For US households, there’s still no alternative to the stock market.

The TINA trade in stocks — which stands for There Is No Alternative — was thought to be waning in recent years as rising interest rates since 2022 boosted bond yields for the first time in years, giving investors another option to lock in steady returns.

However, TINA appears to be back in full swing, and the impulse is particularly strong in US retirement accounts like 401(k)s, Goldman Sachs analysts wrote in a recent note.

Strategists at the bank pointed to red-hot demand for stocks in US retirement accounts, with total 401(k) allocations to equities in the US swelling to $8.9 trillion in 2024.

In 2022, 71% of 401(k) assets were allocated to stocks, up from 66% in 2013. Among account owners in their 20s, the allocation is even higher, with the average investor allocating 90% of their portfolio to stocks, the bank found.

ICI, EBRI, Goldman Sachs Global Investment Research

Retail traders, meanwhile, have snapped up around a net $20 billion in stocks over the last three months, according to estimates from Goldman’s trading desk.

GS FICC & Equities, Goldman Sachs Global Investment Research

Altogether, roaring demand from retirement accounts and retail brokerage accounts paints a healthy backdrop for the stock market. US household demand is a key pillar of strength for the market, the bank said.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

US households have raised their total stock allocation to 49% in recent years, the highest level on record, and the bank said it expects households to directly purchase $425 billion in equities this year.

Federal Reserve, Goldman Sachs Global Investment Research

Those are signs that the TINA trade is in full swing, a major bullish catalyst for stocks, strategists said

“TINA trade remains alive and well in US retirement accounts,” a team of strategists led by David Kostin wrote in a note on Friday. “We believe that persistent household equity demand and high allocations to equities will continue to support elevated equity valuations.

However, the bank also notes that the top 10% of households by wealth represent 87% of household equity ownership, meaning demand is being driven by a relatively small slice of the population. The analysts added that an even smaller group—the top 1%—has been the primary driver of equity demand in the last 30 years.

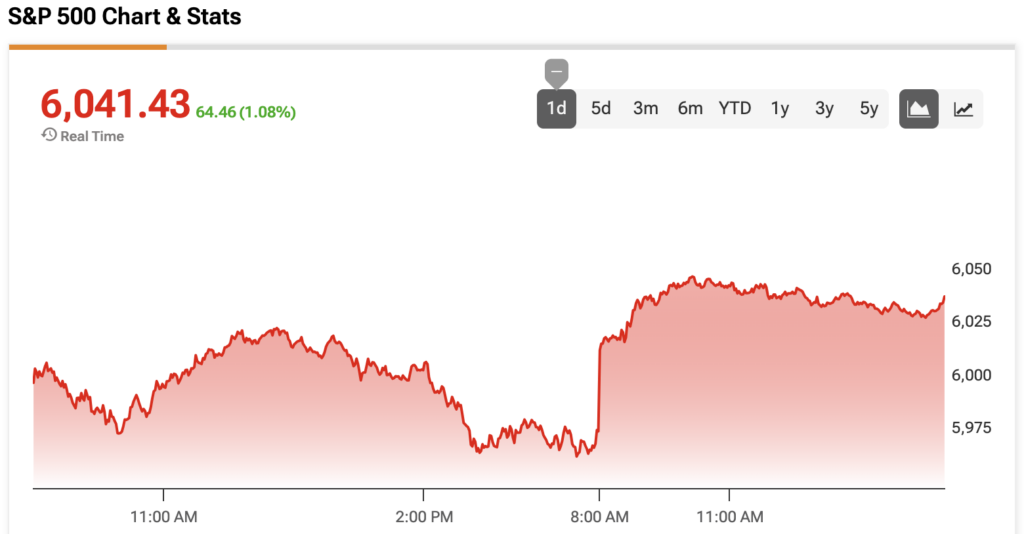

The bank anticipates the S&P 500 rising to a record high of 6,500 over the next 12 months, implying 7% upside from the index’s current levels.

FactSet, Goldman Sachs Global Investment Research

Goldman recently lifted its year-end price target for the S&P 500 to 6,100. Previously, the bank slashed its target for the index to account for the impact of tariffs, but has since lifted its economic outlook amid the easing trade tensions and progress on negotiations.