Continued job growth and an expected economic boost from the tax cuts in the One Beautiful Big Bill … More Act (OBBBA) helped push the probability of an economic downturn closer to the lows of the year. President Trump’s July 9 tariff deadline looms as the next big hurdle this week.

Better-than-expected job growth and the passage of US tax legislation propelled the S&P 500 to all-time highs on Friday. Please note that the tax bill is named the One Beautiful Big Bill Act (OBBBA), so no partisan political views are intended by using its name.

One Chart (Still) Tells The Story

As the threat of recession has waned, as illustrated by the lower betting odds of recession, stocks have rallied to new highs. At the early April stock lows, the massive US tariffs announced on Liberation Day sent the betting odds of recession soaring to 65%. As the tariff threat eased and some progress was made on trade agreements, stocks have recovered sharply. The resiliency of the labor market and an expected economic boost from the tax cuts in the OBBBA helped push the probability of an economic downturn closer to the lows of the year.

Stocks & Recession Odds

Lower Economic Risk

The more economically sensitive cyclical stocks have outperformed less economically impacted defensives since the stocks bottomed, coinciding with the peak of recession fears. This data bolsters confidence in the view that the macroeconomic situation has been the primary driver of stocks so far this year.

Economically-Sensitive Versus Defensive Stocks

Recent Market Performance

The S&P 500 reached an all-time high in the holiday-shortened week, now resting at 2.2% above its previous mid-February high after having declined by almost 20%. The Magnificent 7, comprising Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), has recovered to only 3.5% below its mid-December level after being as much as 30% under the peak.

The strength in US bank stocks remains notable. The Federal Reserve recently revised its methodology, which will result in fewer Stress Capital Buffers (SCBs) being required for banks in the future. All other things being equal, less need for capital means better profitability and the ability to return more capital to shareholders. In addition, banks are economically sensitive, so they typically receive a boost from better economic outlooks.

Market Returns

Job Growth

Employment grew by 147,000 nonfarm jobs, which was above expectations. Previous data was revised slightly higher, which is a positive. The household survey data was solid, with a gain of 93,000 jobs, and the research series, which mirrors the payroll report criteria, rose by 751,000. The significant increase in the research series reverses much of the decline from the previous month.

Monthly Job Growth

Contrary to expectations, the unemployment rate ticked down to 4.1% from 4.2%. The decline was due to job gains of 93,000 in the household survey and a reduction of 130,000 in the labor force.

US Unemployment Rate

Wage growth was below expectations at 3.7% year-over-year, down from 3.8% last month. The average workweek hours were lower at 34.2, just above the five-year low of 34.1 in January, hampered by weather and the LA fires.

Workweek & Wages

Monitoring the employment-to-population ratio among prime-age individuals, aged 25 to 54, should signal when concern about the unemployment rate is warranted. The improvement in the three-month average of the prime-age employment-to-population ratio is evidence that the labor market has been resilient. It should be monitored closely, but it has been able to maintain a steady level so far.

Prime-Age Employment-To-Population Ratio

Initial weekly filings for unemployment benefits remain benign. However, continuing claims for benefits are above the lows, indicating some slowdown in people being rehired after losing their jobs.

Continuing Claims For Unemployment Benefits

Bottom line: The details of the jobs report were less impressive than the headline, but job growth was better than expected, and labor market health remains solid.

Federal Reserve

Markets currently expect two 25-basis-point (0.25%) Fed cuts in 2025, consistent with the median Fed projection. The better jobs data eliminated any chance of a cut in July, but the first move lower in 2025 is still expected in September.

Expected Fed Rate Cuts

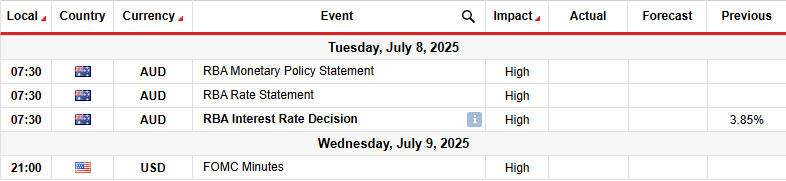

What To Watch This Week

Economic data releases are sparse this week. In addition, there are only two companies in the S&P 500 scheduled to report earnings.

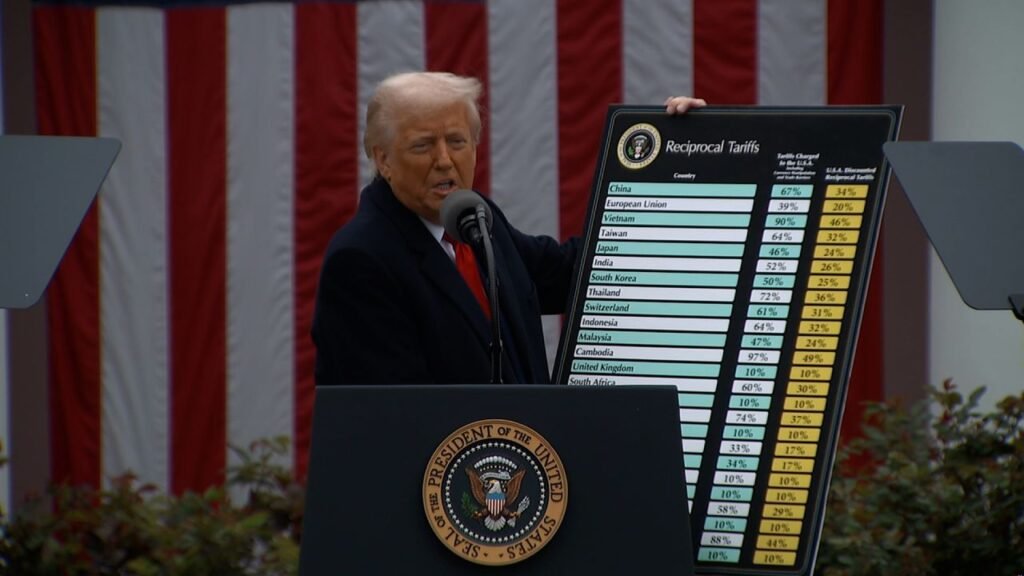

Now that the One Beautiful Big Bill Act (OBBBA) has been signed into law, President Trump’s July 9 tariff deadline should be the focus. While deals with Vietnam and the UK, as well as a détente with China, have been reached, the tariff levels of many large trading partners remain unsettled, barring a trade agreement. President Trump said letters are being sent to the countries notifying them of the effective tariff rate on their exports to the US, effective August 1, unless a trade deal is reached. Market participants will be keen to see if more trade deals are signed or if the possible economic drag from higher tariffs begins to weigh on the US economic outlook again.

Conclusions

Stocks have reacted favorably to the better economic data and the likely boost from the tax cuts passed last week. The hurdles at these valuation levels are higher, but optimism about future corporate earnings has improved as economic downside risks have receded. Another spike in effective tariff rates around President Trump’s July 9 deadline could raise concerns about the economic headwinds increasing again, so increased volatility would not be unexpected.