The electric vehicle (EV) charging industry is at a pivotal inflection point, driven by surging demand for sustainable transportation and aggressive policy support. Blink Charging Co. (NASDAQ: BLNK) has positioned itself as a key player in this transformation, but its path to profitability has been anything but smooth. Over the past year, the company has undertaken a bold strategic overhaul, including aggressive cost-cutting, strategic acquisitions, and a pivot toward high-margin service revenue. This article examines Blink’s operational restructuring, recent M&A activity, and its potential to capitalize on the explosive growth of EV infrastructure.

Operational Restructuring: A Double-Edged Sword

Blink’s restructuring efforts, dubbed the “BlinkForward” initiative, have been both a necessity and a calculated risk. In 2024, the company announced a 14% global workforce reduction, followed by a more aggressive 20% cut in May 2025. These moves are expected to generate annualized savings of over $11 million, though they come with upfront costs of $1–1.5 million in severance and restructuring expenses. The goal is clear: streamline operations, reduce cash burn, and build a leaner, more agile organization.

The financial results reflect the mixed outcomes of this strategy. Q1 2025 saw a 45% revenue drop to $20.8 million, driven by a sharp decline in product sales, while service revenue grew 35% to $6.8 million. By Q2 2025, total revenue had rebounded 38% sequentially to $28.7 million, but gross margins plummeted to 7% from 32% in Q2 2024. The company also reported a $32 million net loss in Q2, largely due to $16.5 million in one-time charges. However, Blink reduced operating expenses by 22% year-over-year, cutting $8 million in annualized costs through compensation reductions and operational efficiencies.

While the restructuring has improved cost discipline, it raises questions about the long-term impact on innovation and employee morale. The EV charging market is highly competitive, and Blink’s ability to maintain its technological edge while cutting costs will be critical.

Strategic M&A: Bolstering Capabilities and Market Reach

Blink’s recent acquisitions and partnerships have been pivotal in reshaping its business model. In July 2025, the company acquired Zometriq, a firm specializing in AI-driven fleet management software and interoperable AC Level 2 chargers. This move addresses a key gap in Blink’s portfolio, particularly in price-sensitive markets like fleets and multifamily housing. Zometriq’s advanced load management capabilities also position Blink to reduce infrastructure costs for customers, a differentiator in an industry where grid integration is a major challenge.

Equally significant is Blink’s partnership with Axxeltrova Capital in the UK, structured as a £100 million Special Purpose Vehicle (SPV) to accelerate growth under the Local Electric Vehicle Infrastructure (LEVI) program. This non-dilutive capital model allows Blink to expand its UK footprint without equity financing, preserving margins and enhancing financial flexibility. The SPV is a masterstroke in a capital-intensive industry, enabling rapid deployment of EV chargers while minimizing risk.

Blink has also expanded its international presence through partnerships like the one with Group Bernaerts, a Belgian office property company. By the end of 2025, Group Bernaerts aims to double its Blink charging stations from 88 to 176, underscoring the growing demand for EV infrastructure in multi-tenant environments. These partnerships align with Blink’s sustainability goals and reinforce its position in Europe, a market expected to see significant EV adoption in the coming years.

Long-Term Profitability: A Race Against Time

The EV infrastructure market is projected to grow from $7 billion in 2025 to $100 billion by 2040, driven by U.S. policies like the Infrastructure Investment and Jobs Act and the Inflation Reduction Act. Blink’s focus on high-margin service revenue—up 46% year-over-year in Q2 2025—positions it to benefit from this trend. The company’s owner-operated model, which saw 339% year-over-year growth in revenue from U.S. DC chargers, is a key driver of recurring income.

However, challenges remain. The “chicken-and-egg” dilemma of EV adoption and infrastructure development persists, and Blink’s recent financial struggles highlight the need for disciplined execution. The company’s cash reserves of $25.3 million as of June 30, 2025, provide some flexibility, but continued losses and high upfront costs for charger installations could strain liquidity.

Investment Implications

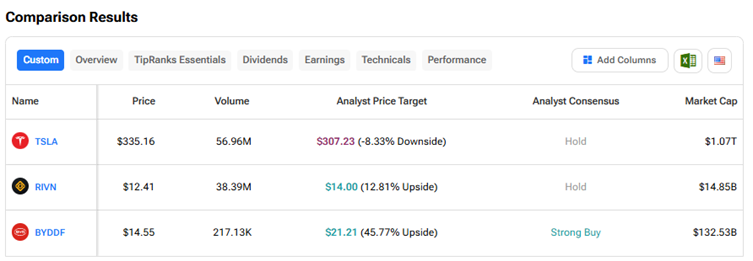

Blink’s strategic moves—cost-cutting, M&A, and non-dilutive capital partnerships—demonstrate a clear focus on long-term value creation. The company’s ability to pivot toward service revenue and leverage AI-driven solutions could differentiate it in a crowded market. However, investors must weigh the risks: execution risks in restructuring, competition from larger players like Tesla and ChargePoint, and the need for sustained capital investment.

For those with a long-term horizon and a tolerance for volatility, Blink presents an intriguing opportunity. The EV charging market is poised for explosive growth, and Blink’s strategic agility could position it as a key player. That said, near-term profitability remains uncertain, and the company’s success will hinge on its ability to execute its BlinkForward plan while maintaining technological innovation.

In conclusion, Blink Charging’s strategic turnaround is a work in progress. While the path to profitability is fraught with challenges, the company’s proactive approach to restructuring, M&A, and market expansion offers a compelling case for investors who believe in the future of EV infrastructure.