Micron is expected to report net earnings per share of $2.65 on revenue of $11.2 billion in its fiscal fourth quarter.

(Bloomberg) — Micron Technology Inc.’s earnings after the bell Tuesday will shed light on whether the chipmaker’s high-flying stock has gotten ahead of itself after a 40% gain in September.

Most Read from Bloomberg

Wall Street is betting that Micron’s results will feature a strong forecast for its high-bandwidth memory chips, a key component of the artificial intelligence infrastructure buildout. The rising demand comes as major companies such as Oracle Corp. affirm their commitment to spending on AI and Nvidia Corp. is investing in OpenAI to support more AI infrastructure.

As a result of this spending, typically sleepy segments of the technology industry like memory and storage have become an epicenter of AI optimism, with shares of Seagate Technology Holdings Plc, Western Digital Corp. and Sandisk Corp. all seeing massive September rallies along with Micron, which is on track for its biggest one-month jump since December 2009. However, it remains to be seen whether these gains will be justified by future growth. That’s why investors will be so eager to hear Micron’s outlook.

“It is all about the guide, and anything north of the consensus would lead to huge applause across the board,” said Daniel Morgan, senior portfolio manager at Synovus Trust, which owned roughly 73,000 Micron shares as of mid-September. “That we’re seeing an uptick in the storage companies just shows how AI is a catalyst that is spilling through to groups that might not ordinarily benefit from a cycle. That Western Digital and Seagate are rallying the way they are gives further confirmation of the trend.”

Shares rose 1% on Tuesday.

Micron is expected to report net earnings per share of $2.65 on revenue of $11.2 billion in its fiscal fourth quarter, which ended Aug. 31, up from EPS of 79 cents on revenues $7.8 billion a year ago. The company raised its forecast last month, citing improved pricing for dynamic random access memory, or DRAM, chips. For the full fiscal year, Micron’s net EPS is projected to rise to $7.42 on revenue of $37 billion, compared with 70 cents and $25 billion in fiscal 2024.

Last year’s earnings report was a watershed moment for Micron, however, because its outlook was so encouraging that the company’s stock had its best session in 13 years the day after the news hit. Now, 12 months later, investors want to see if that pace of growth can continue.

“Micron has already had six straight quarters of profitability, and typically these DRAM cycles last six-to-eight quarters,” Morgan said. “This report, if they give us something to hang our hat on for 2026, could show that this AI boom will extend the cycle beyond what we typically see.”

Despite the rally in Micron shares this month, which are on pace for their biggest monthly gain in more than 15 years, it remains cheap compared to its competitors. The stock is priced at about 12 times earnings over the next 12 months, making it the cheapest component in the Philadelphia Semiconductor Index, which trades at a multiple of 26 times. And it’s at a steep discount to AI chip bellwether Nvidia Corp., which is priced at 32 times forward earnings.

‘Pretty Attractive’

“Twelve times estimated earnings is pretty attractive by the standard of Micron being a major player in AI data centers and enterprise storage,” said Hendi Susanto, portfolio manager at Gabelli Funds, who owns Micron shares. “At the same time, investors shouldn’t neglect how Micron capex is running at a very high level — $14 billion this year and more next year. Capex should remain high for a while.”

In addition, some Wall Street pros see the earnings multiple as a deceptive way to value Micron because of its boom-and-bust cycles, meaning the company’s regularly swings from profits to losses. “During downturns they tend to burn cash,” Bloomberg Intelligence analyst Jake Silverman said. Trailing price-to-book value is a better metric, he said, and by that measure Micron’s “well above the prior cycle” and showing some exuberance

Micron shares closed Monday at $164.62, slightly over Wall Street’s 12-month price target of $162.46, suggesting analysts — nearly 80% of whom have buy ratings on the company — aren’t expecting much upside from here.

“If forced to choose, I’d call Micron a hold rather than a buy or sell,” Susanto said. “What makes Micron difficult to forecast is that pricing trends can swing widely, which means profits can swing wildly, and obviously that follows through to the valuation.”

Several analysts have recently discussed Micron’s growth potential in the data center market, which is at the heart of the AI trade. The company is benefiting from higher-than anticipated demand that’s outstripping production, Citigroup Inc. analyst Christopher Danely wrote in a note to clients earlier this month. He expects Micron to “guide well above consensus” in this earnings report, as data centers account for more than half of its revenue.

Still, after the sharp run-up in Micron shares over the past few weeks, investors are proceeding cautiously. Growth is rarely linear for chipmakers, so a slip, even a brief one, is always a possibility.

“While AI is huge, Micron remains a tremendously cyclical stock,” Synovus’s Morgan said. “DRAM is such a commodity business. Micron is in a good position, but this isn’t Nvidia, where you’re able to command massive margins.”

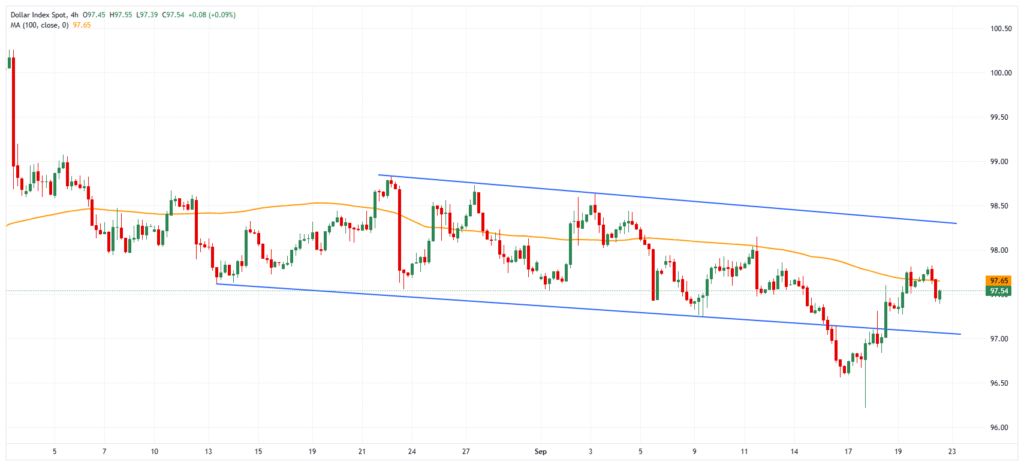

Tech Chart of the Day

Apple Inc. shares broke into positive territory for the year on Monday, the latest milestone in an advance that has put the iPhone maker within striking distance of a record. The stock had been down as much as 31% in early April but has rallied nearly 50% since then along with a broader rebound by the S&P 500 Index.

Top Tech Stories

-

Nvidia Corp. will invest as much as $100 billion in OpenAI to support new data centers and other artificial intelligence infrastructure, a blockbuster deal that underscores booming demand for AI tools like ChatGPT and the computing power needed to make them run.

-

will return to the air on Tuesday, ending a suspension Walt Disney Co. imposed following controversial remarks the ABC late-night host made about the assassination of Republican activist Charlie Kirk.

-

ASM International NV cut its outlook for second-half revenue, citing lower-than-anticipated demand and a “mixed picture” for some clients.

-

Oracle Corp. accelerated its succession plans for top leadership in recent months following a massive acceleration in its cloud business and stock market rally.

Earnings Due Tuesday

–With assistance from Subrat Patnaik and Brandon Harden.

(Updates to market open.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.