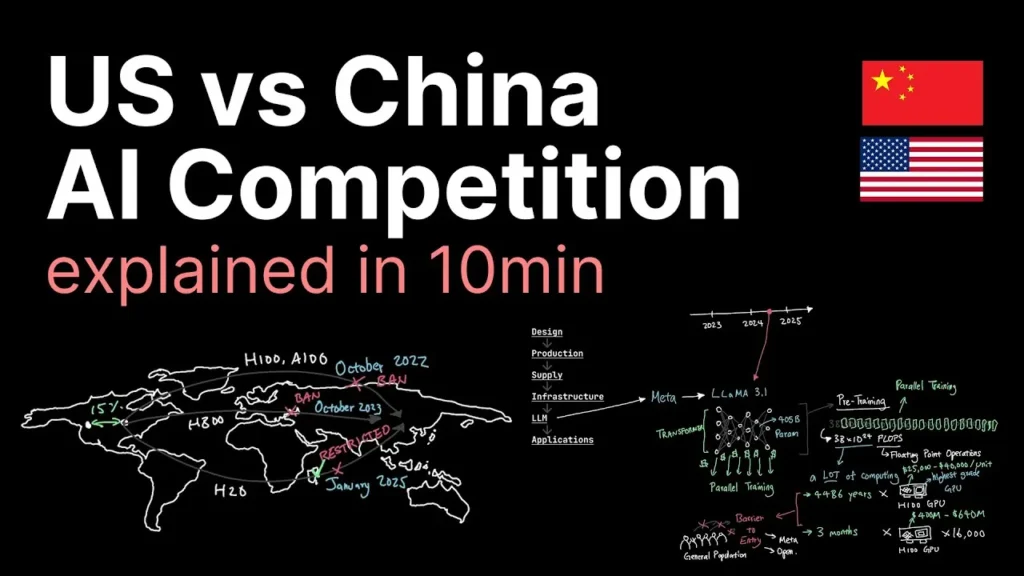

Nvidia is halting production of an artificial-intelligence chip it developed for China after the government in Beijing told companies not to buy it, the latest twist in the U.S.-China tech war centered on the $4 trillion chip designer.

Nvidia in recent days has told some partners to stop work related to making its H20 product, which was approved by the Trump administration for sale in China in exchange for 15% of the sales going to the U.S. government, people familiar with the matter said. The pause came after Chinese officials raised concerns about potential security risks in the chips.

The company and its Chinese customers are now hoping for approval to sell a more advanced AI chip, the people said. They are betting that the product performs better than chips Chinese companies can offer, but worse than the most advanced Nvidia products, and that both governments will be satisfied with the outcome.

Trump recently said he would approve a chip based on Nvidia’s Blackwell architecture that was 30% to 50% worse than the company’s top product.

In recent weeks, Nvidia has presented versions of such a product to U.S. officials, some of the people said. The discussions started earlier this year, before Trump’s comments, and included a chip with roughly 80% of the peak performance. The company has also directed its leading manufacturer in Taiwan to focus on next-generation products.

The jockeying highlights the uncertainty facing companies and governments in the rapidly evolving AI industry. Both Washington and Beijing have zigzagged repeatedly, seeing chips as critical to national security while they hammer out a broader trade agreement. Caught in the middle, Nvidia CEO Jensen Huang has turned into a diplomat, shuttling between the U.S. and China to secure the market access he needs.

Critics of Huang and the Trump administration’s approach warn they could undermine national security if the chips fall into the wrong hands. China is also in a bind, wanting to boost domestic companies like Nvidia-competitor Huawei and catch up in the AI race. That makes it difficult for many in Washington to tell whether Beijing’s H20 security concerns are a negotiating tactic, a legitimate government stance or a combination of both.

“China wants to have the best chips but also wants to have domestic chips at the same time. Those two goals are in conflict with one another,” said Jimmy Goodrich, a senior adviser to the think tank Rand who focuses on tech issues.

“If the U.S. government were to approve a powerful Blackwell for China, even at a 30-to-50% performance reduction, my guess is we’d miraculously see China forget about security concerns,” he added, reflecting a common view among industry executives.

Some in the White House view China’s actions as a move to support Huawei and the domestic AI ecosystem, an administration official said. The Trump administration has cited Huawei’s improving capabilities in justifying exports of AI chips. Chinese developer DeepSeek this week indicated China will soon have its own next-generation chips to run AI models.

“We constantly manage our supply chain to address market conditions,” a Nvidia spokeswoman said. “China won’t rely on American chips for government operations, just like the U.S. government would not rely on chips from China. However, allowing U.S. chips for beneficial commercial business use is good for everyone.”

Many Chinese companies still view Nvidia products as better than what they can get domestically. They would have more than $15 billion available to buy additional AI chips beyond what domestic producers can supply this year if U.S. products like Nvidia’s were available, analysts at investment bank Bernstein estimate.

During a visit to Taiwan Friday, Huang acknowledged the export approval for a Blackwell chip is a big question mark.

“It’s up to, of course, the United States government,” said Huang, who met executives from Taiwan Semiconductor Manufacturing, which makes Nvidia chips, during his trip. “We’re in dialogue with them, but it’s still too soon to know.”

Trump called Blackwell technology “super-duper advanced” and “the latest and the greatest in the world” when he discussed chip exports recently.

Last month, after a meeting between Trump and Huang, the administration said Nvidia could sell the H20 in China, reversing an April decision that had blocked sales.

Customers in China immediately flocked to put in orders after finding domestic supply insufficient, industry participants said. Nvidia placed orders for hundreds of thousands of H20 chips with TSMC to add to its existing inventory.

But the fever only lasted for days. Beijing officials started raising concerns about potential security risks, including trackers that would let other people operate the chips remotely. Nvidia has said its products don’t have such “backdoors.” The government instructed Chinese companies not to buy them until the all-clear was given.

“We’re surprised by that,” Huang said Friday when asked about China’s scrutiny. “They requested and urged us to secure licenses for the H20s for some time.”

Nvidia at least for now sees no point in making more H20s, some of the people said. In recent days, the company has told partners—including TSMC, Foxconn and Samsung—to halt work for producing new H20s. The Information and Reuters earlier reported on Nvidia’s direction to its partners.

Officials in Beijing are reluctant to have Trump’s approval of the H20 treated as a U.S. concession to Chinese wishes—even though Huang said China urged him to get the approval. They say that if the U.S. really wants to show goodwill, it will give Chinese users more access to cutting-edge American technology.

In one considered modification of the Blackwell chip for China, Nvidia initially removed high-bandwidth memory units and the components that allow the chips to communicate with one another, some of the people said. Both help AI computers make more simultaneous calculations and improve performance.

After Huang persuaded the White House to allow H20 exports, Nvidia engineers began to reverse their modifications. They reasoned that since the H20 contains high-bandwidth memory, a Blackwell chip with that feature might get approval too. It is normal for tech companies to discuss products in development with government officials who regulate exports.

Some Chinese companies have tested samples of the new Nvidia chips and seen positive results.

“AI is going to advance around the world, with or without the United States,” Huang said Friday, describing how he explained the issue to Trump. “It’s important for us to maximize our AI export technology at the time when this industry is being formed.”

Write to Raffaele Huang at raffaele.huang@wsj.com and Amrith Ramkumar at amrith.ramkumar@wsj.com