The improving demand for chipmaking equipment has given this semiconductor company’s business a nice shot in the arm.

Semiconductor stocks have been in fine form on the stock market in 2025. That’s evident from the 26% gains clocked by the PHLX Semiconductor Sector index as of this writing, which is double the gain recorded by the S&P 500 index so far this year.

The outperformance of semiconductor stocks can be attributed to the solid demand for chips that go into powering artificial intelligence (AI) workloads across various types of devices. This is precisely the reason why chip giants such as Nvidia (NVDA 0.40%) and Broadcom (AVGO 1.82%) have been witnessing healthy increases in their revenue and earnings.

Nvidia’s dominance of the AI graphics processing unit (GPU) market led to a 32% jump in its stock price this year. Its returns are topped by Broadcom, which logged a 44% jump in 2025, driven by the growing traction of custom AI processors. However, there’s another stock that has crushed both Nvidia and Broadcom this year.

Let’s take a closer look at that name and check why it has the potential to deliver even more upside to investors.

Image source: Getty Images

The booming demand for chips has given this equipment supplier a big boost

Lam Research (LRCX 2.46%) may not be a household name like Nvidia and Broadcom, but its shares are up a whopping 84% in 2025. It is easy to see why Lam stock is crushing both Nvidia and Broadcom this year.

The company’s growth accelerated impressively in the latest fiscal year, which ended in June 2025. Lam’s top line jumped by 23% from the preceding year to $18.4 billion. Its earnings increased at a stronger pace of 43% from the year-ago period to $4.15 per share. This solid performance isn’t surprising, considering that Lam Research sells semiconductor manufacturing equipment.

This industry has been witnessing healthy growth thanks to the fast-growing demand for AI chips that are deployed in data centers and other applications. According to one estimate, semiconductor equipment sales could jump 7% this year to just over $125 billion. The growth is expected to be stronger next year, with equipment sales expected to jump to $138 billion.

However, don’t be surprised if this market sees even faster growth. That’s because major cloud computing companies have been ramping up their capital expenditure budgets rapidly so that they can meet the huge contractual backlogs that they are sitting on. Specifically, big tech companies are on track to raise their capex by 63% this year to $364 billion.

This massive increase in capex is going to flow to chipmakers and foundries, which purchase the chipmaking equipment that Lam manufactures. The company points out that Samsung and Taiwan Semiconductor Manufacturing are its “most significant customers.”

Another point worth noting is that 41% of Lam’s revenue comes from selling memory manufacturing equipment. This is another area that’s witnessing booming growth thanks to the fast-growing demand for high-bandwidth memory (HBM) used in AI GPUs, as well as an increase in memory content in AI-capable smartphones and computers.

Given that sales of both logic and memory chips are gaining traction on account of AI, as evident from the latest results of chip companies across the spectrum, Lam Research seems to be in a solid position to sustain solid growth levels going forward. As such, it is easy to see why the company delivered impressive guidance for the first quarter of fiscal 2026.

It is expecting a 25% year-over-year increase in revenue in the current quarter to $5.2 billion. Non-GAAP (adjusted) earnings are expected to jump by nearly 40% from the prior-year period to $1.20 per share. It won’t be surprising to see Lam maintaining its impressive earnings growth momentum throughout the year, and in the long run, as the spending on semiconductor equipment picks up.

Lam Research stock is primed for more upside

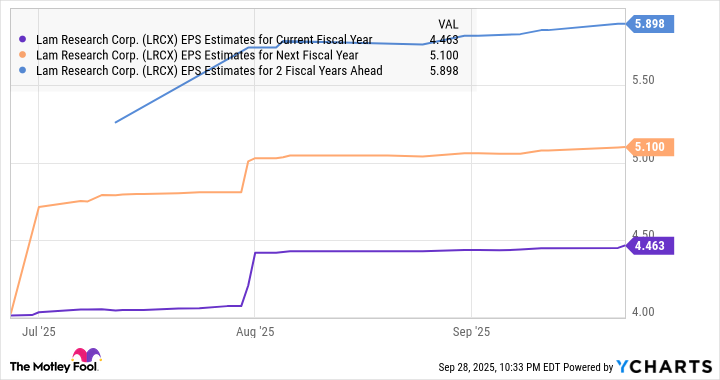

We have already seen that Lam has called for terrific growth in its revenue and earnings in the first quarter of fiscal 2026. Consensus estimates, however, forecast its full-year earnings to grow in the single digits this year, followed by healthy double-digit jumps in the next couple of years.

LRCX EPS Estimates for Current Fiscal Year data by YCharts

There is a good chance that Lam could end up doing better than Wall Street’s expectations, considering the stronger spending on semiconductor equipment that’s expected in 2026 and beyond. But even if the company’s earnings jump to $5.90 per share after three years, its stock price could hit $194 (based on the tech-laden Nasdaq-100 index’s earnings multiple of 33).

That points toward potential gains of 50% from current levels, though don’t be surprised to see this AI stock delivering bigger gains considering its ability to grow its earnings at a faster pace than the market’s expectations.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.