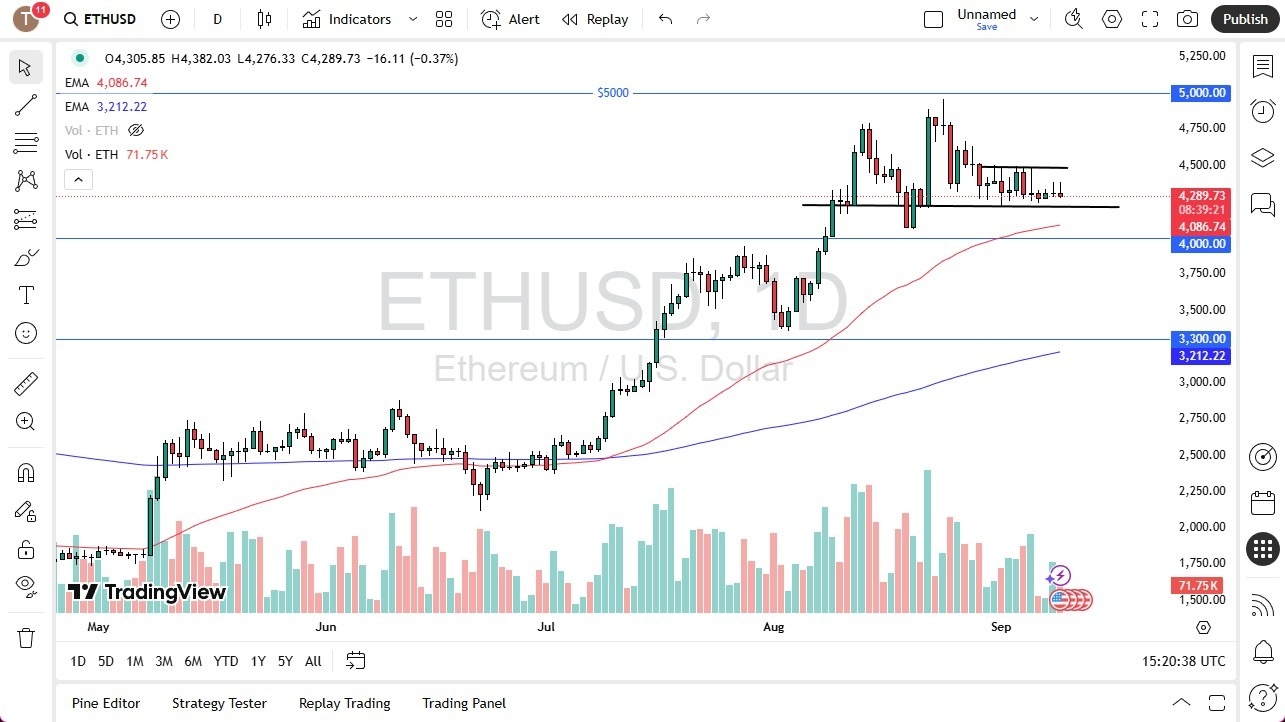

- Ethereum initially did rally during the trading session here on Tuesday, but you can see that we gave back quite a bit of the gains and now we are just hanging around the $4,300 level yet again.

- This is a market that has been struggling between basically $4,200 at the bottom and $4,500 at the top.

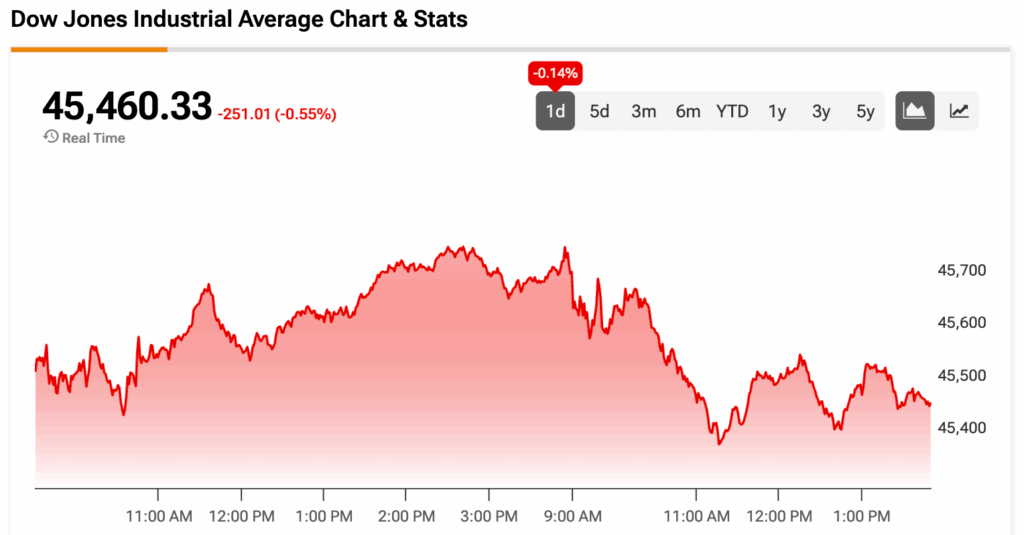

With this being the case, I think we are in a bit of a holding pattern and that makes quite a bit of sense considering that Bitcoin seems to be in a bit of a holding pattern. Furthermore, there are a lot of concerns when it comes to crypto in general and perhaps more importantly, risk appetite. Risk appetite being poor would work against Bitcoin and Ethereum which is even further on the risk appetite spectrum.

The technical analysis for this market has been relatively flat for the last two weeks or so. And I think at this point in time we are trying to find some type of floor that perhaps the buyers can launch from. The $4200 level seems to have been that for a couple of days, but we also have the 50 day EMA sitting just below the $4100 level and then we have the psychological and structural importance of the $4,000 level that has been both support and resistance previously on the upside.

If Buyers Break the Resistance

If we were to break above the $4,500 level, then it opens up the possibility of running towards the $5,000 level. But right now, this is a market that looks tired in a market that looks like we may just have to kind of grind back and forth. If you’re a short-term back and forth type of range-bound trader, this might be a good market for you. But if you’re looking for bigger moves, we are going to need to see some type of major influence to make risk appetite come back to the markets on the whole, not just here in Ethereum.

Ready to trade our ETH/USD forecast? We’ve made a list of the best Forex crypto brokers worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.