This AI infrastructure play has delivered bigger gains than its larger peers since going public earlier this year.

Artificial intelligence (AI) supercharged the growth of Nvidia (NVDA -3.47%) and Palantir Technologies (PLTR -9.39%) in the past couple of years or so, and that’s not surprising, as both companies are playing a key role in the proliferation of this technology with their hardware and software offerings.

While Nvidia’s powerful chip systems are enabling cloud computing giants, governments, and other customers to train AI models and run inference applications, Palantir is helping customers integrate AI into their operations. Not surprisingly, shares of both companies have been in fine form on the stock market.

Palantir stock has shot up a remarkable 116% in 2025. Nvidia, on the other hand, has delivered respectable gains of 33%. However, their gains pale in comparison to CoreWeave (CRWV -4.04%), a cloud AI infrastructure provider that went public less than five months ago.

Image source: Getty Images.

What’s powering CoreWeave’s stunning stock market surge?

CoreWeave stock jumped 125% since its initial public offering (IPO) on March 28 this year. Nvidia and Palantir recorded gains of 62% and 91% during the same period.

This remarkable rally in CoreWeave stock can be attributed to the terrific growth in the company’s revenue on account of the rapidly growing demand for training and deploying AI models and applications in the cloud. The company has built its business by renting out powerful graphics processing units (GPUs) from Nvidia to customers for running AI workloads.

CoreWeave’s accelerated computing platform is optimized for handling AI and machine learning tasks. The company also offers data storage and networking services to customers. Its latest results for the second quarter of 2025 (released on Aug. 12) make it clear that the demand for CoreWeave’s cloud AI infrastructure is extremely robust.

The company’s Q2 revenue tripled year over year to just over $1.21 billion, exceeding the higher end of its guidance range. More importantly, CoreWeave’s revenue backlog grew 86% year over year in Q2, outpacing the 63% growth it recorded in Q1. The company is now sitting on a massive revenue backlog worth more than $30 billion.

The impressive jump in CoreWeave’s backlog can be attributed to an improvement in the company’s customer base, as well as the expansion of its existing contracts. Specifically, the company signed an additional contract worth $4 billion with OpenAI on top of the original contract that was worth almost $12 billion.

Management pointed out that it scored a new hyperscale customer during Q2, which ended up expanding its deal with CoreWeave in the quarter. Moreover, CoreWeave has been quickly expanding its AI data center infrastructure to meet the “unprecedented demand” for its AI infrastructure. The company ended the previous quarter with 470 megawatts (MW) of active data center power capacity, up from 420MW in Q1.

Even better, the company’s contracted power capacity increased by 37% sequentially in the previous quarter to 2.2 gigawatts (GW). The increase in the contracted power capacity means that CoreWeave can eventually offer its cloud AI infrastructure services to more customers in the future. That should help the company corner a bigger share of a massive end-market opportunity.

CoreWeave management anticipates its total addressable market (TAM) to hit a whopping $400 billion by 2028. So, it is easy to see why the company has been investing aggressively to bring more capacity online. It has spent $4.8 billion in capital expenditure in the first half of 2025, up from $3.7 billion in the same period last year.

The higher outlay explains why CoreWeave increased its full-year revenue outlook. It expects $5.25 billion in revenue now at the midpoint of its guidance range, up from the earlier forecast of $5 billion. That would be a big increase over its 2024 revenue of $1.9 billion. Also, the company’s TAM indicates that it has the ability to sustain its outstanding growth in the long run as well, which is why buying it looks like a smart thing to do right now.

The stock is cheaper than Nvidia and Palantir

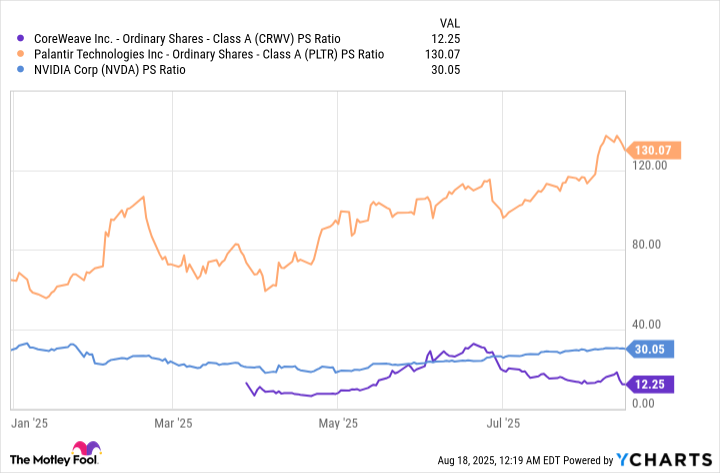

CoreWeave is now trading at 12 times sales. While that’s on the expensive side, investors should note that it is cheaper than both Nvidia and Palantir right now.

CRWV PS Ratio data by YCharts

Another important point worth noting is that CoreWeave is currently growing at a much faster pace than both Nvidia and Palantir. While Nvidia’s revenue in the last reported quarter increased 69% year over year, Palantir reported a 48% jump in revenue to just over $1 billion. Looking ahead, CoreWeave’s growth could continue exceeding its fellow AI peers thanks to the huge backlog that it is sitting on.

That’s the reason why CoreWeave’s forward sales multiples are lower than Nvidia’s and Palantir’s, as seen in the previous chart. All this makes CoreWeave a top AI stock to buy right now as it has the potential to sustain its red-hot rally and outperform Nvidia and Palantir in the future as well.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.