Shin Min-jae, head of KB Asset Management’s stock management 2, is in the process of normalizing the Korean stock market. Promising industries with abundant global liquidity in the second half of the year will implement policies for shipbuilding, defense, steel, and K culture 株. Key to the inclusion of MSCI’s index of advanced countries

“Now is the time to invest in Korean stocks. The combination of government policy and global liquidity has led to a full-fledged re-rating (revaluing) of the domestic stock market.”

In a recent interview with Maeil Economy, Shin Min-jae, head of KB Asset Management’s stock management 2, diagnosed that the domestic stock market has entered a structural upward trend.

“The most important thing in stock investment is supply and demand, and domestic and foreign conditions are supported,” he said. “The upward trend will continue in the second half of this year and the first half of next year.”

Director Shin managed the KB dividend focus fund from August 2010 to August 2015, earning a 110% return, exceeding the KOSPI index by 98.7 percentage points.

The KB ESG Growth Leaders Fund, which he is currently operating, also rose 37.8% over the past three months as of the 25th, exceeding the KOSPI’s yield by 10.3 percentage points.

Shin said the stock price net asset ratio (PBR) of Korean stocks is still undervalued at 1.0 times. “If companies’ shareholder return policies are implemented, the Korean stock market could be re-rated up to PBR 1.2 times,” he said. “There is room for the KOSPI to rise to the 3,500-3700 level just by normalizing the valuation.”

“Unlike already normalized markets like Taiwan and Japan, Korea is now entering that path,” he said. “The policy is also supported, so it is a better time to invest in domestic stocks than other countries.”

He said the supply and demand environment surrounding the domestic stock market is also favorable.

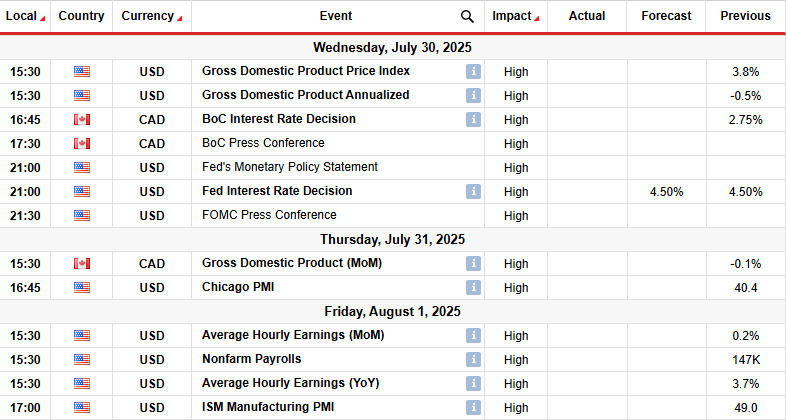

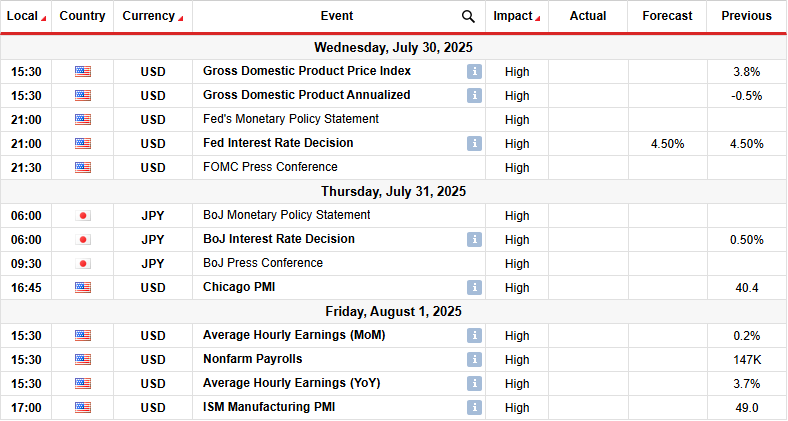

Head Shin said, “A lot of funds are coming into general stock funds recently, and institutions are expanding their share of domestic stocks,” adding, “The U.S. Federal Reserve (Fed) is expected to cut interest rates once this year and four times next year, improving liquidity conditions.”

“Whether the government’s policies, such as separate taxation on dividend income, are actually implemented is a big variable in the stock market in the second half of the year,” he said. “Korea’s inclusion in the Morgan Stanley Capital International (MSCI) Index of advanced countries will also be the biggest issue next year or two.”

In addition to defense and shipbuilding, which showed strong performance in the first half of this year, K culture-related stocks and steel were cited as promising industries in the second half of this year. Director Shin explained, “The shipbuilding industry has improved its operating profit ratio to double digits, continuing performance momentum, and the defense industry is increasing its structural demand as its defense budget is increasing worldwide.”

“K-food and K-entertainment stocks are steadily improving, and the steel industry will benefit from the restructuring of the Chinese steel industry,” he added.

Regarding the semiconductor industry, he said, “It is difficult to see semiconductors as a simple cycle industry as in the past,” adding, “SK Hynix, which has recently been adjusted, is positive in the mid to long term because demand for artificial intelligence (AI) is solid and is changing into a customized semiconductor production structure.” “Samsung Electronics’ performance in the second quarter was bad, but there are evaluations that it will improve in the future,” he said.

Shin recommended individual investors to invest in public offering funds rather than exchange-traded funds (ETFs).

“ETF has difficulties in managing it even during the day and adjusting the timing of buying and selling,” he said. “For most ordinary investors, the strategy of investing in funds comfortably while doing their main job is more appropriate.”

![AI Day Trading - All You Need to Know–Updated [Year, Month]](https://koala-by.com/wp-content/uploads/2025/07/ai1.webp)