Image used for representation purpose only.

| Photo Credit: Reuters

The rupee appreciated 8 paise to 87.50 against the U.S. dollar in early trade on Monday (August 11, 2025), tracking a weak American currency, as investors await cues from the upcoming talks between Russia and the U.S.

Forex traders said the Indian rupee opened with small gains on Monday (August 11, 2025) and is expected to remain within a range of 87.25/87.80 while markets are in a wait-and-watch mode for the U.S. and India CPI inflation and the U.S.-Russia talks on August 15.

At the interbank foreign exchange, the domestic unit opened at 87.56 against the U.S. dollar, then touched an initial high of 87.50, higher by 8 paise over its previous close.

On Friday (August 8, 2025), the rupee pared its intra-day losses and ended flat at 87.58 against the U.S. dollar.

Meanwhile, Brent crude prices fell 0.48% to $66.27 per barrel in futures trade.

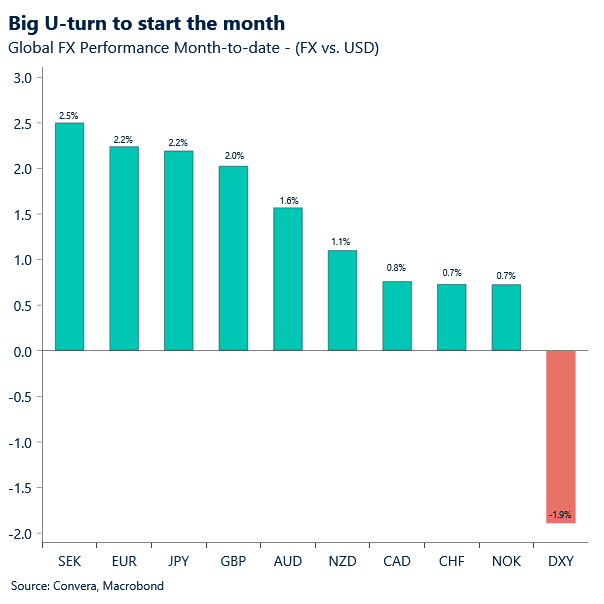

The dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 0.11% to 98.07.

Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP said the U.S.-Russia talks on August 15 could solve India’s problem of additional 25 bps tariffs by the U.S. if a ceasefire happens between the two nations.

India on Saturday (August 9, 2025) welcomed the summit talks between U.S. President Donald Trump and his Russian counterpart Vladimir Putin on the Ukraine war, and reaffirmed Prime Minister Narendra Modi’s consistent position that it is not an “era of war”.

India has been consistently calling for ending the Russia-Ukraine conflict through dialogue and diplomacy.

“Meanwhile, as the Reserve Bank of India (RBI) protects weakness in the rupee by selling dollars, exporters may sell their near-term receivables and importers may buy cash/weekly positions at the lows for the day,” Bhansali said.

Meanwhile, India’s forex reserves dropped by $9.322 billion to $688.871 billion for the week ended August 1 in one of the highest declines in the recent past, the RBI data showed on Friday (August 8, 2025).

The overall reserves rose by $2.703 billion to $698.192 billion in the previous reporting week.

In the domestic equity market, Sensex climbed 104.84 points to 79,962.63 in early trade, while the Nifty was trading up 55.85 points to 24,419.15.

Foreign institutional investors (FIIs) turned net buyers after several days and purchased equities worth ₹1,932.81 crore on Friday (August 8, 2025), according to exchange data.

Published – August 11, 2025 10:02 am IST