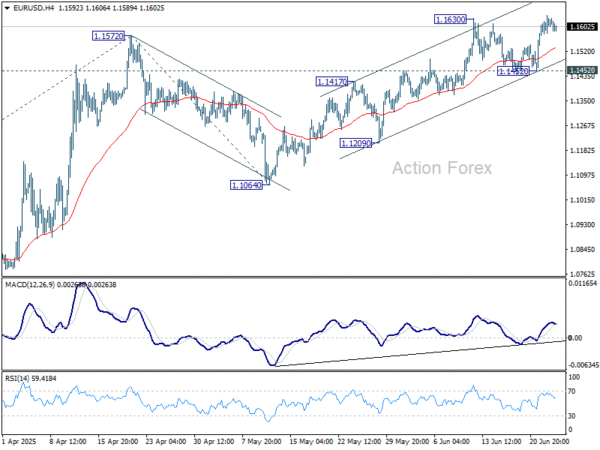

However, rise in global crude oil prices — which had declined for two consecutive sessions — and FII outflows limited the gains for the local unit, according to forex traders.

At the interbank foreign exchange, the rupee opened at 86.00 before rising to 85.92, up 13 paise from its previous close. The local unit had logged its steepest single-day gain in nearly five years on Tuesday to end 73 paise higher at 86.05 against the greenback.

Brent crude, the global oil benchmark, rose 1.30 per cent to USD 68.01 per barrel in futures trade after US President Donald Trump brokered a ceasefire between Iran and Israel.

“Brent oil prices rose slightly after falling in the last two sessions with focus squarely on whether a US-brokered ceasefire between Israel and Iran will hold or not. The White House was also close to announcing a few more trade deals that raised the optimism for risky assets,” Bhansali said.

Live Events

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading up marginally by 0.06 per cent at 97.91. “The dollar struggled to regain lost ground on Wednesday as investors who have been starved of good news latched on to the optimism of fragile truce between Iran and Israel as a reason to take more risk,” Bhansali said, adding that the range of 85-87 continues for the dollar rupee pair. Meanwhile, in the domestic equity market, Sensex jumped 426.79 points to 82,481.90 in early trade while Nifty was up 123.25 points to 25,167.60.

Foreign institutional investors (FIIs) offloaded equities worth Rs 5,266.01 crore on a net basis on Tuesday, according to exchange data.