Forex trading remains subdued and directionless, with most major pairs and crosses holding within Friday’s ranges. Traders appear to be in wait-and-see mode ahead of a packed US data schedule. The spotlight turns first to Tuesday’s ISM Manufacturing report, then to Thursday’s ISM Services and the highly anticipated non-farm payrolls. Until then, price action might continued to stay constrained within recent ranges.

On the trade front, Japan’s negotiator Ryosei Akazawa returned from his seventh round of talks in Washington without securing a clear path forward. US President Trump said he may move ahead with a 25% tariff on Japanese autos, even as Tokyo had requested a review of the measure. Akazawa said he remains committed to reaching an agreement while safeguarding Japan’s economic interests.

Yen leads performance today so far, but weak momentum suggests it’s vulnerable to reverse. Swiss Franc and Kiwi also trade firmer. Sterling lags at the bottom, with Dollar and Aussie also soft. Euro and Canadian Dollar are trading in the middle of the board.

Focus will soon shift to the BoJ’s quarterly Tankan survey, due in the Asian session. The report will offer the first full snapshot of business sentiment following the latest round of US trade measures. Economists expect a modest deterioration in confidence among both manufacturing and service firms, with particular concern about weakening export demand.

Expectations for another BoJ rate hike this year have already faded in recent weeks. A weak Tankan report would reinforce this dovish repricing, especially as trade headwinds mount.

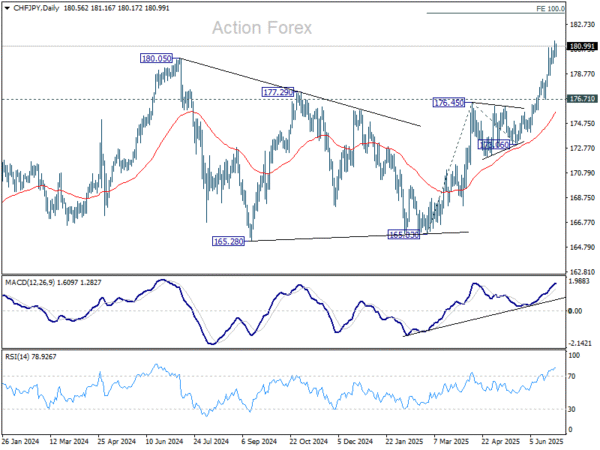

Technically, CHF/JPY’s break of 180.05 resistance last week confirmed long term up trend resumption. Further rally should be seen to 100% projection of 165.83 to 176.45 from 173.06 at 183.68 next. Outlook will continue to stay bullish as long as 176.71 support holds, in case of retreat.

In Europe, at the time of writing, FTSE is down -0.19%. DAX is down -0.19%. CAC is up 0.05%. UK 10-year yield is down -0.019 at 4.487. Germany 10-year yield is down -0.01 at 2.582. Earlier in Asia, Nikkei rose 0.84%. Hong Kong HSI fell -0.87%. China Shanghai SSE rose 0.59%. Singapore Strait Times fell -0.05%. Japan 10-year JGB yield closed flat at 1.436.

Swiss KOF barometer Falls to 96.1, manufacturing outlook worsens

Switzerland’s KOF Economic Barometer dropped to 96.1 in June from 98.6, missing expectations of 99.3 and marking a renewed deterioration in growth momentum.

The decline reflects broad-based weakness across most underlying components, according to KOF, with the manufacturing sector highlighted as being “considerably under pressure.”

While the overall tone was negative, there was a slight offset from improved foreign demand indicators.

Japan’s industrial production rises 0.5% mom in May, far below expectation

Japan’s May industrial output came in far below expectations, rising just 0.5% mom versus the anticipated 3.4% mom growth. Though production improved in key sectors such as machinery and autos, five categories—led by non-auto transport equipment—recorded declines.

Shipments rose 2.2% mom, while inventories fell -1.9% mom, offering some positive signals, but not enough to shift the ministry’s cautious tone.

METI maintained its assessment that output “fluctuates indecisively”. A poll of manufacturers showed expectations for a muted 0.3% mom rise in June and a -0.7% mom drop in July.

China’s PMI manufacturing rises to 49.7, small firms lag

China’s official NBS PMI Manufacturing rose slightly to 49.7 in June, up from 49.5 and matching expectations. While still in contraction for a third straight month, the improvement in production (51.0) and new orders (50.2) suggests some stabilization in activity. Large manufacturers led the gains, with their PMI rising to 51.2, but conditions for small enterprises deteriorated sharply, with a 2-point drop to 47.3.

The Non-Manufacturing PMI also inched up to 50.5 from 50.3, supported by a rebound in construction activity. The construction business activity index rose to 52.8, while services slipped marginally to 50.1. Composite PMI rose to 50.7 from 50.4, reinforcing the picture of a subdued recovery.

NZ ANZ business confidence jumps to 46.3, but growth headwinds persist

Business confidence in New Zealand improved notably in June, with the ANZ headline index rising from 36.6 to 46.3 and firms’ Own Activity Outlook climbing from 34.8 to 40.9. Inflation expectations held steady at 2.71%.

ANZ warned that the underlying environment remains difficult, citing ongoing cost pressures, tight margins, and a global backdrop that continues to “impeding risk-taking”. The bank highlighted that while the 0.8% qoq Q1 growth was solid, the outlook for Q2 appears “not looking nearly so positive. Despite stronger sentiment, actual business conditions and demand may remain under pressure in the months ahead.

ANZ continues to forecast more rate cuts from the RBNZ than the central bank currently projects, arguing that the recovery will likely fall short of policymakers’ expectations. Still, it acknowledged that the RBNZ appears inclined to move slowly, balancing inflation risks with a softening economic backdrop.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.24; (P) 144.59; (R1) 145.01; More…

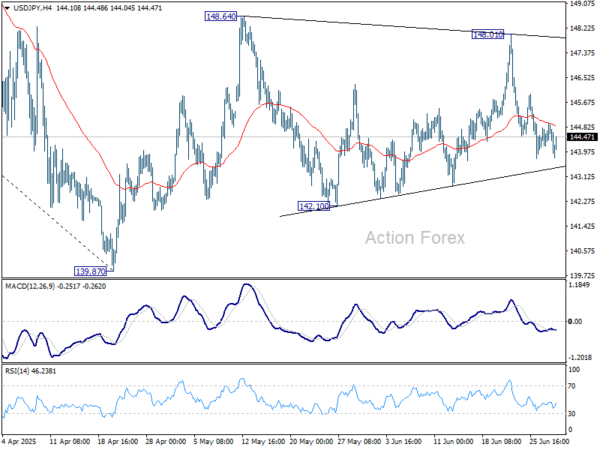

Intraday bias in USD/JPY stays neutral range trading continues inside 142.10/148.01. On the upside, firm break of 148.01 resistance will resume the rise from 139.87 to 61.8% retracement of 158.86 to 139.87 at 151.22. However, break of 142.10 will bring deeper fall back to retest 139.87 low.

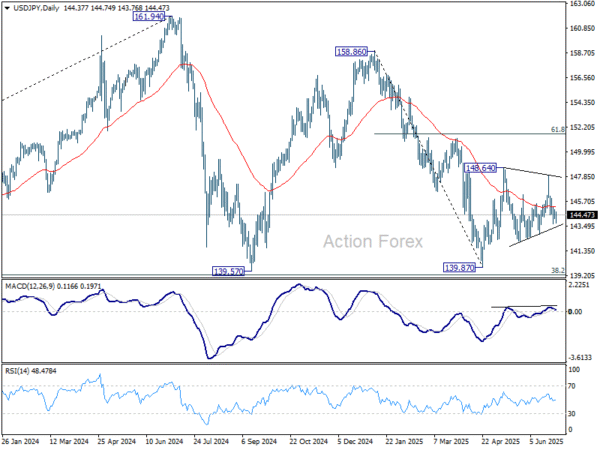

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low), with fall from 158.86 as the third leg. Strong support should be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M May P | 0.50% | 3.40% | -1.10% | |

| 01:00 | AUD | TD-MI Inflation Gauge M/M Jun | 0.10% | -0.40% | ||

| 01:00 | NZD | ANZ Business Confidence Jun | 46.3 | 36.6 | ||

| 01:30 | AUD | Private Sector Credit M/M May | 0.50% | 0.70% | 0.70% | |

| 01:30 | CNY | NBS Manufacturing PMI Jun | 49.7 | 49.7 | 49.5 | |

| 01:30 | CNY | NBS Non-Manufacturing PMI Jun | 50.5 | 50.3 | 50.3 | |

| 05:00 | JPY | Housing Starts Y/Y May | -34.40% | -14.80% | -26.60% | |

| 06:00 | EUR | Germany Import Price Index M/M May | -0.70% | -0.30% | -1.70% | |

| 06:00 | EUR | Germany Retail Sales M/M May | -1.60% | 0.50% | -1.10% | |

| 06:00 | GBP | GDP Q/Q Q1 | 0.70% | 0.70% | 0.70% | |

| 06:00 | GBP | Current Account (GBP) Q1 | -23.5B | -19.7B | -21.0B | |

| 07:00 | CHF | KOF Economic Barometer Jun | 96.1 | 99.3 | 98.5 | 98.6 |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y May | 3.90% | 4.00% | 3.90% | |

| 08:30 | GBP | M4 Money Supply M/M May | 0.20% | 0.20% | 0% | |

| 08:30 | GBP | Mortgage Approvals May | 63K | 61K | 60K | |

| 12:00 | EUR | Germany CPI M/M Jun P | 0.00% | 0.20% | 0.10% | |

| 12:00 | EUR | Germany CPI Y/Y Jun P | 2.00% | 2.10% | ||

| 13:45 | USD | Chicago PMI Jun | 42.7 | 40.5 |