Nvidia (NVDA) shares rose more than 4% Wednesday to notch a new record high of $154.31, completing a remarkable turnaround from earlier this year.

Nvidia shares previously hit a record close of $149.43 on Jan. 6. The stock’s gain also saw shares reach a fresh intraday high during Wednesday’s trading session.

The AI chipmaker’s stock has seen a significant upswing following its first quarter earnings in late May, which featured revenue that beat Wall Street’s expectations and showed the company continuing to thrive despite a new export ban on sales of its chips to one of its largest markets: China.

Read more about Nvidia’s stock moves and today’s market action.

Shares have jumped more than 14% since Nvidia’s May 28 earnings report, far ahead of the S&P 500’s (^GSPC) roughly 3.4% gain in that time frame.

Loop Capital analyst Ananda Baruah on Wednesday raised his price target on Nvidia stock to $250, the highest of Wall Street analysts tracked by Yahoo Finance. The new price target suggests Nvidia’s market cap could soar to $6 trillion from its current $3.6 trillion level.

“While it may seem fantastic that NVDA fundamentals can continue to amplify from current levels, we remind folks that NVDA remains essentially a monopoly for critical tech, and that it has pricing (and margin) power,” Baruah wrote in a note to clients, adding that Loop Capital analysts see the market for AI chips growing to $2 trillion in 2028.

To be sure, questions remain over whether AI infrastructure demand will continue to rise, as Big Tech companies rake in far less revenue than they’re spending to build the tech.

Nvidia stock had struggled in the months following its record close in January as President Trump embarked on his trade war and artificial intelligence competition in China rattled the broader markets.

Nvidia shares plunged in late January when a new cheap AI model from Chinese startup DeepSeek prompted demand concerns for its AI chips. Then, the stock plummeted again in April as Trump’s steep tariff announcements rocked the stock market. Trump enacted a ban on sales of Nvidia’s H20 chips to China, costing the chipmaker $2.5 billion in lost revenue in the first quarter and a projected $8 billion loss in the second quarter.

Read more: How does Nvidia make money?

At the same time, Nvidia’s competition in the Chinese market was heating up from domestic tech giant Huawei. Huawei is reportedly readying a new advanced AI chip that would be competitive with Nvidia’s prior-generation H100 chips.

Shares hit their lowest closing price in over a year on April 4, ending the trading session at just over $94.

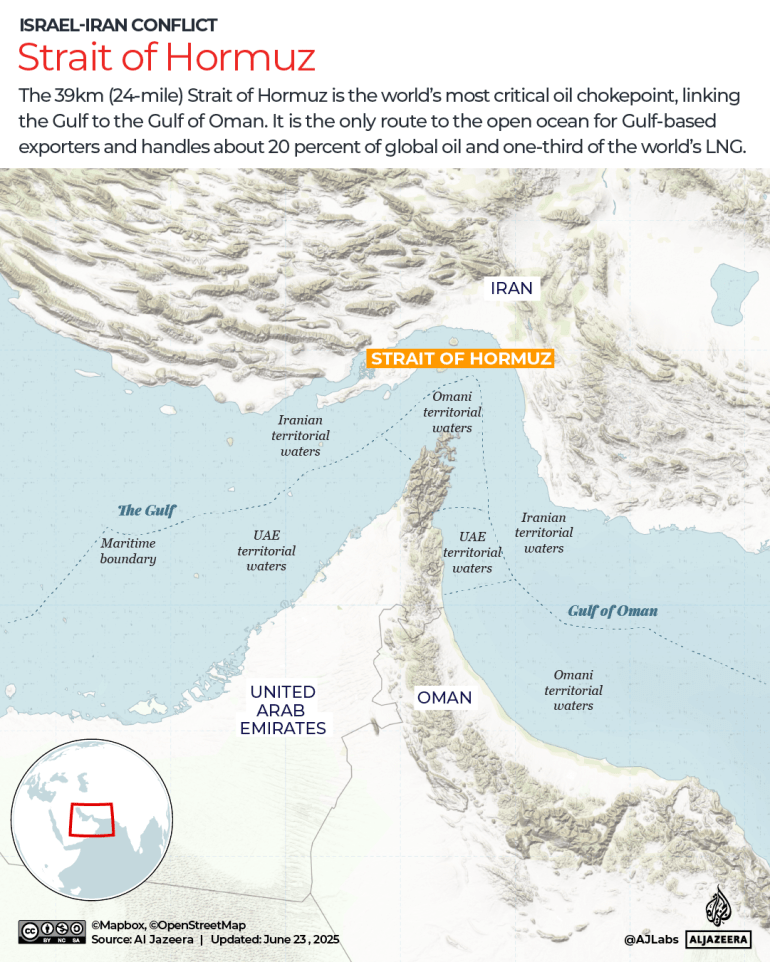

Before the chipmaker’s first quarter earnings report, Nvidia stock was bolstered in May by deals with Saudi Arabia and the United Arab Emirates to supply hundreds of thousands of its AI chips to the countries. The stock’s comeback helped it briefly overtake Microsoft (MSFT) as the world’s most valuable company in early June.

The upswing comes as investors pile back into tech stocks. Bank of America analysts said in a note Tuesday that tech inflows hit their highest level last week since June 2024.

On Tuesday, the Nasdaq 100 (^NDX) also hit a fresh record close, while the Nasdaq Composite (^IXIC) notched its highest levels since February.

Laura Bratton is a reporter for Yahoo Finance. Follow her on Bluesky @laurabratton.bsky.social. Email her at laura.bratton@yahooinc.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance