This story is available exclusively to Business Insider

subscribers. Become an Insider

and start reading now.

Have an account? .

subscribers. Become an Insider

and start reading now.

Have an account? .

- Oracle stock saw its best-ever trading day on Wednesday.

- The company reported earnings and issued highly bullish revenue guidance.

- Here are the most important numbers driving its stock increase and CTO Larry Ellison’s wealth boost.

One of the market’s more unsung tech giants was launched into the ranks of elite AI players after earnings revealed an aggressively bullish sales forecast.

Oracle stock, a poster child of the dot-com tech boom, is putting up huge numbers on Wednesday, driven by a blockbuster quarterly earnings report. The move was so large it catapulted its co-founder and CTO, Larry Ellison, to the title of world’s richest person, surpassing Tesla CEO Elon Musk.

Here are the big numbers behind Oracle’s record-setting day.

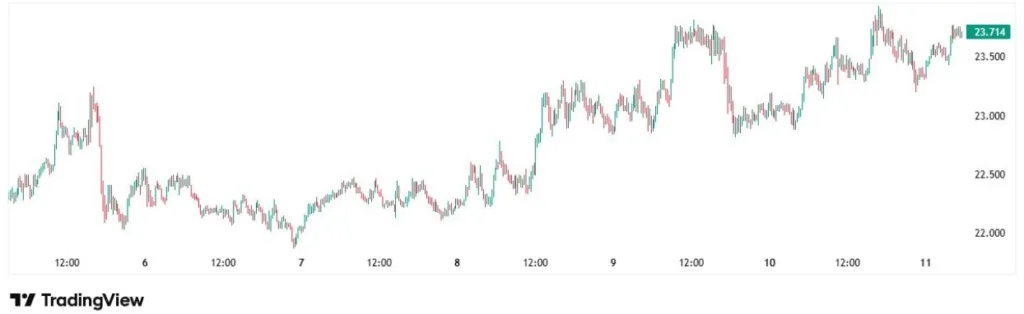

The stock move

- Shares rallied 43% to an intraday high of $345.68 on Wednesday, representing the stock’s largest-ever increase in a single trading day.

- The stock is up 102% year-to-date.

- Shares are up more than 700% from their peak during the dot-com bubble.

Larry Ellison becomes the richest person in the world

- Ellison’s net worth rose by more than $100 billion to a total $393 billion. That puts him ahead of Tesla CEO Elon Musk, whose total wealth is worth around $385 billion, according to the Bloomberg Billionaires Index.

- He has now doubled his net worth in 2025 alone, bringing his year-to-date increase to more than $200 billion.

The key forecast

- The company has over $455 billion in remaining performance obligations, or expected future revenue from contracts.

- That is roughly four times that of Google, suggesting that Oracle’s “cloud-growth rate is poised to surpass” Google’s, according to Bloomberg Intelligence.

- Cloud revenue is expected to increase 77% this fiscal year to $18 billion. It rose 28% to $7.2 billion in the last quarter.

- The figure is expected to hit $144 billion by the end of the decade.

Visited 1 times, 1 visit(s) today