Palantir Technologies (PLTR -0.34%) experienced a significant rise over the past few years and is now the 24th largest company by market capitalization globally. However, through a combination of factors, I think there could be multiple stocks that pass Palantir over the coming years.

Three that I think have that chance are ASML Holding (ASML -1.40%), International Business Machines (IBM 1.44%), and Salesforce (CRM 1.00%), but this list could grow if the market comes to its senses regarding Palantir’s stock.

Image source: Getty Images.

Palantir’s stock appears to be significantly overvalued

Palantir has been on an absolute tear since the start of 2024, rising nearly 800%. However, its revenue only grew 39% year over year in the first quarter, indicating a significant disparity between stock price appreciation and actual business growth.

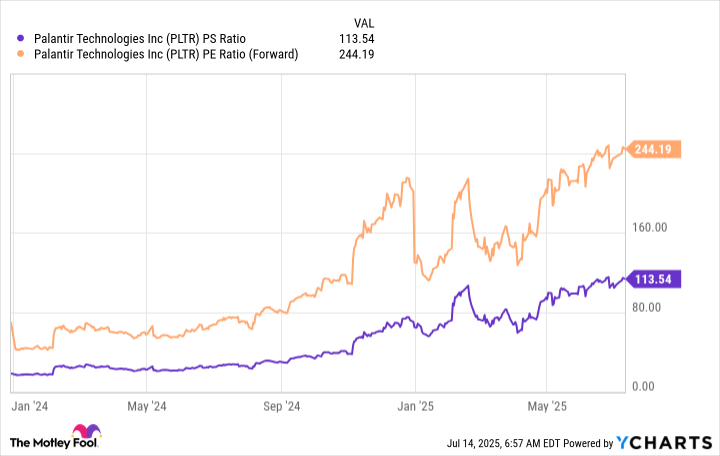

This shows up in the stock’s valuation, which trades for 113 times sales and 244 times forward earnings.

PLTR PS Ratio data by YCharts; PS = price to sales, PE = price to earnings.

Very few companies ever reach this valuation for good reason: It’s nearly impossible to live up to expectations. If we use a five-year timeline to examine Palantir’s stock, let’s make the following assumptions:

- Revenue growth of 40%.

- Profit margin reaches 30%.

- Share count remains flat.

Those are three incredibly bullish assumptions — the company hasn’t achieved 40% year-over-year growth in recent quarters and would have to sustain that for five years. Also, a 30% profit margin would place it among the best software companies, and its current 18% margin is still a considerable distance from that level.

Lastly, management is notorious for issuing a large number of shares to employees, and its share count has increased by 7.3% since the start of 2024, indicating significant dilution.

Regardless, if these heady assumptions could come true, Palantir would generate $16.8 billion in revenue and $5 billion in profits. That’s huge growth from today’s $3.1 billion in revenue, but it would still value the company at 67 times hypothetical 2030 earnings.

A 67 multiple for forward earnings makes for a very expensive stock, and Nvidia, which is consistently growing faster than Palantir, has only a 38 forward earnings multiple right now.

I think this is a fairly clear-cut case that Palantir is drastically overvalued at today’s levels. Even with the most bullish assumptions, Palantir’s stock would still appear overvalued five years from now, even if the company achieves incredible growth figures.

As a result, I believe the stock is ripe for a decline, and there are many other stocks (beyond the ones I mentioned) that could surpass Palantir.

This trio has a strong outlook and significantly cheaper prices

ASML is only slightly behind Palantir’s $362 billion market cap, with a valuation of $292 billion at the time of this writing. It is a key provider of machinery in chip manufacturing, and it holds a technological monopoly with its extreme ultraviolet (EUV) machines.

As more chip fabrication facilities emerge to support the huge AI demand, the company will experience strong growth, which management has told investors to expect in 2026. As a result, I think ASML could easily surpass Palantir.

IBM is a legacy computing business that’s working to make the pivot into AI and quantum computing, which is forecast to see commercial adoption around 2030. If it becomes the go-to for this technology, the stock could be ripe for huge upside from its current $266 billion valuation.

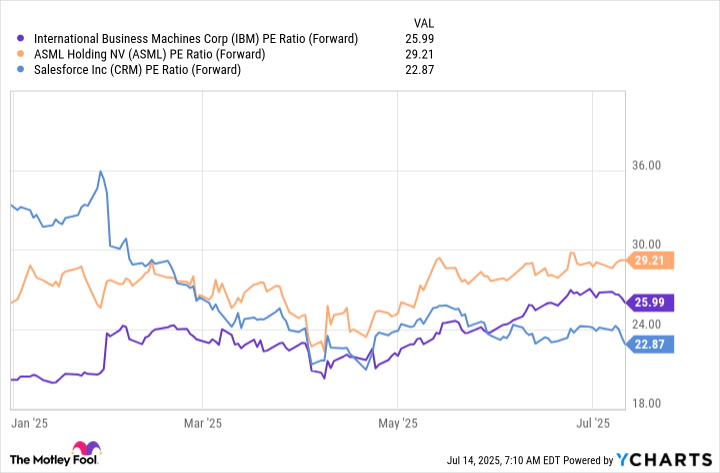

Lastly, Salesforce dominates in customer relationship management software. It’s also working to integrate AI into its product and maximize its profitability. Compared to many stocks on the market, it is relatively cheap and is valued at a lower level than the S&P 500, which trades for 23.7 times forward earnings.

IBM PE Ratio (Forward) data by YCharts.

As a final note, all three of these stocks trade for far less than Palantir’s hypothetical 2030 valuation, which should be a sign for investors that the stock is unsustainably expensive. There is a near-endless list of stocks that appear to be better investments, and these three are among them.

Keithen Drury has positions in ASML, Nvidia, and Salesforce. The Motley Fool has positions in and recommends ASML, International Business Machines, Nvidia, Palantir Technologies, and Salesforce. The Motley Fool has a disclosure policy.