Retail FX and CFD broker Plus500 Ltd (LON:PLUS) today provided a trading update for the three-month period ended 30 September 2025.

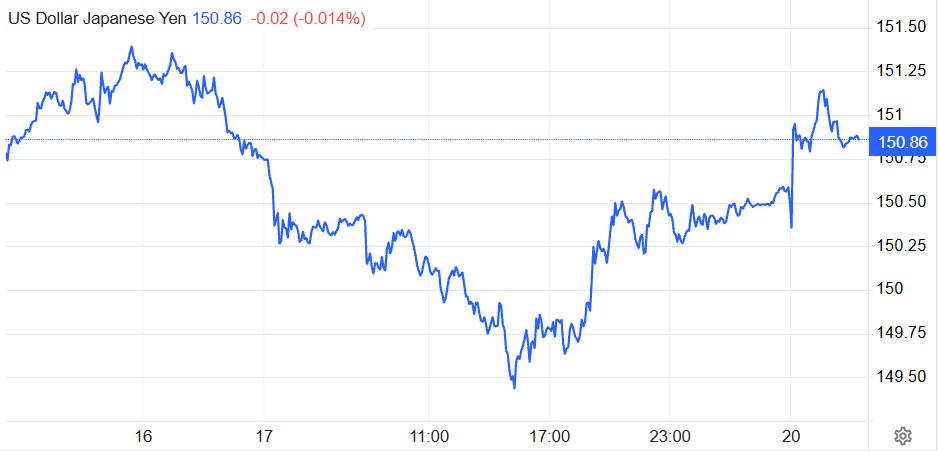

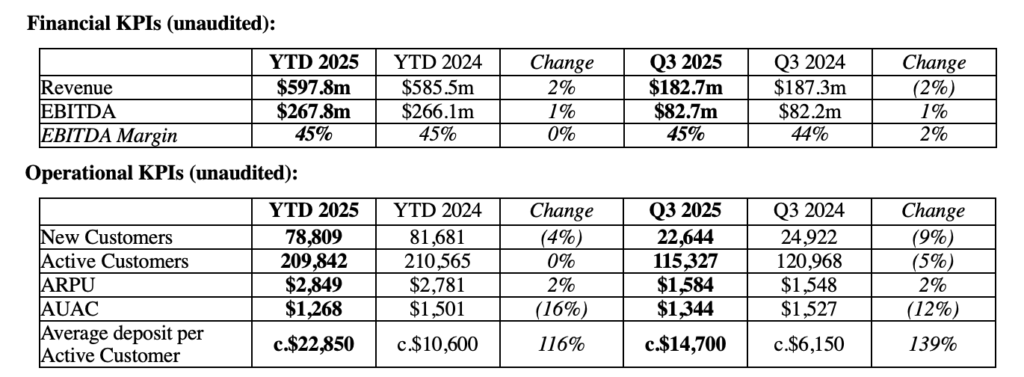

Revenue for Q3 2025 was $182.7 million (Q3 2024: $187.3m), comprising trading income of $161.6m (Q3 2024: $173.2m) and interest income of $21.1m (Q3 2024: $14.1m), reflecting the lower levels of volatility across global financial markets during the period.

Customer Income, a key measure of the Group’s underlying performance, was $165.2m in Q3 2025 (Q3 2024: $166.3m).

Customer Trading Performance stood at ($3.6m) in Q3 2025 (Q3 2024: $6.9m). The Group expects that the contribution from Customer Trading Performance will be broadly neutral over time.

EBITDA was $82.7m in Q3 2025, which equated to an EBITDA margin of 45% (Q3 2024: $82.2m and 44%, respectively). For the nine-month period ended 30 September 2025, revenue stood at $597.8m (YTD 2024: $585.5m), EBITDA was $267.8m and the EBITDA margin was 45% (YTD 2024: $266.1m and 45%, respectively).

Total customer trades were 14.9m during Q3 2025 (Q3 2024: 14.5m) and total customer trades for the nine-month period ended 30 September 2025 reached 50.4m (YTD 2024: 41.0m), representing growth of approximately 23% year-on-year.

The Group onboarded 22,644 New Customers during Q3 2025 (Q3 2024: 24,922) and New Customers for the nine-month period ended 30 September 2025 were 78,809 (YTD 2024: 81,681).

The number of Active Customers during Q3 2025 was 115,327 (Q3 2024: 120,968) and Active Customers for the nine-month period ended 30 September 2025 were 209,842 (YTD 2024: 210,565).

The Group remained debt-free and maintained its strong financial position during the period, with cash balances of over $815m as of 30 September 2025 (31 December 2024: $890.0m).

During Q3 2025, the Company repurchased a total of 1,508,613 shares, at an average price of £31.87, for a total cash consideration of c.$65m. As of 30 September 2025, the remaining number of ordinary shares in issue was 70,133,617. Ordinary shares that are repurchased by the Company under its buyback programmes are held in treasury, are not entitled to dividends and have no voting rights.

The Group’s FY 2025 revenue and EBITDA are expected to be in-line with current market expectations.