Nvidia is priced for perfection in a market and trend that are anything but perfect.

Arguably the most important data release of the entire third quarter is just days away. Following the closing bell on Wednesday, Aug. 27, Wall Street’s largest publicly traded company, and the innovative leader fueling the evolution of artificial intelligence (AI), Nvidia (NVDA 1.65%), will report its fiscal second-quarter operating results (its fiscal year ends in late January).

No technological advancement has been hotter on Wall Street than AI. Empowering software and systems with AI so they can make split-second decisions and grow more efficient over time without human intervention is a game changer that can accelerate growth in most industries around the globe. In Sizing the Prize, analysts at PwC pegged the economic impact of AI at $15.7 trillion come 2030.

While an approximately 1,100% increase in Nvidia’s stock since the start of 2023 signals that the company is firing on all cylinders, a case can be made that the face of the AI revolution is priced for perfection in a market and trend that are anything but perfect. Despite its near-parabolic ascent, Nvidia will likely struggle to live up to Wall Street’s sky-high expectations on Aug. 27.

Image source: Nvidia.

Margins will be in the spotlight and likely act as a drag

In terms of AI-graphics processing units (GPUs), Nvidia has been the kingpin. Its Hopper (H100) and Blackwell GPUs have been deployed more than any other chips in high-compute data centers, with the respective compute capabilities of Nvidia’s hardware standing tall when compared to the competition.

But what’s been even more important than Nvidia’s competitive advantages is persistent AI-GPU scarcity.

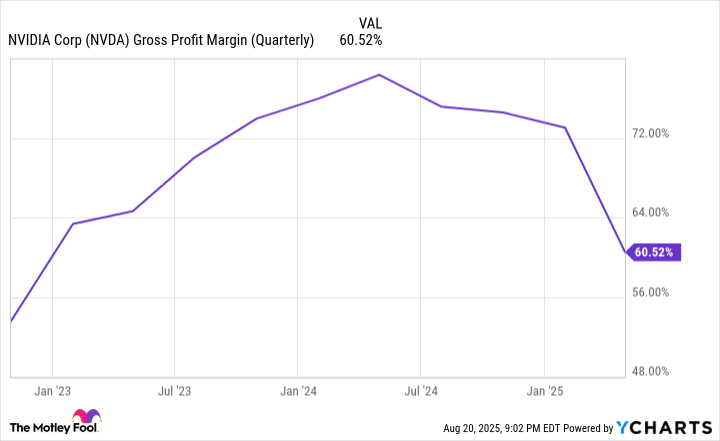

The law of supply and demand states that when demand for a good or service outpaces its supply, the price of said good or service will climb until demand tapers. With an impressive backlog for its AI-GPUs, Nvidia has been able to command a premium price for its hardware, which in turn sent its generally accepted accounting principles (GAAP) gross margin to a high of 78.4% during the first quarter of fiscal 2025. As long as this AI-advanced chip scarcity persists, Nvidia’s gross margin is golden.

The problem for Nvidia is that it’s no longer the only rodeo in town. Advanced Micro Devices and China-based Huawei are external competitors that are actively ramping up production of their data-center chips. However, the biggest threat to Nvidia’s GAAP gross margin potentially comes from within.

NVDA Gross Profit Margin (Quarterly) data by YCharts.

Nvidia’s top customers, in terms of net sales, have consistently been members of the “Magnificent Seven.” Most of these leading clients are internally developing AI GPUs and solutions to use in their respective data centers. Even though these chips are no threat to Nvidia’s compute advantages, they are considerably cheaper and not backlogged like Blackwell. In my view, it’s inevitable that internal chip development will cost Nvidia precious data center real estate.

More importantly, this internal development is working against the AI-GPU scarcity that Nvidia has held so dear. As the insatiable demand for AI-accelerating chips calms, Nvidia should see its pricing power and GAAP gross margin fade over time. We’ve already been witnessing steady gross margin erosion for more than a year.

Nvidia will have a difficult time justifying its valuation in multiple respects

In addition to gross margin being front and center, Nvidia is going to have a near-impossible task of justifying its valuation premium amid a historically pricey market.

To be abundantly clear, I believe Nvidia is deserving of a valuation premium thanks to its competitive advantages. The issue, while subjective, is how far this premium can be stretched before it becomes excessive.

Historical precedent tells us that industry leaders of next-big-thing trends have a relatively short leash when it comes to extended valuations. Prior to the bursting of the dot-com bubble a quarter-century ago, prominent internet leaders like Cisco Systems, Microsoft, and Amazon peaked at price-to-sales (P/S) ratios ranging from 31 to 43, respectively. Except for Palantir Technologies, whose P/S ratio recently entered a separate orbit, no megacap company on the leading edge of a game-changing technology has been able to maintain a P/S ratio in the 30 to 40 range for a substantial length of time.

Less than a week ago, Nvidia’s trailing-12-month P/S ratio was hovering north of 30. While its P/S ratio will decline a bit when it reports projected year-over-year sales growth of 53% in the fiscal second quarter, it’ll still be tipping the scales at a multiple that’s far above anything that’s been historically sustainable.

On top of being individually pricey, Nvidia is one of a handful of high-growth tech stocks that have lifted the S&P 500‘s (^GSPC 1.52%) Shiller price-to-earnings (P/E) ratio to its third-highest multiple during a continuous bull market when back-tested 154 years. Previously documented occasions when the stock market was this expensive were eventually followed by declines of 20% or more in the benchmark S&P 500.

Pardon the pun following the gross margin discussion above, but there’s simply no margin for error.

Image source: Getty Images.

Historical precedent is an undeniable worry for Wall Street’s leading AI stocks

The final piece of the puzzle that helps explain why Nvidia is positioned to disappoint come Aug. 27 (and beyond) has to do with history.

For the better part of the last three decades, investors have been privy to no shortage of next-big-thing trends and game-changing innovations. While many of these trends went on to positively impact corporate America, including the advent of the internet, all endured early-stage bubble-bursting events.

The problem with hyped innovations is that investors consistently overshoot when it comes to widespread adoption timelines and early-stage utility. For example, businesses didn’t fully understand how to make the internet revolution work in their favor until many years after it went mainstream. It takes time for game-changing innovations to mature, which makes it unlikely that artificial intelligence has done so in a little over two years.

While demand for AI-data center infrastructure and AI software has been impressive, most businesses aren’t yet optimizing their AI solutions, nor are many generating a positive return on their AI investments. These are telltale signs that investors have, yet again, overestimated how impactful artificial intelligence will be, at least in the early going.

No megacap company’s growth has been more reliant on investor euphoria surrounding the evolution of AI than Nvidia, which has added close to $4 trillion in market cap in less than three years. Even the slightest hiccup can disrupt this hype.

To reiterate, Nvidia is a solid and time-tested company that isn’t going anywhere. But it’s far from perfect — and perfection is all Wall Street will settle for at this point.

Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Cisco Systems, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.