After stumbling to value that challenged the 0.58000 level in late August, the NZD/USD has been able to produce a hard fought incremental climb higher and is near the 0.59300 ratio as of this writing.

The NZD/USD has found buyers in the past two weeks, but day traders have had a constant battle fighting reversals within the currency pair. As of this morning the NZD/USD is traversing around the 0.59300 ratio. Yesterday’s highs around 0.59625 touched value not seen since the 14th of August. On the 22nd of August however, the NZD/USD stumbled to within sight of the 0.58000 level.

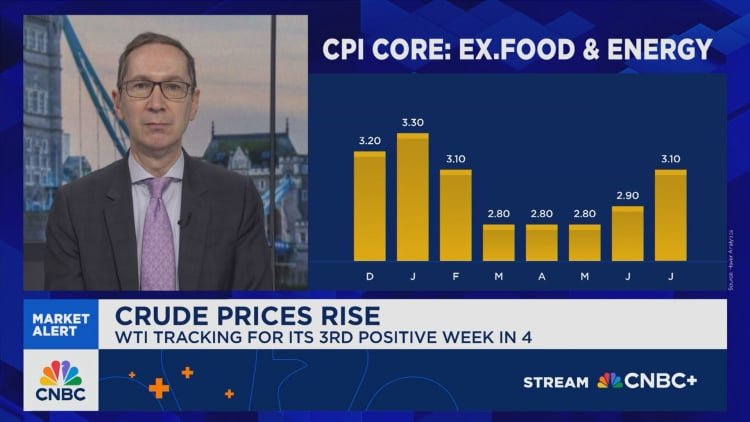

The NZD has fought headwinds over the mid-term as it has been confronted by lackluster economic data in New Zealand. Tomorrow manufacturing sentiment will be seen from New Zealand which may have an affect on the NZD/USD early on Friday. Later today from the U.S the Consumer Price Index statistics will be released. Incremental gains in the NZD/USD have been hard fought.

Reactions and the Search for Correlations

While the NZD/USD certainly is influenced by the broad Forex market and correlates often to other major currencies movement versus the USD, the currency pair has produced a rather difficult road for day traders to pursue over the mid-term. Price velocity in the NZD/USD is always able to spark a fast change of direction. Day traders did manage to see movement higher when the U.S released its Producer Price Index statistics yesterday which came in lower than expected.

The movement higher which was produced yesterday however, was not much better than the ratios tested on Tuesday in the NZD/USD. Actually the broad Forex market as a whole yesterday did not see the USD decline in value too much. It is tempting to believe that financial institutions have already priced in an interest rate cut in September and believe another one will come in October from the Federal Reserve. But day traders should not be too quick to believe this narrative. Greater impetus is desired.

The 0.60000 Level Appears Overly Ambitious

On the 13th of August the NZD/USD came within sight of the 0.60000 but did not touch the mark, in July the currency pair did trade above 0.60000. While other major currencies have been able to gain on the USD and sustain some higher values, a fight has persisted in the NZD/USD regarding equilibrium.

- New Zealand economic data via the BusinessNZ Manufacturing Index will be important, today’s U.S CPI will play a role in the NZD/USD too.

- However day traders waiting for a powerful punch upwards may not get their wishes fulfilled unless U.S Fed policy next week is publicly dovish.

- Until then the NZD/USD is likely to remain rather full of difficult reversals.

- The slight incremental move higher the past few days may be optimistic and this may lend itself towards buying of the NZD/USD, but speculators should not get too ambitious.

NZD/USD Short Term Outlook:

Current Resistance: 0.59360

Current Support: 0.59270

High Target: 0.59480

Low Target: 0.59210

Ready to trade our daily Forex analysis? Here’s a list of the brokers for forex trading in New Zealand to choose from.