- The Pound Sterling climbs to near 1.3765 against the US Dollar on hopes that President Trump will announce Fed Powell’s successor soon.

- Fed’s Powell warned that the tariff-driven inflation could prove to be persistent.

- UK employers aim to reduce their labor force to offset the impact of the increase in contributions to social security schemes.

- Shell denies reports stating that it bid for British Petroleum.

The Pound Sterling (GBP) extends its winning streak against the US Dollar (USD) for the fourth consecutive trading day on Thursday, refreshing an over three-year high at around 1.3765 at the time of writing. The GBP/USD pair strengthens as the US Dollar faces a sharp selling pressure after United States (US) President Donald Trump reiterated attacks on Federal Reserve’s (Fed) independence, following Chair Jerome Powell’s commitment to a “wait and see” approach on interest rates in the two-day semi-annual testimony before Senate.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh three-year low around 97.00.

Financial market participants have shown concerns about US President Trump interfering in the Fed’s operations, which is an autonomous body. This has challenged the US Dollar’s exceptionalism, potentially diminishing its appeal.

A report from the Wall Street Journal (WSJ) showed earlier in the day that President Trump could announce Fed Powell’s contender this summer.

Trump also called Fed’s Powell “terrible” while speaking with reporters on Wednesday and confirmed that he has three or four potential contenders in mind for his replacement.

“I know within three or four people who I’m going to pick,” Trump said, Reuters reported. The report from the agency also stated that contenders would be former Fed Governor Kevin Warsh, National Economic Council head Kevin Hassett, current Fed Governor Christopher Waller, and Treasury Secretary Scott Bessent.

Daily digest market movers:Pound Sterling gains sharply despite growing UK labor market concerns

- The Pound Sterling outperforms its peers, except the Japanese Yen (JPY), on Thursday. The British currency gains despite growing concerns over the United Kingdom (UK) labor market and a slight slowdown in consumer inflation expectations.

- According to a Reuters report, the British Chambers of Commerce (BCC) stated that nearly one-third of small and medium-sized enterprises have reduced their labor force or plan to do so as they struggle to bear the burden of an increase in employers’ contributions to social security schemes.

- In the Autumn statement, Chancellor of the Exchequer Rachel Reeves announced an increase in employers’ contribution to National Insurance (NI) to 15% from 13.8%.

- This week, Bank of England (BoE) Governor Andrew Bailey also warned of labor market risks in his testimony before the Lords Economic Affairs Committee. Bailey said that the central bank has started seeing “labour market softening, and expects that wage settlements will come off”. He added that the increase in employers’ contribution to social security schemes seems to be “affecting labour market”.

- Meanwhile, a Citi/YouGov survey showed on Wednesday that the public’s inflation expectations for a year have slowed down to 3.9% in June from 4% in May. Such a scenario forces traders to increase their bets supporting more interest rate cuts.

- In the corporate segment, gian energy producer Shell dimisshed speculations that it is considering the acquisition of British Petroleum (BP). The energy giant clarified in a statement that it “has not been actively considering making an offer for BP” and “confirms it has not made an approach to, and no talks have taken place with, BP with regards to a possible offer”, Reuters reported.

- In the US region, investors await the US Personal Consumption Expenditures Price Index (PCE) data for May, which will be released on Friday. The PCE inflation report is expected to show that price pressures grew at a faster pace.

- Signs of inflationary pressures accelerating would boost market expectations that the Fed could keep interest rates at their current levels for longer. However, soft numbers are unlikely to accelerate Fed dovish bets as Jerome Powell said in the two-day testimony that the central bank will closely monitor the impact of tariffs on inflation in June and July.

- Powell stated in his testimony that the central bank is careful about considering interest rate cuts as the “tariff-driven inflation could lead to a persistent inflation” in the economy.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.56% | -0.60% | -0.71% | -0.27% | -0.45% | -0.35% | -0.54% | |

| EUR | 0.56% | -0.00% | -0.22% | 0.30% | 0.14% | 0.20% | 0.03% | |

| GBP | 0.60% | 0.00% | -0.22% | 0.30% | 0.14% | 0.23% | 0.03% | |

| JPY | 0.71% | 0.22% | 0.22% | 0.47% | 0.32% | 0.37% | 0.21% | |

| CAD | 0.27% | -0.30% | -0.30% | -0.47% | -0.15% | -0.17% | -0.27% | |

| AUD | 0.45% | -0.14% | -0.14% | -0.32% | 0.15% | -0.02% | -0.12% | |

| NZD | 0.35% | -0.20% | -0.23% | -0.37% | 0.17% | 0.02% | -0.11% | |

| CHF | 0.54% | -0.03% | -0.03% | -0.21% | 0.27% | 0.12% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling extends upside above 1.3750

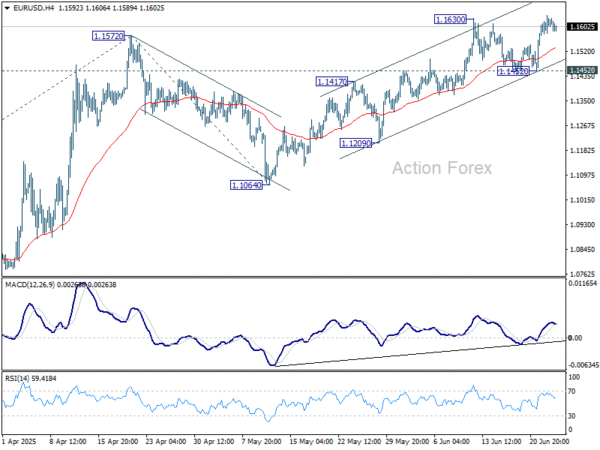

The Pound Sterling posts a fresh three-year high above 1.3700 against the US Dollar on Thursday after breaking above the horizontal resistance near the June 13 high around 1.3630. The upward-sloping 20-day Exponential Moving Average (EMA) around 1.3535 suggests that the near-term trend is bullish.

Moreover, the 14-day Relative Strength Index (RSI) jumps to near 65.00, suggesting that the momentum is on the upside.

Looking down, Monday’s low around 1.3370 will act as a key support zone. On the upside, the January 13, 2022, high around 1.3750 will act as the key barrier.