Photo used for representation purpose only.

| Photo Credit: Reuters

The rupee gained 21 paise to 85.87 against the U.S. dollar in early trade on Thursday (June 26, 2025), mainly due to a weakened greenback in the global markets.

However, a rise in global crude oil prices and FII outflows prevented sharp gains in the local unit, according to forex traders.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.27 per cent down at 97.41 after strengthening in the previous session.

“The greenback clocked more losses on a report that U.S. President Donald Trump is to announce the successor to Federal Reserve Chairman Jerome Powell much earlier than expected in a likely bid to undermine Powell and spur expectations for interest rate cuts,” Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP, said.

At the interbank foreign exchange, the rupee opened at 85.91 against the dollar before rising further to 85.87, up 21 paise from its previous close.

On Wednesday, the rupee gave up its gains to settle lower by 3 paise at 86.08 against the U.S. dollar.

“Yesterday, there was good U.S. Dollar buying at 85.80 from oil companies and FPIs who were sellers in equity, keeping the rupee lower at 86.08. However, the dollar index fell and the euro rose, giving the rupee a strong opening with the day’s range expected between 85.75 and 86.25,” Bhansali said.

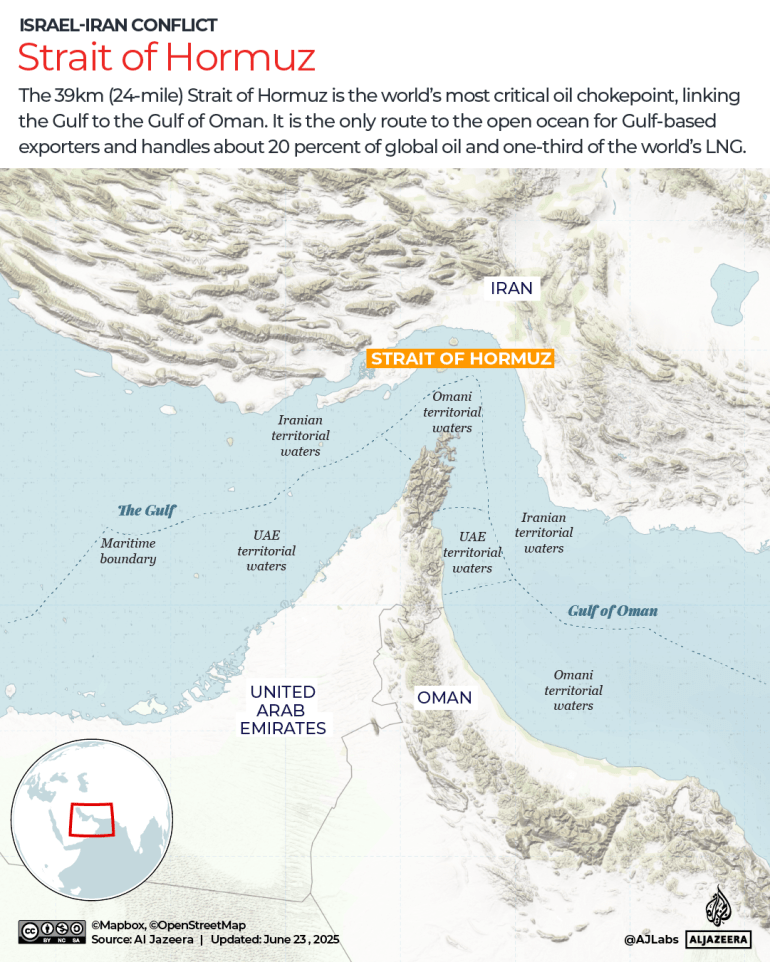

Brent crude, the global oil benchmark, rose 1.30% to $68.01 per barrel in futures trade.

According to Bhansali, Brent oil prices edged higher on bumper U.S. inventory drawdown, which helped spur some optimism over strong demand, while weakness in the US dollar also kept oil prices up.

“The truce between Iran and Israel seems to be holding, diminishing supply disruptions in the West Asia,” he added.

Foreign institutional investors (FIIs) offloaded equities worth ₹2,427.74 crore on a net basis on Wednesday, according to exchange data.

Published – June 26, 2025 10:14 am IST