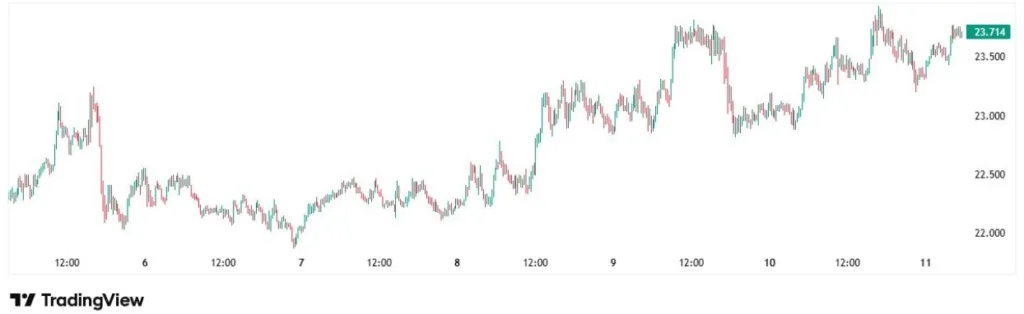

Oracle (ORCL) stock jumped over 40% Wednesday after the software giant said its AI-fueled cloud revenue is set to jump to $144 billion by its 2030 fiscal year.

That marks a massive leap from the company’s projection of less than $20 billion for the business in its current fiscal year.

“We expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year — and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years,” CEO Safra Catz said in a statement on Tuesday.

The stock’s gain comes despite Oracle reporting earnings for the first quarter of its fiscal year 2026 that fell below Wall Street’s expectations. The company reported revenue of $14.9 billion, slightly below the $15 billion expected by analysts polled by Bloomberg. The software giant’s adjusted earnings per share of $1.47 also came in below the projected $1.48.

Read more: Live coverage of corporate earnings

Oracle’s optimistic revenue outlook came as it raised its remaining performance obligation (RPO), or the total value of contract revenue Oracle will deliver in the future, based on customer agreements.

“We signed four multibillion-dollar contracts with three different customers in Q1,” Catz said in a statement Tuesday. Catz said this resulted in the company’s contract backlog increasing 359% to $455 billion in its first quarter. The executive added that the company expects to sign up several additional multibillion-dollar customers and for its RPO to exceed half a trillion dollars.

“We have signed significant cloud contracts with the who’s who of AI, including OpenAI, xAI, Meta, and many others,” Catz said in a call with investors following the company’s earnings report.

Oracle has been securing a massive amount of Nvidia’s coveted GPUs (graphics processing units, or AI chips) and renting out that computing power through its OCI business to rival those of Big Tech peers such as Amazon (AMZN) and Alphabet’s (GOOG, GOOGL) Google. As the software giant has poured billions into its AI ambitions by investing in data center infrastructure, it has laid off workers and reportedly discussed eliminating cash raises and bonuses for employees this year.

The software giant said that its capital expenditures will jump to roughly $35 billion in 2026, up from its previous outlook of around $25 billion for the year and $21 billion last year.

Shares in Oracle have soared more than 70% over the past year.

The company’s last quarterly earnings caught Wall Street’s attention when it announced a new deal with a customer set to bring in over $30 billion in annual revenue starting in its 2028 fiscal year. Multiple media outlets reported the customer was OpenAI (OPAI.PVT), and investors were listening for any commentary from executives on further details of the deal, but none were given.

Investors also hoped for details on Oracle’s role in the Stargate AI project, but executives didn’t comment Tuesday.

Stargate — a massive $500 billion AI infrastructure deal — was unveiled in January at the White House by the CEOs of Oracle, OpenAI, and SoftBank (SFTBY), alongside President Trump.

After reports that the project was stalling in July, OpenAI said its partnership with Oracle to launch a data center in Abilene, Texas, as part of Stargate was “progressing,” with some of the facility already “up and running.” But SoftBank later said it’s taking longer than expected to get Stargate off the ground.

The last major update investors heard from Oracle about its work on Stargate was from Catz last quarter. “Stargate is not formed yet,” she said. “But some of our business with OpenAI is part of our future.”

Correction: A previous version of this article misstated that the Stargate AI project was announced at the White House in June. It was announced in January.

Laura Bratton is a reporter for Yahoo Finance. Follow her on Bluesky @laurabratton.bsky.social. Email her at laura.bratton@yahooinc.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance