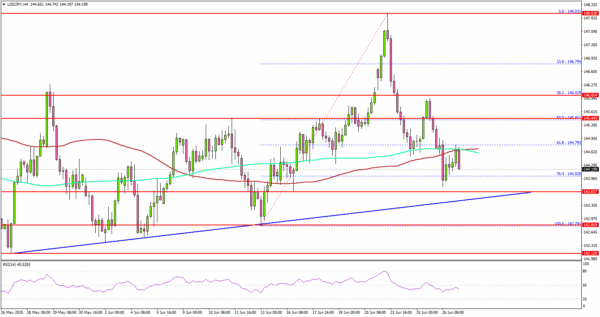

The conflict in the Middle East has restored the US dollar’s status as a safe-haven asset, but that has also been its downfall. The inverse correlation with US stock indices amid growing global risk appetite has caused the USD index to hit three-year lows. Investors perceive the ceasefire as the end of the Twelve-Day War between Israel and Iran and are buying stocks.

Carry traders are actively using the US dollar as a funding currency. Since the beginning of the year, its effectiveness in arbitrage against a basket of emerging market currencies has exceeded 8%. The use of the yen in carry trades has yielded just over 2%, while the euro and Swiss franc have been unprofitable.

The weakening of the US dollar is part of the White House’s plans. Donald Trump is putting pressure on the central bank to lower rates by 2 to 2.5 percentage points. The president intends to name Jerome Powell’s successor ahead of schedule, as early as this autumn. The emergence of a shadow Fed chair will put pressure on the USD index.

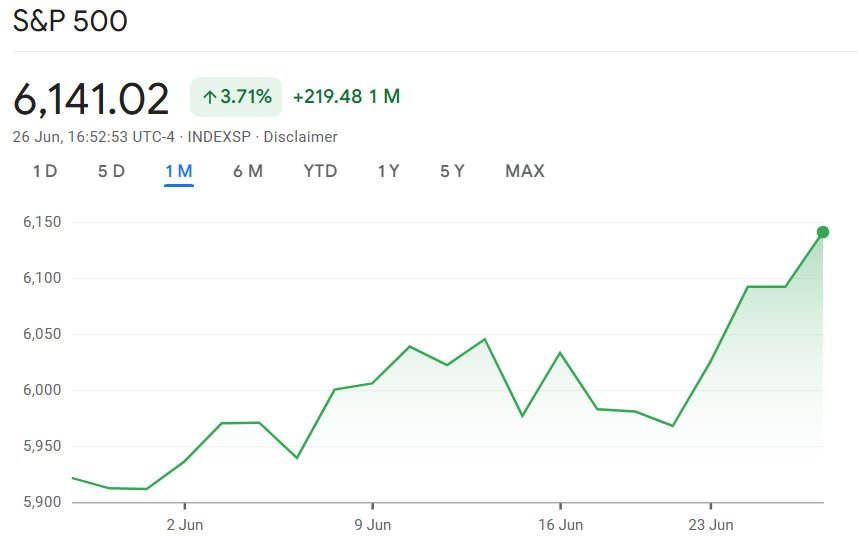

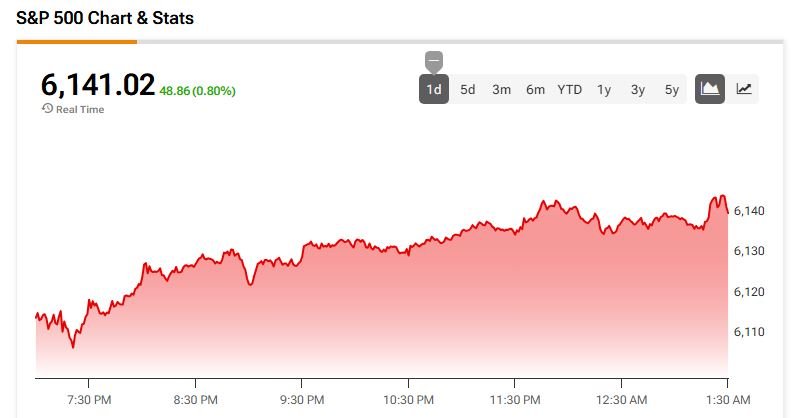

Stock indices

The de-escalation of the conflict in the Middle East brought the S&P 500 closer to record highs. A new wave of interest in artificial intelligence has allowed the Nasdaq 100 to update its historical peaks. The growth of US stock indices at the end of June is being called a rally of tech giants. NVIDIA has surpassed Microsoft in terms of market capitalisation, again becoming the most expensive company in the world.

Support from the White House is creating a tailwind for US stocks. However, the market is overly confident about Donald Trump’s intention to extend the 90-day delay in import duties or to limit himself to a minimum universal tariff of 10%. The US president has repeatedly emphasised that his policies have brought billions of dollars into the budget. His chief economist, Stephen Mnuchin, has estimated the inflow of money from tariffs at $3 to $5 trillion over 10 years. As the expiry date approaches, fear may return to the markets.

The inflated fundamental valuations of the S&P 500 are causing concern. The price-to-earnings ratio exceeds 22. This is 35% higher than the historical average for the indicator.