Photo used for representation purpose only.

| Photo Credit: Reuters

The rupee traded in a narrow range and depreciated 4 paise to 85.72 against the US dollar in early trade on Monday (June 9, 2025), weighed down by elevated crude oil prices and the dollar index.

Forex traders said while the rupee benefitted from the initial reaction to the RBI rate cut, the aggressive rate cut narrows the interest rate differential with global peers.

At the interbank foreign exchange, the domestic unit opened at 85.61 against the greenback. In initial trade, it witnessed an early high of 85.60 and a low of 85.72 against the American currency, registering a fall of 4 paise over its previous close.

On Friday, the rupee pared initial losses and appreciated 11 paise to close at 85.68 against the US dollar, after the Reserve Bank cut repo rate by a higher-than-expected 50 basis points to prop up growth.

“While the rupee benefited from the initial reaction, the aggressive rate cut narrows the interest rate differential with global peers, which would put pressure on the rupee and make Indian assets less attractive,” CR Forex Advisors MD Amit Pabari said.

Adding to the pressure, Brent prices rose by 2 per cent to USD 66 per barrel, driven by heightened Russia-Ukraine tensions, which could widen India’s trade deficit, as India is a net oil importer, making the rupee more vulnerable in the near-to-medium term.

Along with the Dollar Index on the rise, the rupee might face short-term pressure.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading lower by 0.16 per cent at 99.02.

Brent crude, the global oil benchmark, fell 0.06 per cent to USD 66.43 per barrel in futures trade.

“The USD/INR is expected to trade within a range, with strong resistance at 86.10-86.20 and key support between 85.20-85.50. A breakout above 86.20 could trigger further weakness in the rupee, potentially pushing the pair towards 86.50 to 86.80,” Pabari added.

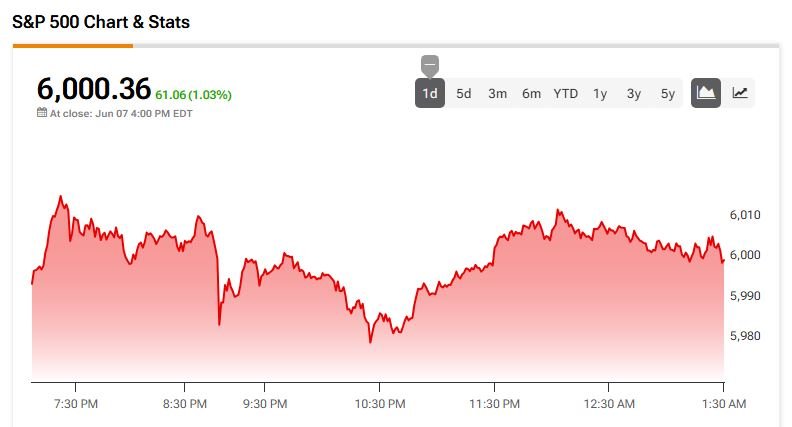

In the domestic equity market, the 30-share BSE Sensex advanced 342.48 points, or 0.42 per cent, to 82,531.47, while the Nifty rose 93.30 points, or 0.37 per cent, to 25,103.20.

Foreign institutional investors (FIIs) purchased equities worth Rs 1,009.71 crore on a net basis on Friday, according to exchange data.

Published – June 09, 2025 10:20 am IST

![The display board at the Hana Bank dealing room in Jung District, central Seoul, shows the Kospi index and other indicators on June 9. [YONHAP]](https://koala-by.com/wp-content/uploads/2025/06/c2d16ac7-e806-4d27-be52-f60ba0825392.jpg)