What’s going on here?

Earnings season delivered a grab bag of surprises this week, with firms like American Express and Truist Financial surpassing forecasts and lifting US stock indexes, while several big names saw their shares slip despite positive results.

What does this mean?

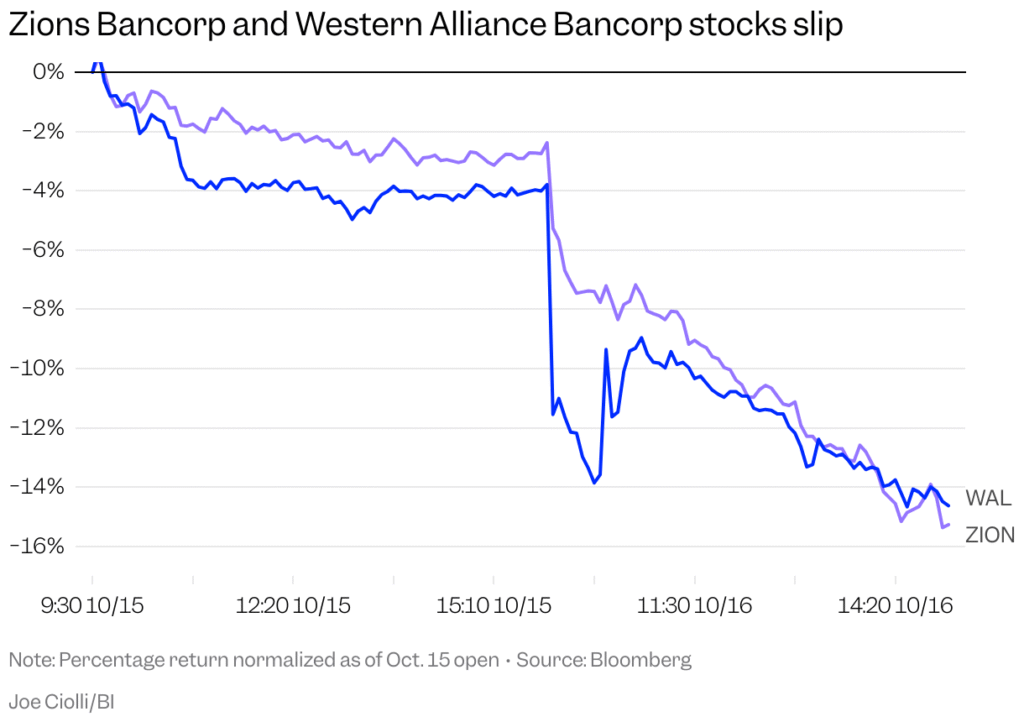

Corporate earnings stole the spotlight, showing just how unpredictable investor reactions can be. American Express posted third-quarter earnings of $4.14 per share—well ahead of estimates—and boosted its 2025 outlook, sparking a nearly 7% rise in its stock. Truist Financial delivered its own beat, pulling shares up 3.6%. Meanwhile, Oracle unveiled a bold 2030 target of $225 billion in revenue and locked down $65 billion in new cloud deals, but that didn’t stop its stock from dropping 7%. State Street topped both earnings and revenue estimates, yet shares slipped 2.9%, and Novo Nordisk’s stock fell 3.8% on US political headlines about lowering Ozempic’s price. Major indexes like the S&P 500, Nasdaq, and Dow Jones bounced back on Friday, ending a choppy week on an upbeat note after earlier credit concerns hit regional banks.

Why should I care?

For markets: Strong results don’t always move the needle.

Earnings beats and optimistic forecasts gave major indexes a lift, but individual stock movements told a different story. Investors have set the bar high—so unless companies deliver real wow moments or clear growth drivers, even stellar reports might not do the trick. That’s leading to a pickier market mood, where strong fundamentals are no guarantee against sudden sell-offs.

The bigger picture: Profits take a back seat to policy moves.

Earnings aren’t the whole show—government actions and policy talk can swing stocks as much as the numbers do. With drug prices and bank stability both in the political spotlight, investors are watching headlines and regulatory moves just as closely as earnings, signaling that the market’s mood is set by more than just financial health.

SPONSORED BY PROSPERO.AI

Live long and Prospero.ai

You now have the chance to back Prospero.ai: the award-winning AI platform with trading signals that have outperformed the S&P 500 by 67% over the past four years.

Prospero.ai is embedding itself in retail investors’ routine. Weekly active users jumped 50% in just three months, with traders logging in almost daily for new plays. That momentum fueled a 200% revenue increase last year, with another 150% expected this year.

Investors aren’t the only ones interested. Multiple boards have praised Prospero.ai: its won awards from Best AI Fintech (Global Financial Market Review) to Most Influential CEO 2025 (CEO Monthly). Our very own analysts are also exploring how they could use Prospero.ai’s smart signals in their research.

If you want to be an early investor in a platform with triple-digit growth, you can check out the crowdfunder here.

Investing in private securities is risky, speculative, and illiquid. You should not invest unless you can afford to lose the entire amount invested. Past performance is not indicative of future results. Please review the full offering materials and disclosures before making an investment decision.