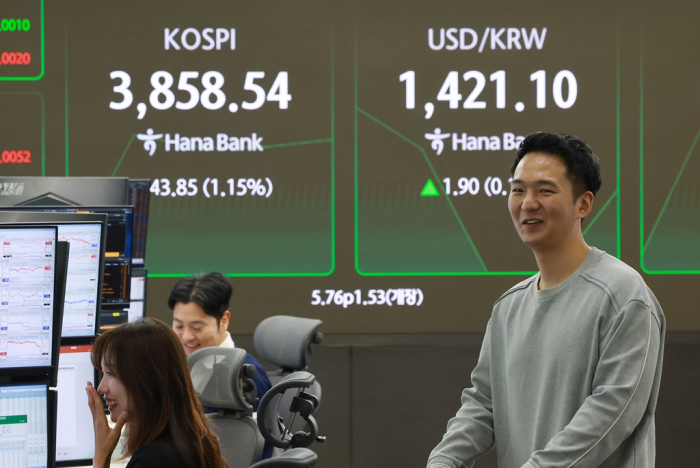

South Korea’s benchmark Kospi index has surged past 3,800 points, cementing its position as the world’s best-performing major stock market this year amid an investor frenzy over semiconductor stocks.

On Monday, the index closed at a record 3,814.69, up 1.76% from last Friday.

Seoul shares continued to rise in early Tuesday trade, with the index opening at 3,851.01, extending a rally that has lifted the Kospi index nearly 60% so far this year.

That outpaces gains in Hong Kong’s Hang Seng index, up 31.8%, and Japan’s Nikkei 225, up 25.1%, making Seoul’s benchmark the global frontrunner.

With the Kospi now comfortably above 3,800 and the chip trade showing no signs of fatigue, investors are debating whether Korea’s equity rally has further to run, analysts said.

To keep investor interest in Korean stocks, the Korea Exchange (KRX) said it will slash stock trading fees by up to 40% for two months starting in December – the first overhaul of its pricing structure since the bourse operator’s debut in 2005.

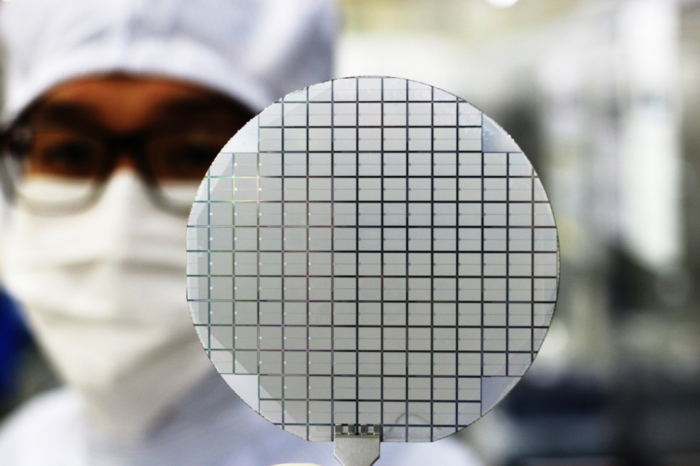

BLISTERNING RUN IN CHIPMAKERS

The milestone has been driven overwhelmingly by a blistering run in chipmakers such as Samsung Electronics Co. and SK Hynix Inc., which together have accounted for nearly two-thirds of the market’s gains since September.

According to the Korea Exchange (KRX), foreign investors have poured a combined 9.8 trillion won ($6.9 billion) into the two stocks over the past six weeks, betting on an extended rebound in memory-chip prices and rising global demand for artificial intelligence hardware.

Since early September, the Kospi has jumped from around 3,100 to above 3,800, pushing the total market capitalization of the KRX’s main board to 3,088 trillion won as of Oct. 17 from 2,583 trillion won in early September.

Samsung’s market cap swelled by 179 trillion won over the same period to 579.5 trillion won, while SK Hynix added 152.5 trillion won.

The two accounted for 65.8% of the overall increase, underscoring how the chip rally has defined the current bull market.

The KRX Semiconductor Index has soared 52% since September, dwarfing gains in other sectors.

The healthcare gauge rose just 4.7% over the same period, while previous market leaders such as Hanwha Ocean Co. and Hanwha Aerospace Co. climbed only 1.5% and 7.8%, respectively.

In mid-September, global investment banks JPMorgan and CSLA called Korea “the most attractive market in Asia,” followed by India, Hong Kong, China and Taiwan, as the region enters what it described as a “Goldilocks rally.”

FEAR OF MISSING OUT

Portfolio managers, fearful of missing out on the chip boom, have been forced to chase the rally.

“Managers are selling other holdings to add semiconductor exposure, including leveraged ETFs,” said a domestic equities head at a Seoul-based asset manager. “When Samsung moves like this, liquidity across other sectors dries up. Many small- and mid-cap or biotech fund managers are feeling severe FOMO.”

Brokerages expect semiconductor dominance to continue into the rest of the year.

Samsung Securities Co. raised its year-end target for the Kospi to 4,050, citing an upgrade in earnings forecasts for chipmakers.

Over the past month, 12-month forward earnings estimates for Kospi 200 companies have been revised up by 9.4%, with semiconductors alone contributing 8.8 percentage points, industry data showed.

“Export prices for chips are rising sharply,” said Yang Il-woo, a Samsung Securities analyst. “We expect this semiconductor-led bull market to persist for now.”

Still, some strategists warn against excessive concentration.

“The market has clearly entered a long-term uptrend, so there’s no need to panic-buy semiconductors,” said Jeong Sang-jin, head of equities at Korea Investment Management Co. “Other sectors like shipbuilding, defense and entertainment are only lagging due to temporary fund flows. Their fundamentals remain intact, offering attractive entry points.”

Write to In-Soo Nam at isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.