- Plug Power recently secured a US$1.66 billion loan guarantee from the U.S. Department of Energy to fund new hydrogen plants, while announcing an extended partnership with logistics firm Uline through 2030 and new international collaborations in Brazil.

- These developments, combined with growing demand for the company’s hydrogen fuel cells from large data center projects, underscore Plug Power’s ambition to capitalize on both government support and rapid expansion in clean energy infrastructure.

- We’ll explore how the Department of Energy’s backing could reshape Plug Power’s investment narrative and outlook on hydrogen sector growth.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Plug Power Investment Narrative Recap

To be a Plug Power shareholder today, you need conviction in hydrogen’s future as a critical enabler of decarbonization, as well as confidence in government backing and Plug Power’s ability to execute at scale. The recent US$1.66 billion Department of Energy loan signals strong federal support, which could meaningfully mitigate the company’s short-term liquidity risk, still, margin improvement and execution on project timelines remain the primary catalysts and risks that investors are watching most closely, and these fundamentals remain largely unchanged following this announcement.

Among recent announcements, Plug Power’s partnership extension with Uline through 2030 stands out as particularly relevant; it reinforces recurring demand in the material handling sector and helps underpin revenue visibility as the company ramps hydrogen production with new government funding. This combination of long-term customer commitments and infrastructure investment is directly tied to Plug Power’s ambition to scale revenues while working towards improved profitability over time.

Yet despite policy tailwinds, investors should also be aware that Plug Power’s capital needs remain substantial and its persistent negative cash flow may still force decisions about new financing or share issuance…

Read the full narrative on Plug Power (it’s free!)

Plug Power’s outlook projects $1.2 billion in revenue and $124.7 million in earnings by 2028. This requires annual revenue growth of 22.2% and an earnings increase of $2.1 billion from current earnings of -$2.0 billion.

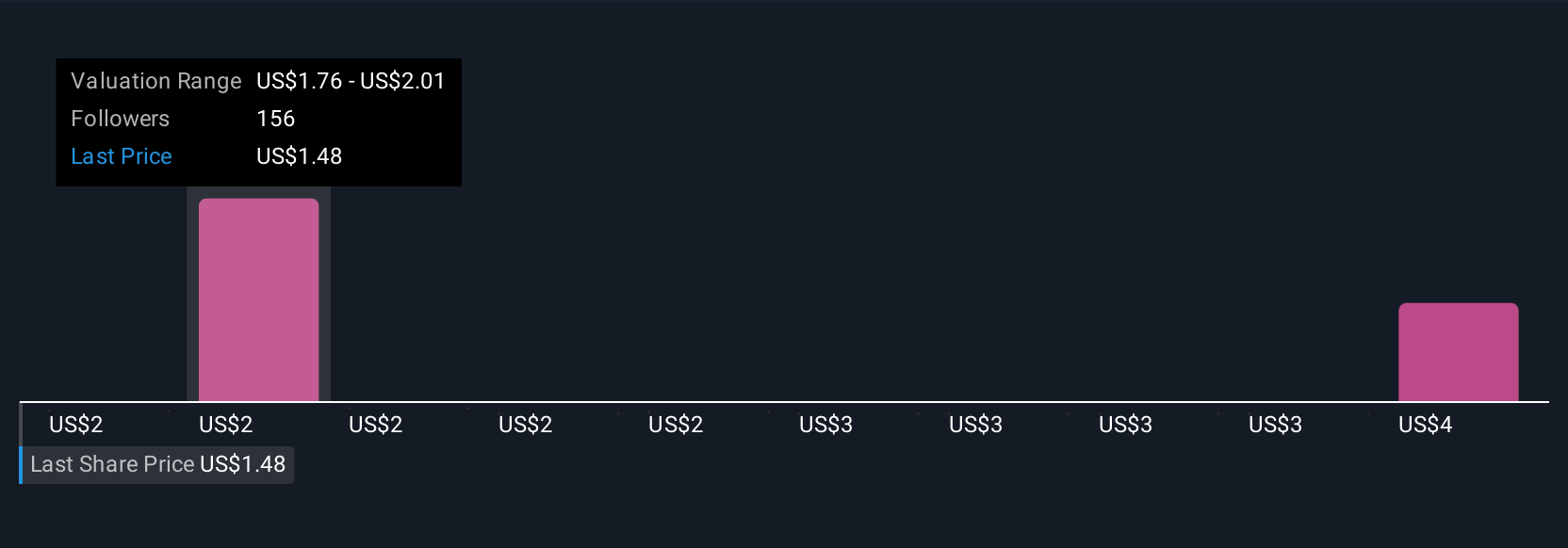

Uncover how Plug Power’s forecasts yield a $2.08 fair value, a 21% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members recently set Plug Power fair values from US$1.49 to US$4.23, with 18 unique perspectives. Meanwhile, persistent negative margins and heavy reliance on government support present ongoing challenges that could shape financial outcomes, take a closer look at how viewpoints can differ among market participants.

Explore 18 other fair value estimates on Plug Power – why the stock might be worth as much as 60% more than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com