New York

—

It’s been a whirlwind year for investors.

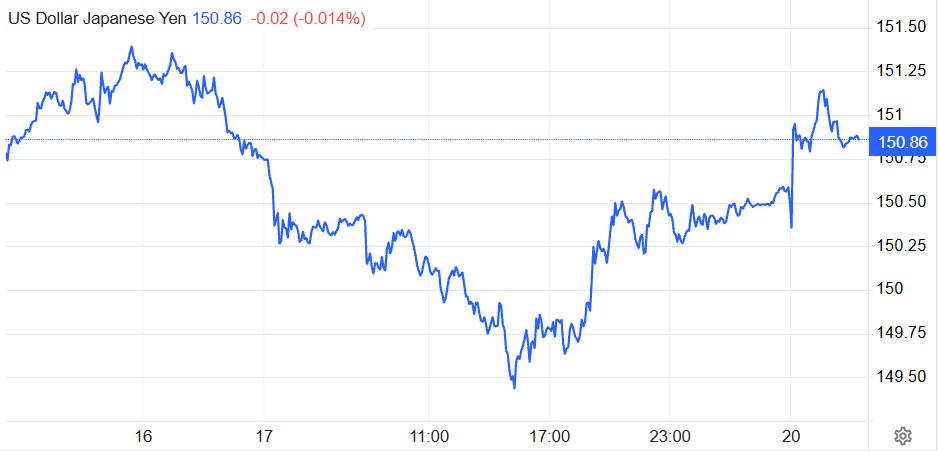

Stocks are hovering near record highs, but volatility is creeping back into markets as US-China trade tensions flare up. Gold and silver — safe havens during uncertain times — are soaring higher.

Investors are worried about trade wars, signs of an AI bubble and now credit market turmoil.

With all the uncertainty, it can feel overwhelming. However, long-term investors are best off keeping calm, tuning out the noise and sticking to a consistent plan that aligns with their financial goals, experts say.

“Rather than trying to time the next downturn, the smarter move is to stick to fundamentals,” said Jared Gagne, a wealth manager at Claro Advisors.

“Good investing is boring,” he said.

US stocks have been on a record-breaking rally, rebounding sharply after tumbling in the spring over concerns about President Donald Trump’s tariffs. And Wall Street strategists say stocks have more room to run, with better-than-expected corporate earnings and Federal Reserve interest-rate cuts supporting stocks.

Still, concerns are lingering about a stock market bubble and historically expensive valuations.

It’s essential for investors to maintain a well-diversified portfolio with target allocations for each asset. An example of a classic portfolio includes 60% stocks, 30% bonds, 5% commodities like gold and 5% cash.

“Keep a diversified portfolio, rebalance when positions get stretched and continue investing on a disciplined schedule,” Gagne said.

“If one part of your portfolio has ballooned, consider trimming back to your target allocation rather than making wholesale exits,” he said. “This keeps gains aligned with your long-term plan while taking some profit off the table.”

Younger investors, who have time to make up for any market dips, can probably stand to have more in riskier assets like stocks; investors nearing retirement, who might need their money sooner and likely don’t have the same time to compensate for a market downturn, should have more more in bonds and cash-equivalents like Treasury bills.

“Make sure that you’re in an investment strategy that aligns with your financial goals,” said Ryan Kenny, portfolio manager at Crestwood Advisors. “One that’s predicated on quality and diversification and being in something that allows you to ride out the volatility that it is inherent in markets.”

Dollar cost averaging, when investors buy stocks at consistent intervals over time, can also help smooth out market ups and downs.

“That’s a good way to give yourself a discipline and not get kind of swept up in the heat of the moment,” said Tim Thomas, chief investment officer at Badgley Phelps Wealth Managers.

Timing the market by predicting where stocks will go is an exceptionally rare skill — and doing it consistently over long periods is even harder. For the vast majority of investors, staying put is much better than trying to sell or buy at peak opportunities.

The S&P 500 has rallied 30% since April. Investors who sold in the market panic that month missed out on those monster gains.

“Timing the market successfully requires being correct twice: 1) knowing the right time to exit and 2) the most opportune time to reenter,” said Sam Stovall, chief investment strategist at CFRA Research. “Investors are better off reminding themselves of the speed with which the market tends to recover from declines.”

History shows that the S&P 500 tends to rise in the long-term, rewarding investors who stay in the market. Since World War II, it has taken an average of four months from the bottom of a decline of up to 20% to get back to breakeven, Stovall said.

“The investors who focus on time in the market, not timing the market, are the ones who have the most success investing,” Gagne at Claro Advisors said.

As with all things in investing, there is no one-size-fits-all. Each person has their own financial goals and tolerance for risk.

But whatever your plan, it’s important to stick with it consistently.

“It’s really important to keep emotions out of it and have a system that’s repeatable no matter what’s going on in the market environment,” Thomas of Badgley Phelps Wealth Managers said. “Just keeping a level head is the key to success.”