Chinese automaker Chery has managed to gain a massive foothold in the European EV market, leaving other automakers shocked at its ability to get into a highly competitive market so quickly.

Reuters broke down Chery and other Chinese automakers’ quick move into the market and how they’ve managed to get a foothold in such a short amount of time. Chery wanted to launch its Omoda 5 SUV in Europe, but doing so would require an overhaul of the EV SUV’s suspension to accommodate the continent’s faster, windier, bumpier roads.

So the company’s engineers overhauled the vehicle’s design over the course of a weekend and began shipping the EVs to Europe within six weeks.

“You can forget doing something that fast with a European automaker,” said Riccardo Tonelli, Chery’s senior vehicle-dynamics expert, who led the overhaul. “It’s impossible.”

Ensuring safety would be one of those reasons, but if the move still went through a thorough quality assurance process during those intervening weeks, the aggressive move is impressive, also expanding access to more eco-friendly, cost-effective vehicles.

Quick-turn versatility and aggressiveness, especially on price, have been the defining features of Chinese automakers’ sudden takeover of the EV market around the world. With massive workforces (BYD employs 900,000 workers, which is almost as many as Toyota and Volkswagen combined) and a supply chain that is fully self-contained, China’s automakers have made a huge splash in the market, seeing sales soar from 4.6 million cars in 2020 to 9.5 million in 2024.

Compare Chery’s quick turn to a company like Tesla, which has seen sales decline in virtually every global market in 2025, behind a lineup of sedans and compact SUVs that haven’t seen a major design update in several years.

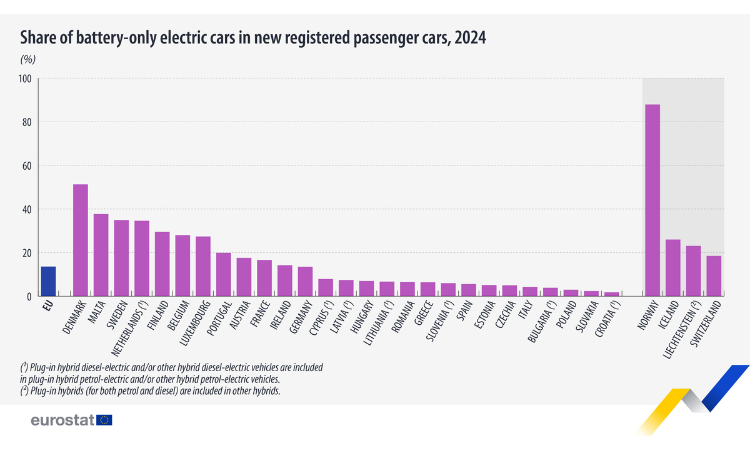

Three Chinese automakers have cracked the top 12 in global sales, and as they further enter the European market, that share continues to grow.

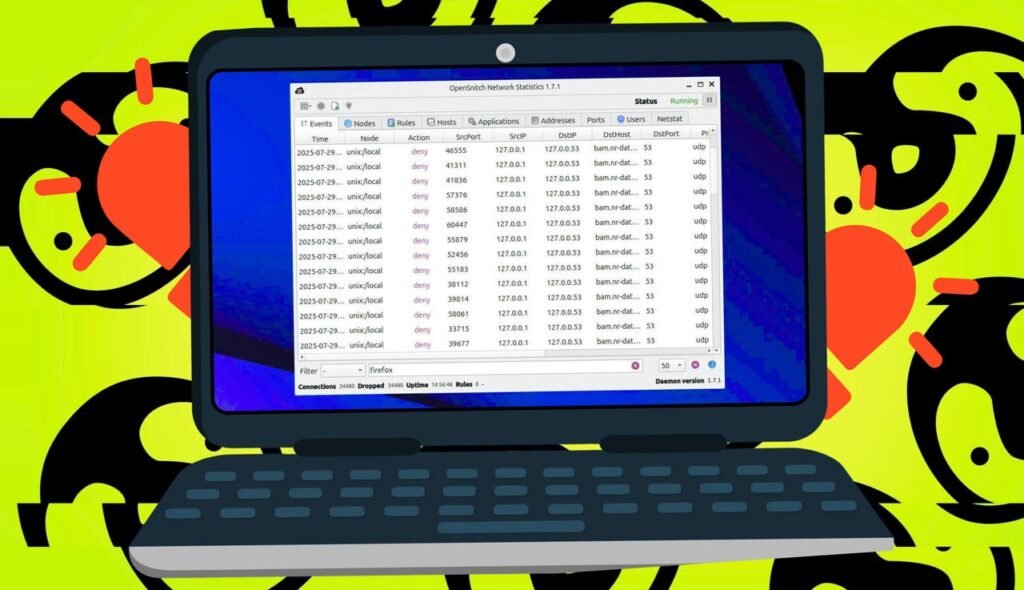

However, while their accelerated development and design process gets things to the market faster, it’s not without risks. With less time spent on real-world safety testing and more focus on AI modeling, it’s unclear how well their cars will hold up over the long term.

And without access to the U.S. market, which has essentially locked Chinese companies out of the country, it could be difficult for them to continue their meteoric rise much further on the global market.

“It will be pretty challenging for BYD to reach that goal without access to the U.S. market,” said Tu Le, founder of consultancy Sino Auto Insights, of BYD’s global sales target.

But with a versatile production line and the ability to produce new models as fast as new technology is rolled out, it’s clear that Chinese manufacturers pose a very real threat to Western companies’ stranglehold on the global EV market.

Join our free newsletter for good news and useful tips, and don’t miss this cool list of easy ways to help yourself while helping the planet.