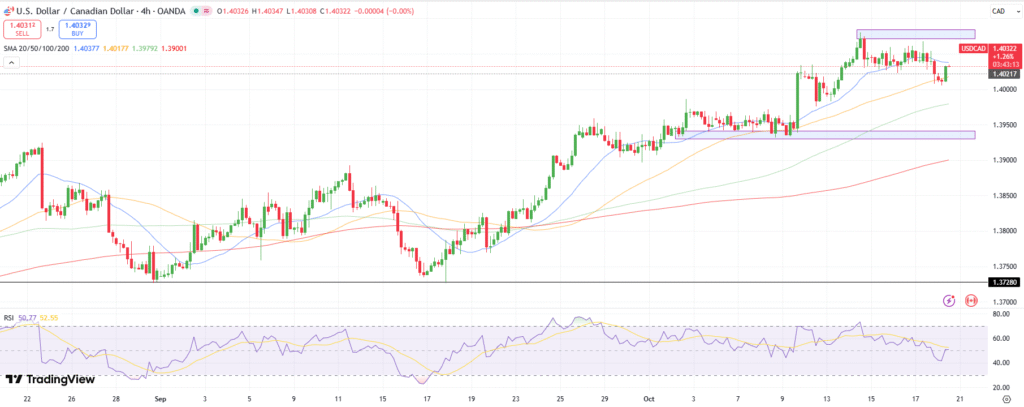

Today’s Gold Analysis Overview:

- The overall of Gold Trend: Strongly bullish.

- Today’s Gold Support Points: $4210 – $4160 – $4070 per ounce.

- Today’s Gold Resistance Points: $4380 – $4440 – $4500 per ounce.

Today’s Gold Trading Signals:

- Sell Gold from the resistance level of $4440 with a target of $4100 and a stop-loss of $4500.

- Buy Gold from the support level of $4160 with a target of $4380 and a stop-loss of $4100.

Technical Analysis of Gold Price (XAU/USD) Today:

What happened in the gold trading market at the end of last week was completely normal. Intraday gold prices gains culminated in a new historic record high of $4380 per ounce, the highest price in the history of gold. It was natural to see a technical correction via profit-taking selling operations, which drove the price of the yellow metal towards the support level of $4186 per ounce. With the factors driving gains in the gold market still in effect, prices closed around the $4250 per ounce level.

Is It Better to Buy Gold Now?

According to gold analyst forecasts, the general trend for the gold price index remains strongly bullish, at least as long as it remains stable above the psychological resistance of $4000 per ounce. Experts are increasingly divided following the gold’s large gains and the sharp near-term decline, while key investor positions have remained relatively stable. According to the forecasts, gold trading has seen strong performance and may need some rest. Silver and platinum prices are seeing corrections today, which signals a slowdown in the upward momentum of precious metals.

According to some experts, “We would like to see a correction to $4000. It has been a historic, unidirectional rise, and any genuine correction would establish a more durable base to test the next historic resistance of $5000 per ounce. The metal’s general trend remains bullish, as the weakness of the US Dollar, the fully anticipated interest rate cuts, and the US government dysfunction are all factors pointing to higher gold prices.”

In general, we can expect some volatility after the significant gains we have seen over the past week and month. We do not anticipate any intense sell-offs, either in terms of price or time, because the main factors that have driven gold purchases over the past three years are still valid. However, a temporary pause and market reorganization would not be unwelcomed and would not affect the long-term outlook.

Trading Advice:

The bullish path for gold remains the strongest. Therefore, we expect renewed gold buying on every sharp decline in prices. But never risk, and closely monitor the factors influencing the gold market to achieve the best entry levels.

Factors Influencing Gold Trading

The gold trading market is expected to continue being affected by the following events. With the ongoing federal government shutdown in the United States, financial markets are forced to rely on private sector data, which will include existing home sales and manufacturing figures this week. However, markets will receive some official inflation figures, as the Bureau of Labor Statistics recalled a limited number of workers to release the US Consumer Price Index (CPI) report for September, so the government can calculate the annual cost-of-living adjustment for Social Security beneficiaries before November 1.

Next Thursday, financial markets will receive existing home sales for September, and the CPI report for September is scheduled for release on Friday, followed by the S&P Global Flash Purchasing Managers’ Index (PMI).

On another note, and across the platforms of trusted brokerage firms, the yield on the US two-year Treasury bond has hit a three-year low, and the yield on the ten-year bond has hit a six-month low. The US Dollar Index (DXY) is seeing its worst week since early August. While the global market is experiencing sharp volatility, gold is not only a safe haven but also exhibits some risk-taking trading characteristics.

According to some analysts, “Although gold’s momentum appears unsustainable, strong investors are still investing in market dips. We saw investment inflows begin last month. The gold index rose by 880% year-on-year last month. This is unsustainable. Accordingly, we will see the gold price at $5000. It may retrace, but even if it falls to $4000.”

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.