In this photo illustration, Beyond Meat’s Beyond Burgers are shown on February 29, 2024 in Chicago, Illinois.

Scott Olson | Getty Images

Beyond Meat has regained a bit of its meme mojo status, surging 93% on Tuesday.

The food company known for its plant-based meat alternatives is having an incredible week, with shares surging more than 127% Monday in its best day ever after Roundhill Investments, which develops thematic ETFs, added the name to its Roundhill Meme Stock ETF (MEME).

It continued that rally Tuesday after Beyond Meat announced a deal with Walmart to expand distribution to more stores across the U.S.

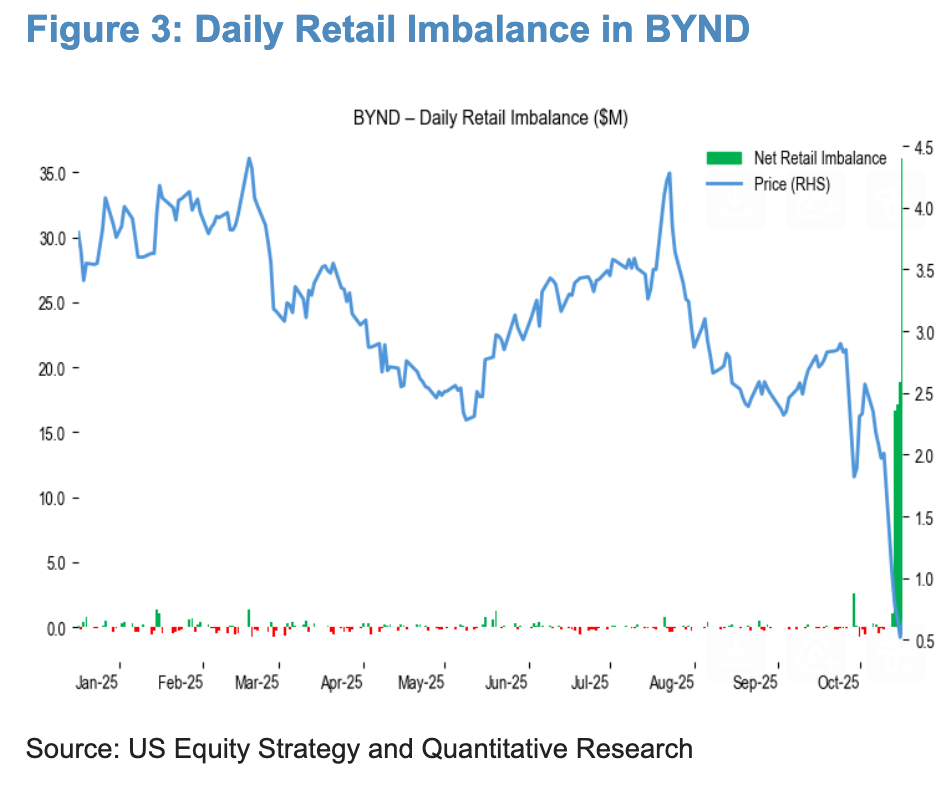

It appears the ETF addition has unleashed a short squeeze with investors who bet against the stock forced to cover their position. More than 63% of the shares available for trading were sold short, per FactSet.

Beyond Meat, 1-day performance

It’s a remarkable turnaround for a stock that tumbled more than 67% just last week, after the company announced it has finalized a debt deal. The stock is currently trading around $2 per share, after ending last week at just 65 cents.

Indeed, the stock has been under pressure for many years, posting losing returns over each of the last five years. After surging past $230 per share following its IPO in 2019, it has since become a penny stock.

BYND, all time

Yet this week’s rally harkens back to when Beyond Meat enjoyed meme stock status among retail traders, who crowded into the stock based more on sentiment than on corporate fundamentals after coordinating on online message boards.

In 2021, Bank of America called Beyond Meat a Reddit stock to watch. It ended that same year down more than 47%.

The return of Beyond Meat could also be the latest sign of a frothy market, as investors pile into more speculative names in spite of elevated valuations, and possibly a signal of a market top.

Roundhill actually shut its meme ETF down at one point because of lack of interest, but revived it earlier this month as retail traders dive back into this relentless bull market.