QIAGEN N.V. QGEN recently launched Ingenuity Pathway Analysis (“IPA”) Interpret, a new feature designed to simplify and accelerate the interpretation of complex biological data. Leveraging AI technology, IPA Interpret helps researchers understand which genes are involved in a disease, a biological process or a response to a drug or environmental condition.

IPA Interpret is an integrated component of QIAGEN IPA. The latest launch aims to expand the QIAGEN Digital Insight (“QDI”) portfolio.

QGEN Stock’s Trend Following the News

Subsequent to the news, QGEN stock’s price moved north 0.2% to $46.06 at after-market trading yesterday. QIAGEN has been gaining synergies from its continuous efforts to integrate AI technology into the company’s QDI portfolio. Earlier this year, QIAGEN introduced QIAGEN Clinical Insight (“QCI”) Interpret to bring significant performance and scalability enhancements for high-throughput NGS labs moving to larger test panels and higher test volumes. Additionally, the company released an AI-driven biomedical knowledge base to drive data-driven drug discovery. Henceforth, we expect QIAGEN stock to remain positive surrounding the latest launch.

QIAGEN currently has a market capitalization of $9.65 billion. The company delivered an average earnings surprise of 3.52% for the trailing four quarters.

About QIAGEN’s IPA Interpret

IPA Interpret combines extensive knowledge with advanced analyses and AI algorithms to automatically analyze, compare and contextualize complex gene expression datasets available in IPA, identifying key biological processes, pathways and networks in a streamlined web-page report. Additionally, IPA Interpret provides updated graphical representations of key results, enhancing the clarity and impact of the insights.

One of the standout features of IPA Interpret is its ability to generate comprehensive reports that can be easily shared with colleagues and collaborators. With a simple link, researchers can distribute their findings, fostering collaboration and accelerating the dissemination of scientific knowledge.

Industry Prospects Favor QIAGEN

Per a report from the Business Research Company, the biological data visualization market has seen substantial growth, increasing from $0.61 billion in 2023 to an anticipated $0.70 billion in 2024, with a compound annual growth rate of 15.1%. Key factors influencing the market growth are the adoption of high-throughput technologies, the emergence of single-cell analysis techniques and advancements in imaging techniques.

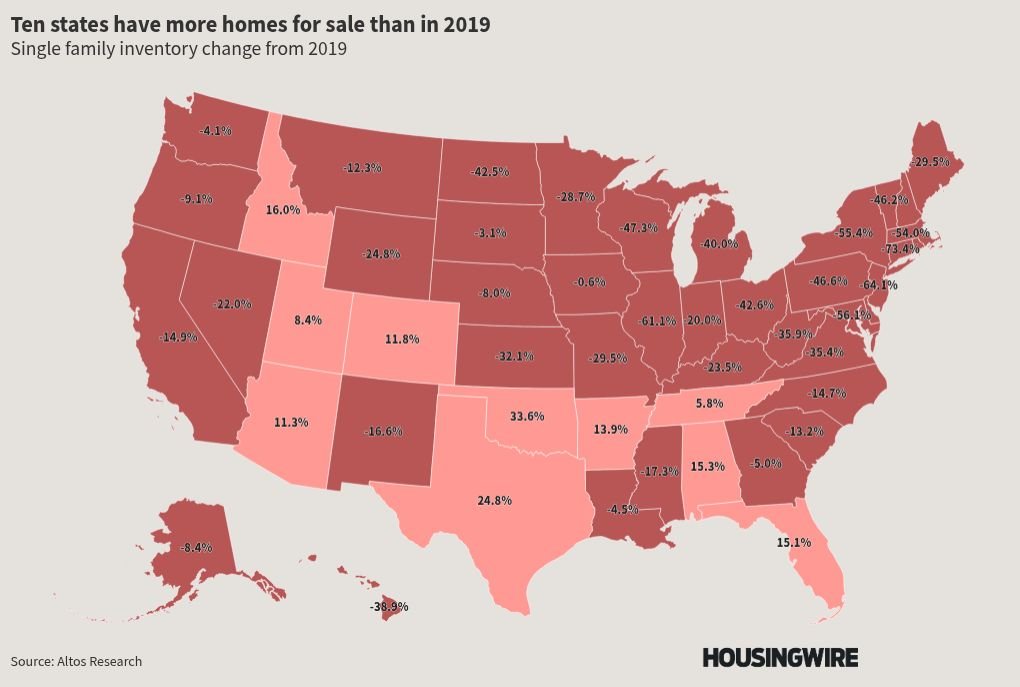

Image Source: Zacks Investment Research

Recent Developments by QIAGEN

Earlier this month, QIAGEN reached a milestone with more than 1000 EZ2 Connect automated sample preparation instrument placements. The updated EZ2 Connect has quickly become a market-leading instrument for sample preparation and data management, contributing to more than 5,500 EZ series instruments placed globally. The latest development highlights customers’ trust in QIAGEN’s automation portfolio to enhance laboratory operations.

Additionally, QIAGEN launched two new tools for designing and ordering custom solutions to support microbial analysis of bacterial, fungal and viral targets.

QGEN Stock’s Price Performance

In the past year, QGEN’s shares have risen 7.3% compared with the industry’s 5.6% growth.

QGEN’s Zacks Rank and Key Picks

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Penumbra PEN and ResMed RMD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics has an earnings yield of 5.02% compared with the industry’s 1.18%. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.39%. The company’s shares have risen 1.8% compared with the industry’s 23.1% growth in the past year. Estimates for HAE’s 2025 EPS have moved north 0.4% to $4.59 in the past 30 days.

Estimates for Penumbra’s 2024 EPS have moved north 8.1% to $2.79 in the past 30 days. Shares of the company have surged 60.6% in the past year compared with the industry’s growth of 32.7%. PEN’s earnings surpassed estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 10.54%.

Estimates for ResMed’s fiscal 2025 EPS have risen 2.7% in the past 30 days. Shares of the company have surged 86.3% in the past year compared with the industry’s 32.1% growth. RMD’s earnings surpassed estimates in each of the trailing four quarters, the average beat being 6.4%. In the last reported quarter, it delivered an earnings surprise of 8.4%.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

ResMed Inc. (RMD) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.