Image for representation

| Photo Credit: Reuters

The rupee declined 11 paise to 87.36 against the U.S. dollar in early trade on Friday (August 22, 2025) amid a rise in dollar demand.

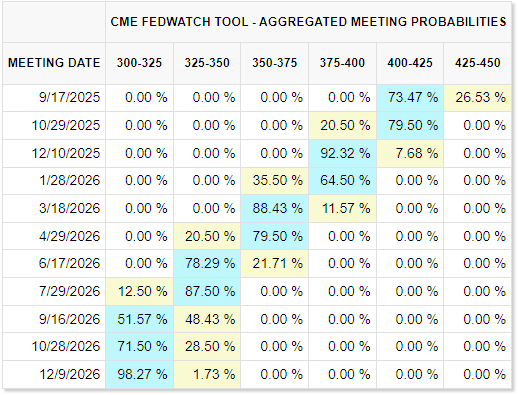

However, positive FII inflows and a decline in crude oil prices prevented sharper losses in the local unit as traders awaited US Fed Chief Jerome Powell’s speech at the Jackson Hole Symposium later in the day, forex traders said.

The rupee opened at 87.47 against the U.S. dollar and inched up to 87.36, down 11 paise from its previous close.

The rupee pared initial gains on Thursday to settle lower by 18 paise at 87.25 against the greenback.

“The rupee fell yesterday (Thursday) as importers and a big public sector bank bought dollars. Rupee was unable to pierce the support of 86.92 yesterday (Thursday) as dollar buying emerged on dips though FPIs were buyers of Indian equity,” Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP, said.

“Uncertainty on tariffs remained as we approach August 27, the day on which 25% additional tariffs will be imposed by the US on Indian exports,” he said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, gained 0.10% to 98.72.

Brent crude, the global oil benchmark, was trading 0.18% down at $67.55 per barrel in futures trade.

“Brent oil prices were steady on Friday morning amid sustained risk aversion before more cues on US monetary policy from Fed Reserve Chair Jerome Powell. Oil prices, however, headed for weekly gains amid increasing signs that peace negotiations between Russia and Ukraine were stalling,” Bhansali added.

On the domestic equity market front, stock markets declined 262.05 points to 81,738.66 in early trade, while Nifty dropped 81.55 points to 25,002.20.

Foreign Institutional Investors purchased equities worth Rs 1,246.51 crore on Thursday, according to exchange data.

Published – August 22, 2025 10:35 am IST