Asian equity markets opened the week on a positive note, supported by cautious optimism surrounding the high-stakes US-China trade negotiations in London. US Treasury Secretary Scott Bessent, along with Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer, are meeting Chinese counterparts as efforts to revive dialogue intensify. The outcome of these talks could set the tone for broader risk sentiment in the coming sessions.

Despite the upbeat market tone, traders appear restrained in their positioning. While recent developments — such as China’s approval of rare earth export licenses — hint at a willingness to de-escalate, there’s little in the way of concrete breakthrough yet. White House economic adviser Kevin Hassett tempered enthusiasm by pointing out that China’s release of critical minerals remains below what the US believes was agreed to previously in Geneva. As such, expectations for a definitive deal remain muted, limiting any aggressive risk-on trades for now.

Currency markets reflect this tempered tone. Aussie and Kiwi are modestly firmer, benefiting from the underlying improvement in sentiment, Dollar and Loonie are trading on the softer side. European majors and Yen are relatively steady in the middle. With most major pairs holding inside Friday’s ranges, the currency space is clearly in wait-and-see mode.

Beyond trade, inflation will be the other key macro theme this week. The US will release its May CPI and PPI data, alongside the University of Michigan’s consumer sentiment and inflation expectations. Markets are keen to assess whether signs of tariff-driven are beginning to firm. A surprise to the upside could challenge the current market view that the Fed’s next move will be no earlier than Q4, particularly if inflation expectations also pick up.

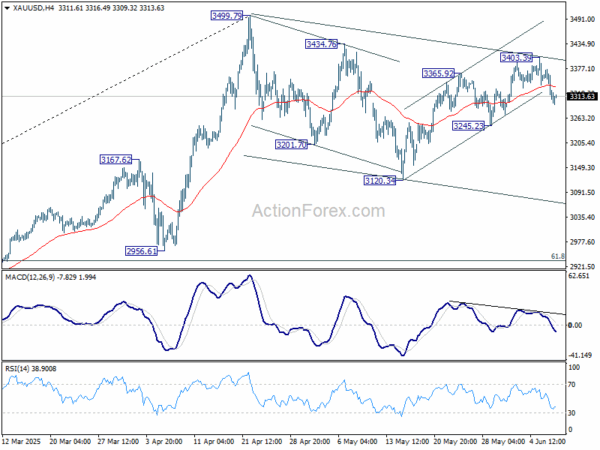

Technically, Gold’s extended decline argues that rebound from 3120.34 might have completed at 3403.39 already, with break of near term channel support and bearish divergence condition in 4H MACD. Further fall is now in favor to 3245.23 support first. Firm break there will the solidify the case that corrective pattern from 3499.79 is already in its third leg, and target 3120.34 support and possibly below.

In Asia, at the time of writing, Nikkei is up 0.89%. Hong Kong HSI is up 0.88%. China Shanghai SSE is up 0.26%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is up 0.011 at 1.470.

China’s CPI falls -0.1% yoy in May, negative for fourth month

China’s headline CPI stayed in negative territory for the fourth consecutive month in May, coming in at -0.1% yoy, slightly better than the expected -0.2% yoy.

The persistent softness in overall inflation was largely driven by a sharp -6.1% yoy decline in energy prices, which alone shaved off nearly half a percentage point from the annual CPI reading.

On a monthly basis, CPI fell -0.2% mom, with energy again dragging down the figure through a -1.7% mom decline.

In contrast, core inflation, which strips out food and energy prices, rose to 0.6% yoy, the highest level since January.

Producer price pressures continue to weaken further, with PPI dropping to -3.3% yoy from -2.7% yoy previously, marking the deepest contraction in nearly two years. Wholesale prices have now been stuck in deflation since October 2022.

China’s trade surplus widens to USD 103.2B in May, US exports slump -34.5% yoy

China’s trade surplus widened to USD 103.2B in May, exceeding expectations of USD 101.3, even as headline export and import figures undershot forecasts. Exports rose 4.8% yoy, just shy of the 5.0% yoy consensus. Imports fell -3.4% yoy, a sharper drop than the anticipated -0.9% yoy.

Exports to the US plunged -34.5% yoy, highlighting the entrenched trade tensions despite Washington’s partial tariff rollback in April. However, the impact was cushioned by robust growth in exports to ASEAN (15% yoy), the European Union (12% yoy), and Africa (33% yoy).

ECB’s Nagel signals Pause, cites maximum flexibility at current rates

German ECB Governing Council member Joachim Nagel indicated over the weekend that the central bank is likely entering a pause phase after last week’s eighth rate cut in the current easing cycle, which brought the deposit rate to 2.00%.

Speaking on Deutschlandfunk radio, Nagel also noted that the current level of interest rates offers “maximum flexibility.” And, “We can now take the time to look at the situation first.”

BoE’s Greene warns on inflation sensitivity, risk of wage-price spiral

BoE Monetary Policy Committee member Megan Greene acknowledged at a Saturday conference that while UK inflation is moving “in the right direction,” the pace of decline is slower than she would prefer.

Speaking candidly about April’s upside inflation surprise, Greene stated that while the MPC believes it can “look through” the jump, there remains a “pretty big risk” that price pressures could become more entrenched, especially if second-round effects materialize.

Greene also highlighted the behavioral shift triggered by the recent cost-of-living crisis, warning that past inflation shocks may have left households and businesses more reactive to even small price increases. That, in turn, could “feed through the wage-price behavior.” S

He noted that private-sector wage growth remains “way above” the level consistent with the BoE’s 2% inflation target.

Tariff effects under scrutiny as US CPI, PPI and inflation expectations take center stage

A relatively quiet week for global economic releases will nevertheless carry key signals for monetary policy in both the US and UK.

US May CPI report will be front and center, offering insight into whether there is an emerging inflation pickup from tariffs. Headline CPI is expected to accelerate from 2.3% yoy to 2.5% yoy. Core CPI is seen rising to 2.9% after troughing at 2.8% for two months. A rise in both measures would raise concerns that 2025’s slow disinflation trend is reversing just as tariffs begin to seep into consumer prices.

Additional confirmation may come from upstream price pressures in PPI data, alongside consumer inflation expectations in the University of Michigan’s sentiment survey. If all three elements—CPI, PPI, and expectations—firm, the Fed’s cautious stance would harden further. While markets currently lean toward a September cut, such an inflation environment could shift expectations toward Q4.

In the UK, attention will turn to April GDP and labor market data. GDP is expected to show a mild contraction of -0.1% mom. But that may be less concerning given signs that post-trade deal clarity with the US could support stronger growth later in Q2. The more pivotal element will be wage growth, which has remained stubbornly high and continues to feed into sticky services inflation—a key concern for BoE.

Diverging views within the Monetary Policy Committee remain apparent. While some members are inclined to ease, Chief Economist Huw Pill has warned last month that the UK’s weak productivity growth and embedded wage pressures could mirror past inflationary episodes. His remarks highlight that underlying structural risks—especially in the labor market—may prevent BoE from loosening policy too quickly, even if growth remains uneven.

Here are some highlights of the week:

- Monday: New Zealand manufacturing sales; Japan GDP final; China CPI, PPI, trade balance.

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; UK employment; Swiss SECO consumer climate; Eurozone Sentix investor confidence.

- Wednesday: Japan PPI; Canada building permit; US CPI.

- Thursday: Japan BSI manufacturing; UK GDP, industrial and manufacturing production, goods trade balance; US PPI, jobless claims.

- Friday: New Zealand BNZ manufacturing; Japan tertiary industry index; Germany CPI final; Eurozone industrial production, trade balance; Canada wholesale sales, manufacturing sales; US U of Michigan consumer sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6476; (P) 0.6497; (R1) 0.6513; More...

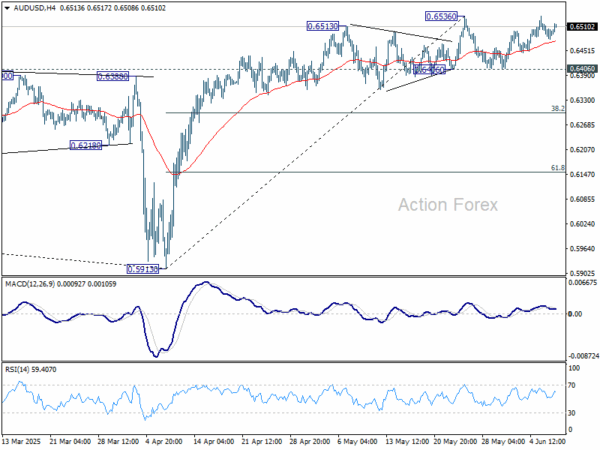

AUD/USD recovers mildly today but stays below 0.6536 resistance. Intraday bias remains neutral for the moment. Further rise is in favor as long as 0.6406 support holds. On the upside, decisive break of 0.6536 will resume the rally from 0.5913 to 61.8% retracement of 0.6941 to 0.5913 at 0.6548. However, firm break of 0.6406 will turn bias to the downside for 38.2% retracement of 0.5913 to 0.6536 at 0.6298.

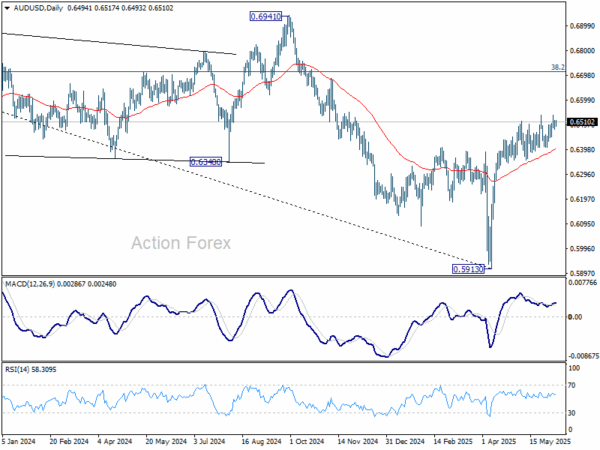

In the bigger picture, AUD/USD is still struggling to sustain above 55 W EMA (now at 0.6443) cleanly, and outlook is mixed. Sustained trading above 55 W EMA will indicate that rise from 0.5913 is at least correcting the down trend from 0.8006 (2021 high), with risk of trend reversal. Further rise should be seen to 38.2% retracement of 0.8006 to 0.5913 at 0.6713. However, rejection by 55 W EMA will revive medium term bearishness for another fall through 0.5913 at a later stage.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q1 | 5.10% | 1.10% | 3.00% | |

| 23:50 | JPY | Bank Lending Y/Y May | 2.40% | 2.40% | 2.40% | 2.30% |

| 23:50 | JPY | Current Account (JPY) Apr | 2.31T | 2.59T | 2.72T | |

| 23:50 | JPY | GDP Q/Q Q1 F | 0.00% | -0.20% | -0.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 3.30% | 3.30% | 3.30% | |

| 01:30 | CNY | CPI Y/Y May | -0.10% | -0.20% | -0.10% | |

| 01:30 | CNY | PPI Y/Y May | -3.30% | -3.00% | -2.70% | |

| 03:00 | CNY | Trade Balance (USD) May | 103.2B | 101.1B | 96.2B | |

| 05:00 | JPY | Eco Watchers Survey: Current May | 44.4 | 43.9 | 42.6 | |

| 14:00 | USD | Wholesale Inventories M/M Apr F | 0% | 0% |