Here is what you need to know on Wednesday, August 20:

Pound Sterling holds its ground following a two-day slide as markets assess July inflation data from the UK. Later in the American session, the Federal Reserve (Fed) will release the minutes of the July 29-30 policy meeting. Several Fed policymakers are scheduled to deliver speeches in the second half of the day.

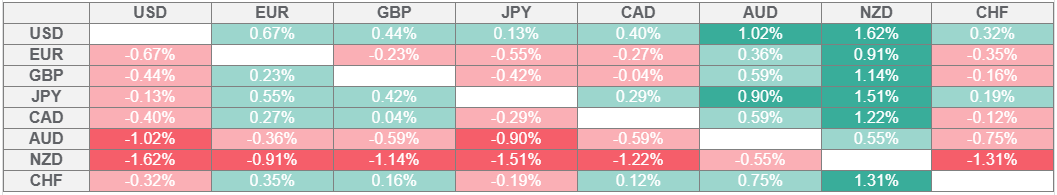

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The Reserve Bank of New Zealand (RBNZ) announced early Wednesday that it lowered the policy rate by 25 basis-points (bps) to 3%, as anticipated. The policy statement showed that some policymakers preferred a 50 bps rate cut and highlighted that there is scope to lower the policy rate further if medium-term inflation pressures continue to ease as expected. RBNZ acting Governor Christian Hawkesby noted that they are comfortable with the fall in the New Zealand Dollar (NZD). NZD/USD stays under strong selling pressure early Wednesday and trades at its weakest level since mid-April below 0.5850, losing more than 1% on a daily basis.

The UK’s Office for National Statistics reported on Wednesday that the Consumer Price Index (CPI) rose by 3.8% on a yearly basis in July. This print followed the 3.6% increase recorded in June and came in above the market expectation of 3.7%. In this period, the core CPI also increased by 3.8%. On a monthly basis, the CPI was up 0.1%, compared to analysts’ estimate for a 0.1% decrease. GBP/USD recovered from daily lows after the inflation report and was last seen trading marginally higher on the day, slightly above 1.3500.

The US Dollar (USD) Index stays in a consolidation phase above 98.00 after closing in positive territory for two consecutive days. Meanwhile, US stock index futures lose between 0.3% and 0.4% in the early European session, highlighting a cautious market stance. The US Treasury will hold a 20-year note auction later in the day.

EUR/USD struggles to stage a rebound and trades below 1.1650 in the European session on Wednesday. Eurostat will release revisions to July inflation data later in the session.

Annual inflation in Canada, as measured by the change in the CPI, declined to 1.7% in July from 1.8% in June, Statistics Canada reported on Tuesday. After rising about 0.5% on Tuesday, USD/CAD fluctuates in a tight channel above 1.3850 early Wednesday.

The data from Japan showed early Wednesday that Machine Orders increased by 3% on a monthly basis in June. This print surpassed the market expectation for a 1% decline by a wide margin. Other data revealed that Exports and Imports declined by 2.6% and 7.5%, respectively, on a yearly basis in July. USD/JPY edges lower in the European session and trades below 147.50.

Gold lost more than 0.5% on Tuesday and registered its lowest daily close since August 1. XAU/USD corrects higher early Wednesday and trades slightly above $3,320.