Hong Kong’s markets hit their lowest point in more than a decade in 2022, squeezed by rising friction between Washington and Beijing. With the US Federal Reserve tightening monetary policy aggressively, Asian markets were starved of liquidity. Hong Kong’s benchmark fell below 16,000 points in 2022, one of the steepest drops among global indices.

Three years later, the story has flipped. The Hang Seng Index has surged about 30 per cent so far in 2025, marking the stock market’s strongest performance since 2017. Venture capital firms that once pulled out are now pouring back in, and Hong Kong has reclaimed its position as the world’s leading hub for launching IPOs. A tentative easing of US-China tensions is adding to the momentum, breathing new life into Asia’s premier financial centre.

The Fed has shifted course, cutting rates on September 17, and global central banks have opened the taps. Lending in major currencies is growing at its fastest pace since the pandemic rebound, and capital is once again flowing into emerging markets.

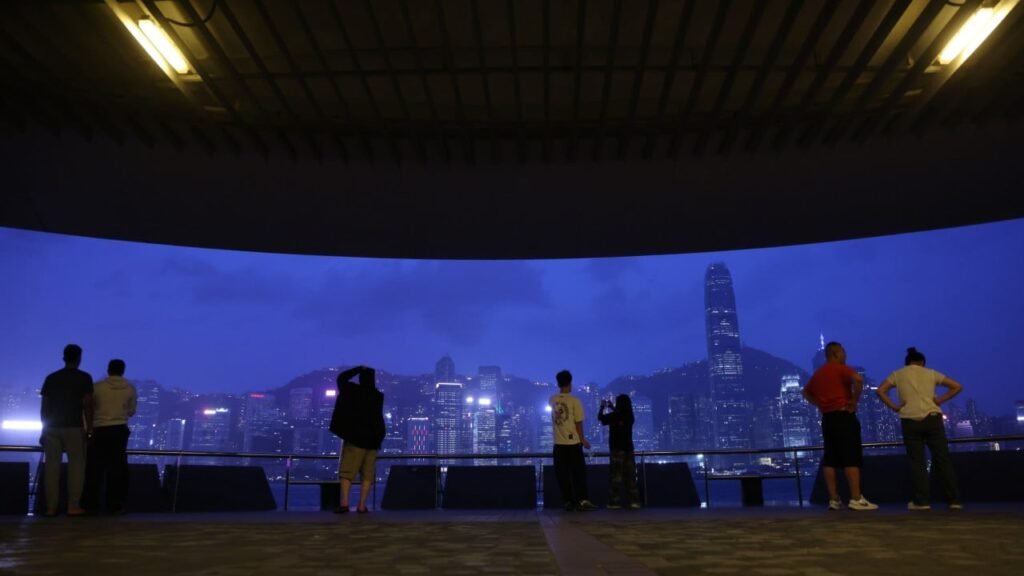

Nowhere has this change been more visible than in Hong Kong. The local interbank rate has fallen below 1 per cent for the first time in years, signalling plentiful liquidity. Average trading volumes on the stock exchange have doubled to more than HK$200 billion (US$25.7 billion) a day, levels not seen since the city’s heyday. Investors who once fled Hong Kong are returning with renewed confidence.

The reversal is striking given how bleak things looked just two years ago.

01:44

China’s largest EV battery maker CATL celebrates strong debut at Hong Kong stock market

China’s largest EV battery maker CATL celebrates strong debut at Hong Kong stock market

The city’s IPO market tells the story best. In the first half of this year, Hong Kong raised more than US$14 billion through new listings, a sevenfold increase on the same period last year. Mainland investors have been a driving force, funnelling record sums through Stock Connect, with southbound inflows at their strongest since the programme began a decade ago.

Visited 1 times, 1 visit(s) today