The USD/BRL has moved higher the past couple of days and finished yesterday’s trading near 5.5740, this is a value the currency pair was essentially touching last week at this time too.

The USD/BRL has seen some slight movement over the past handful of days. The currency pair fell to a low of nearly 5.5120 last Thursday. The USD/BRL traded at a high around 5.6080 momentarily yesterday. Having said this, the USD/BRL closed Tuesday’s price action around the 5.5740 ratio, which is where trading has languished via give and take within Forex since the 9th of July.

Volatility has been seen sporadically in the USD/BRL but cautious sentiment in financial institutions has led to the price of the currency pair displaying a rather tight equilibrium the past few weeks. The USD/BRL is awaiting today’s Federal Reserve policy statement, but it is also waiting on any rhetoric that comes via the tariff negotiations between the U.S and Brazil over the next three days.

Calm on the South American Front

The USD/BRL has actually been able to produce a very solid range between 5.50000 and 5.60000 with only minor outliers the past few weeks. Financial institutions have shown patience in the currency pair, this as they await potential impetus which could shake the USD/BRL from its tight range. However, the lack of a wide price range the past few weeks as news is waited on may also show financial institutions are not expecting much to change.

Traders should not get overly ambitious about the USD/BRL. The lack of big volume in the currency pair does make it vulnerable to large orders affecting the price quickly. The coming three days of trading should start to shake the USD/BRL out of its tight range. For all of the stated nervousness about potential outcomes for Brazil regarding tariff negotiations with the U.S, the USD/BRL has correlated to the broad Forex market in a rather intriguing manner the past week.

Lows Followed by Highs Correlates to Global Forex

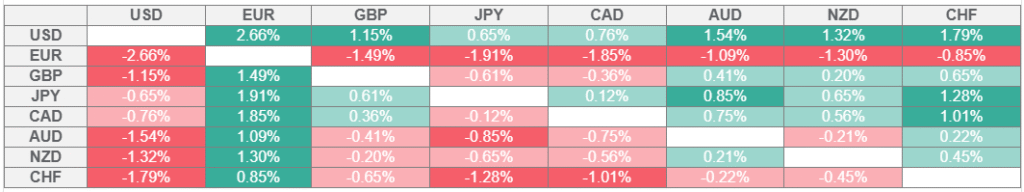

Other major currencies have sold off against the USD the past few days. The USD/BRL has actually produced a similar trajectory. The Fed’s pronouncements today will cause volatility for the USD/BRL.

- However, traders need to look for quick hitting targets and not let winning positions vanish because of sudden reversals, thus take profit orders need to be used.

- Folks looking for a slight reversal lower in the UDS/BRL to develop later today could be right, but should be cautious because the U.S Fed may have a surprise or two that it offers regarding future policy.

- What has been a tight price realm for the USD/BRL the past few weeks is likely to be tested in the near-term.

Brazilian Real Short Term Outlook:

Current Resistance: 5.5790

Current Support: 5.5705

High Target: 5.6240

Low Target: 5.5270

Want to trade our daily forex analysis and predictions? Here are the best brokers in Brazil to check out.