Palantir Technologies (PLTR -3.87%) has been on a tearing run on the stock market over the past year, registering astronomical gains of 495% as of this writing. Its dynamic growth is driven by the terrific success of the company’s Artificial Intelligence Platform (AIP) that has led to a nice acceleration in its growth in the past few quarters.

However, Palantir’s astronomical surge brought the stock’s valuation to levels that don’t seem sustainable. It is trading at a whopping 623 times earnings and 114 times sales. Not surprisingly, Palantir’s 12-month price target of $110, as per 28 analysts covering the stock, points toward a 23% decline from current levels.

So, the possibility of Palantir’s market cap slipping from the current figure of $338 billion cannot be ruled out. If that’s indeed the case, there is a chance that it could be overtaken by another fast-growing AI company that’s currently trading at much more attractive levels. Let’s take a closer look at that name and check why its valuation could be more than Palantir’s within the next two years.

Image source: Getty Images.

This chipmaker’s growth is as solid as Palantir’s, and it has multiple AI-related catalysts

Advanced Micro Devices (AMD 0.21%) is known for designing chips that go into multiple applications such as personal computers (PCs), data centers, and gaming consoles. The company has been growing at a healthy pace in recent quarters thanks to the growing demand for its AI chips in data centers and PCs.

This is evident from the 36% year-over-year growth in AMD’s revenue in the first quarter of 2025 to $7.4 billion. That was close to the 39% revenue growth that Palantir recorded in the same quarter. What’s more, AMD’s non-GAAP earnings growth of 55% was also close to the 62% jump in Palantir’s bottom line last quarter.

Importantly, AMD is trading at a significantly cheaper valuation when compared to Palantir.

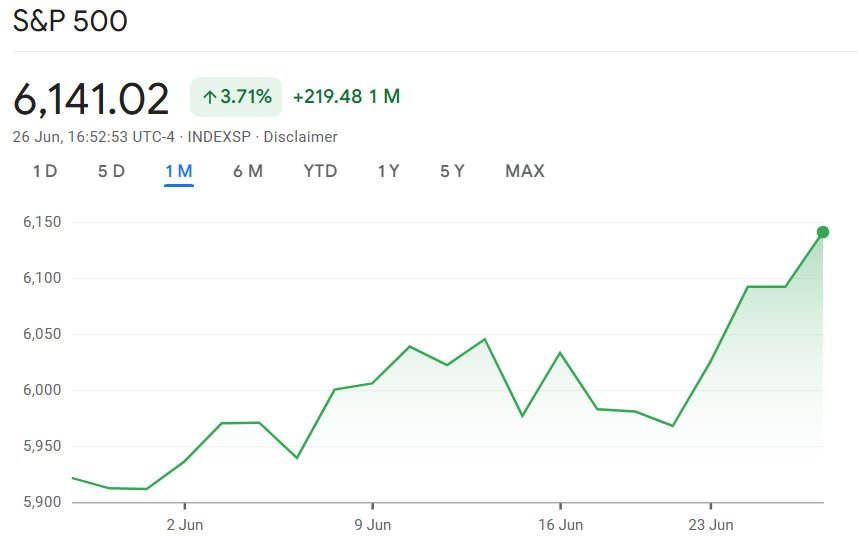

AMD PE Ratio (Forward) data by YCharts

Another advantage that AMD enjoys over Palantir is its presence in multiple end markets that are getting an AI-powered boost. While Palantir serves the AI software market, AMD stands to gain from the proliferation of this technology in data centers, industrial automation, robotics, and PCs.

The chipmaker is witnessing robust growth in two of these markets right now. Its revenue from the data center segment shot up an impressive 57% year over year in Q1 to $3.7 billion. This terrific growth was driven by the robust demand for AMD’s server processors and graphics processing units (GPUs). The company points out that these chips are being deployed by leading cloud infrastructure providers such as Oracle, Alphabet‘s Google, and Microsoft, among others.

The growing demand from these customers allowed AMD to gain share in the server processor market. Its share of the server processor market increased by 3.6 percentage points year over year in the first quarter to 24.4%, indicating that it still has a lot of room for growth in this space.

Meanwhile, the company is trying to close the gap with Nvidia in the data center GPU market with its new chips. As a result, there is a good chance that AMD’s revenue from sales of data center GPUs could increase significantly moving forward.

Coming to the PC market, sales of AI-enabled PCs are expected to jump by an impressive 165% this year. More importantly, the market is expected to keep growing at a healthy pace with an annual growth rate of 44% through 2028. AMD is already offering AI-capable Ryzen central processing units (CPUs) for the PC market, and they are helping the company corner a bigger share of this space.

Its share of the desktop CPU market increased by 4.1 percentage points in Q1 to 28%, while laptop CPU market share was up by 3.2 points to 22.5%. If AMD manages to capture a bigger share of the client CPU market with its AI chips, it won’t be surprising to see it sustain the impressive momentum that it already gained in this segment.

Specifically, AMD’s client revenue jumped an impressive 68% year over year in Q1 to $2.3 billion. The long-term volume growth opportunity in client CPUs along with the potential for more market share gains could send this business soaring in the long run.

Why AMD could be worth more than Palantir

Analysts expect AMD’s earnings to increase by 17% this year followed by a stronger jump of 47% next year, which will take its earnings to $5.71 per share at the end of 2026. Palantir, on the other hand, is expected to register a 42% spike in earnings this year and a 26% jump in 2026, taking its earnings per share to $0.73 by the end of next year.

AMD has a forward earnings multiple of 25, as we saw in the chart earlier. That’s a nice discount to the U.S. technology sector’s earnings multiple of 48. Assuming AMD is rewarded with a richer earnings multiple of 35 after a couple of years and achieves the projected earnings of $5.71 per share, its stock price could jump to $200. That would be a 44% jump, taking its market cap to $323 billion from $224.5 billion right now.

Applying a similar multiple to Palantir’s projected earnings of $0.73 after two years points toward a stock price of just $25, which is much lower than where it is trading right now. As such, the possibility of AMD becoming more valuable in the next couple of years cannot be ruled out thanks to the chipmaker’s accelerating growth and its significantly lower valuation.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.