Palantir (PLTR 2.59%) has been one of the best-performing stocks so far this year, with its price more than doubling. Finding stocks that can achieve that is a dream for every investor, and considering the circumstances of Palantir’s run-up, nearly any stock could be a candidate for such performance.

So, what stocks could duplicate this incredible run moving forward? Let’s take a look.

Palantir’s run-up isn’t business-related

Although Palantir posted strong earnings results in Q1, 39% revenue growth normally doesn’t justify the stock doubling. Furthermore, that’s year-over-year revenue growth, and considering the stock has risen around 800% since the start of 2024, there’s something a bit odd here.

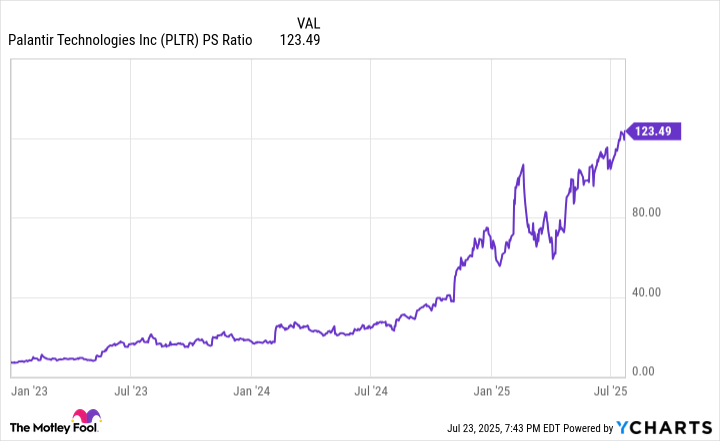

The mismatch between growth and stock performance can be attributed to the stock’s valuation, which has exploded over the past year.

PLTR PS Ratio data by YCharts

Palantir has risen from a stock that traded in the typical software valuation range of 10 to 20 times sales to more than 120 times sales. A good rule of thumb is that a software company should be increasing its revenue at a rate greater than its price-to-sales (P/S) ratio. Ideally, it’s growing at two to three times this rate. However, Palantir’s growth is a third of its valuation, indicating an incredibly expensive stock.

This indicates that most of Palantir’s movement has come from market exuberance rather than business performance. Considering Palantir’s stock entered the year trading at an already expensive 65 times sales, the rise is almost directly tied to its valuation rising to an even more expensive level. If its stock were truly tied to the business, then it wouldn’t be valued as high.

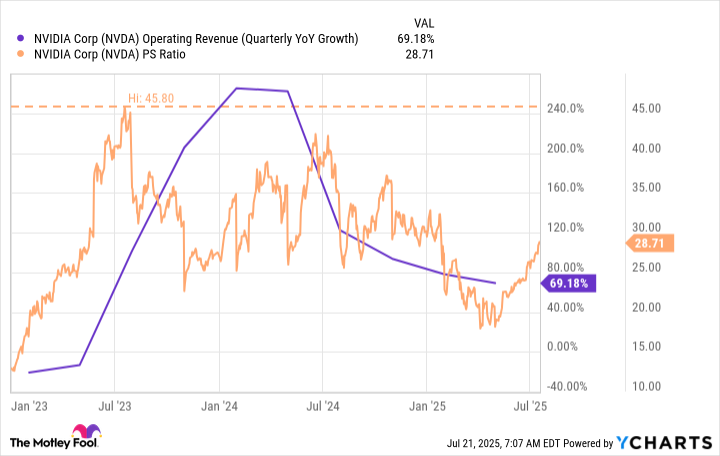

For reference, when Nvidia (NASDAQ: NVDA) was tripling its revenue year over year, it never traded for more than 46 times sales. Furthermore, it’s still growing much faster than Palantir is right now and is far cheaper.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts

The reality is that Palantir’s stock has become far too expensive for its growth rate, and an unrealistic valuation has driven its impressive performance. Any stock has the potential to be bid up substantially by its shareholders and yield incredible returns, as seen with Palantir. So, if you’re looking for a stock that may double, then literally any stock in the market is a candidate if the circumstances are the same as Palantir’s.

However, here are a couple stocks that have the potential to realistically double, without requiring unreasonable valuations to achieve it.

Alphabet

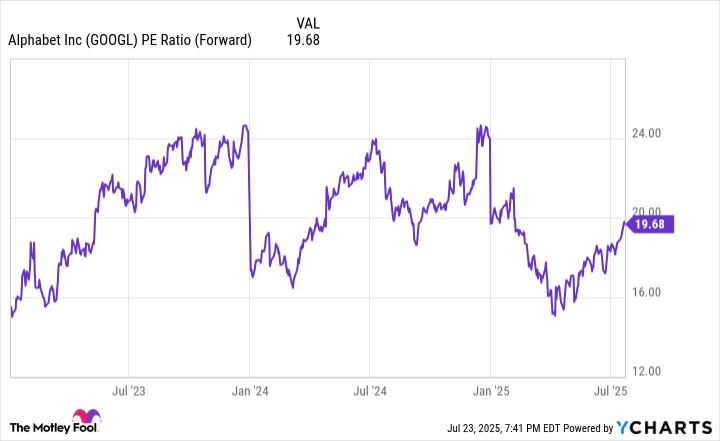

Alphabet (GOOG 0.45%) (GOOGL 0.54%) is the parent company of Google, and doesn’t receive the same premium that many of its big tech peers do. This is unfortunate, as its growth rates are often comparable to those of some of its peers. The big concern is that Google Search could be overtaken by generative AI, so the market prices it at a discount to its peers.

Currently, Alphabet trades at 20 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts

Most of its big tech peers trade in the low- to high-30s forward P/E range, so if Alphabet can return to receiving the same premium as its peers, then it has the potential to double.

While I don’t think a true double is realistic, I believe a 50% gain is easily achievable if the market recognizes that Google Search is here to stay.

IonQ

IonQ (IONQ -1.80%) is a leader in quantum computing. Although this technology hasn’t proved its worth, it’s rapidly approaching that point. 2030 is expected to be a key year for quantum computing deployment, and if IonQ can prove that its technology is a top option, the stock could be poised for a significant rise.

By 2035, this market is expected to be worth $87 billion, providing IonQ with a substantial revenue base to capture. Considering that IonQ is currently a $11 billion company, it could be poised for a significant stock rise if it announces a breakthrough in its pursuit of making quantum computing commercially relevant.

The reality is that any stock can double under the circumstances that Palantir’s did. But, if you’re looking for two stocks with realistic possibilities to double, Alphabet and IonQ may not be too far off.

Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.