According to Reuters, during talks held in London last week, sources indicate that Beijing has yet to commit to approving exports of certain specialized rare-earth magnets used by U.S. military contractors in fighter jets and missile systems. Meanwhile, the U.S. continues to enforce export restrictions on China’s access to advanced AI chips, the report adds.

Notably, sources mention that the U.S. is reportedly considering extending the tariff deadline reached last month in Geneva by another 90 days beyond August 10, as Reuters highlights. This may signal that a long-term trade agreement between the U.S. and China is unlikely to be reached before then, Reuters suggests.

Reuters notes that, with Chinese negotiators linking their export controls on military-grade rare earth magnets to ongoing U.S. restrictions on advanced AI chips, trade talks have shifted focus—from earlier issues like tariffs and China’s trade surplus to the growing importance of export controls.

Current Status of China’s Rare Earth Export Controls

Sources cited by Reuters note that, during the London talks, China pledges to accelerate approval for rare-earth export applications from nonmilitary U.S. manufacturers. Reuters also mentions that Beijing reportedly proposes establishing a “green channel” to fast-track license approvals for trusted U.S. firms.

In a sign of progress, Chinese rare-earth magnet producer JL MAG Rare-Earth announces on Wednesday that it had received export licenses covering shipments to the U.S. China’s Commerce Ministry also confirms it had approved certain “compliant applications” for export licenses, according to Reuters.

Selective Approvals and Six-Month Constraints

However, Reuters points out that China has remained firm on restricting exports of specialized rare earths—such as samarium—which are used in military applications and fall outside the fast-track framework agreed upon in London. In contrast, automakers and other manufacturers primarily rely on different rare earth magnets, including dysprosium and terbium, as noted by Reuters.

Additionally, Wall Street Journal highlights that China is imposing a six-month limit on rare-earth export licenses issued to U.S. automakers and manufacturers, in an effort to maintain flexibility for escalating trade tensions if necessary.

As TechNews notes, China holds about 40% of global rare earth reserves and accounts for nearly 70% of global production—particularly in heavy rare earths. These elements are vital to modern technologies and strategic sectors such as defense, aerospace, electronics, and electric vehicles (EVs).

Read more

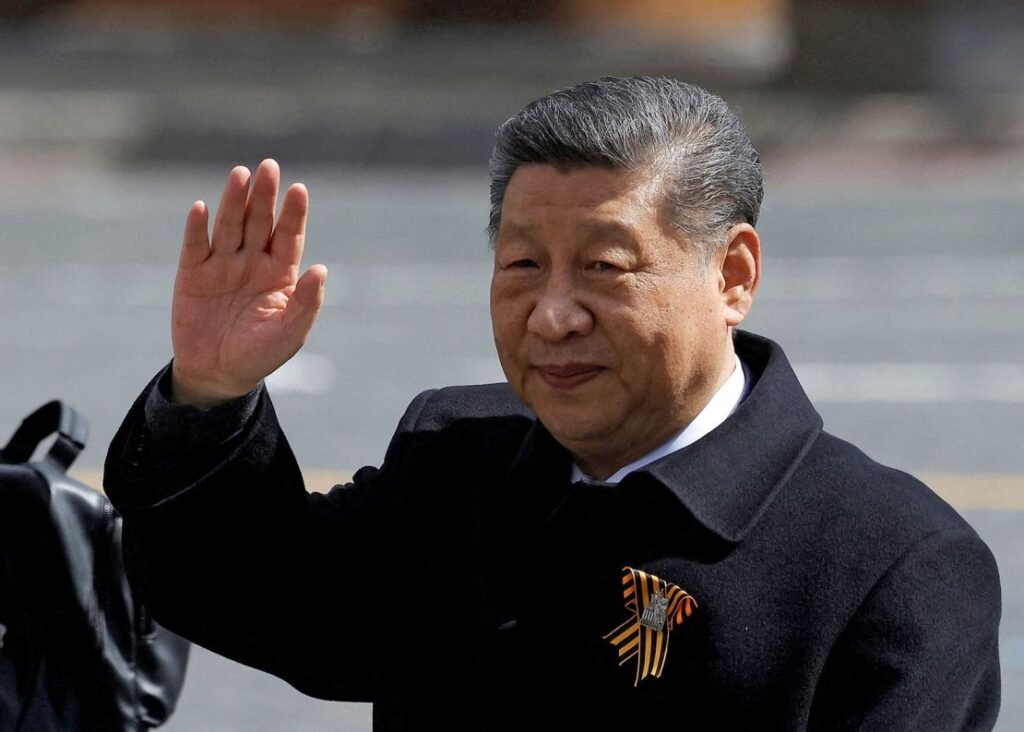

(Photo credit: The White House)

Please note that this article cites information from Reuters, Wall Street Journal, and TechNews.