The S&P 500 made a new all-time high this week. The move was supported by several factors, such as a ceasefire between Israel and Iran, the announcement of a trade deal with China, and a reading on inflation that was in line with expectations. Adding more fuel to the rally is the growing expectation that Congress will pass the Trump administration’s “big, beautiful bill” perhaps as early as this weekend.

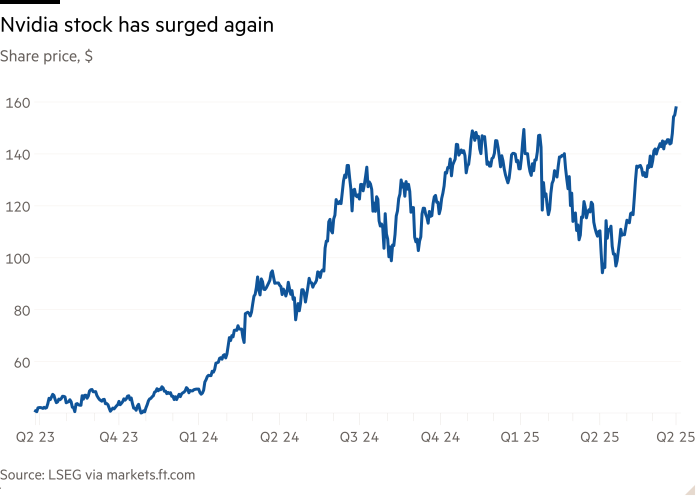

Each of these items removes a little uncertainty from the market. That’s stirring up a risk-on sentiment, which continues to focus on the artificial intelligence (AI) trade and could set the stage for significant gains in the second half of the year.

Next week will be a short trading week. The markets will be closed on Friday for Independence Day in the United States. However, the MarketBeat team will help you stay on top of the stocks and stories that can help your portfolio. Here are some of the most popular stories from this week.

Articles by Thomas Hughes

As the AI trade continues into the software phase, Oracle Co. ORCL has become one of the sector’s hottest stocks. The stock hit a record high, and Thomas Hughes highlighted why it may reach $300 by the end of the year.

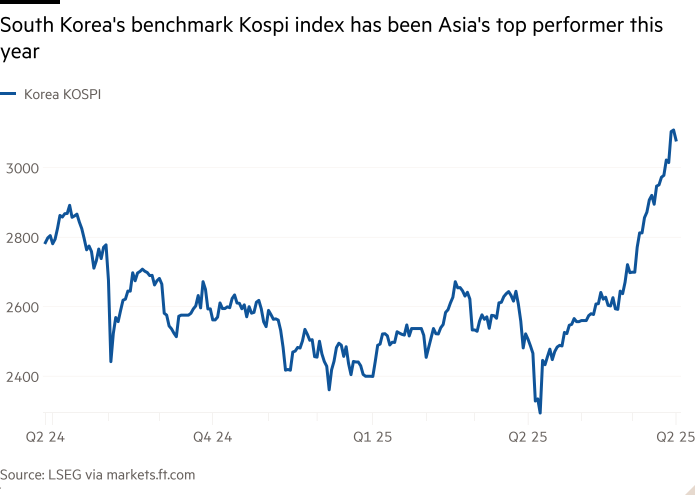

A familiar name also hit a new high this week: NVIDIA Corp. NVDA. Hughes noted that the exact reason for the stock’s recent surge is unclear. However, both technical and fundamental signals are aligned, which could be rocket fuel for the stock after the company reports earnings in August.

Hughes also wrote about the bullish reversal for Advanced Micro Devices Inc. AMD. The company’s AI event in June has analysts and investors believing in the company’s ability to take market share from NVIDIA. The next hurdle will be the company’s earnings report in July, but if that news is bullish, Hughes noted the potential for a 30% upside move.

Articles by Sam Quirke

The company known for the saying “Just Do It” finally did it this week. NIKE Inc. NKE delivered a better-than-expected earnings report, which investors rewarded with a 10% gain. Sam Quirke summarized the report this week and noted that all the bad news may be priced into the stock. This means that NKE stock could stage the mother of all comebacks.

Staying on the subject of comebacks, Tesla Inc. TSLA is up 50% from its April lows. Quirke pointed out that analysts remain divided on the stock, making the company’s earnings report in July a make-or-break moment.

Amazon.com Inc.

Articles by Chris Markoch

Spending on AI infrastructure will accelerate over the next several years. This week, Chris Markoch pointed out that it’s not too late to buy semiconductor stocks and suggested three names that can help investors capitalize on that trend.

Keep in mind, the AI infrastructure story goes beyond semiconductors. This week, Markoch wrote about three AI technology stocks that give investors a different way to invest in the insatiable demand for artificial intelligence and are trading at a discount.

Sticking with the AI theme, Markoch explained why Skyworks Solutions Inc. SWKS is well-positioned as companies are looking to move AI on devices. This trend of bringing AI to the edge is a key reason analysts are projecting strong earnings growth in the next three to five years.

Articles by Ryan Hasson

Industrial stocks have made an impressive run in 2025 with Deere & Co. DE being one of the names leading the way. This week, Ryan Hasson explained that while the fundamentals don’t scream value, the technical setup suggests the likelihood of upside continuation for DE stock.

If the market sustains a rally in the second half of the year, small-cap stocks stand to be among the strongest gainers. However, some stocks in this sector are already making a bullish move. This week, Hasson called attention to five small-cap stocks that have recently moved higher and have catalysts that suggest there’s more room to move higher.

Articles by Gabriel Osorio-Mazilli

Palantir Technologies Inc. PLTR is one of the best-performing stocks over the last 12 months. It’s also expensive, and investors are looking for a stock that may be the next Palantir. This week, Gabriel Osorio-Mazilli explained why BigBear.ai Holdings Inc.

BBAI is a name for investors to consider.

Some investors looking for the next Palantir may also be interested in quantum computing stocks. This week, Osorio-Mazilli examined this hot growth area and pointed investors to two quantum stocks with multi-bagger potential.

Reddit Inc. RDDT is up 30% in the last three months. Osorio-Mazilli pointed investors to the options chain that shows traders are making bullish bets on RDDT stock, which could send the stock higher.

Articles by Leo Miller

Broadcom Inc. AVGO stock is down after its earnings report in June. However, that goes against the sentiment of analysts who suggest that AVGO stock has an upside of close to 18%. Leo Miller noted that the key could be found in Broadcom’s guidance which, if accurate, could prove the analysts are right.

Miller also wrote about the recent analyst upgrades that suggest Meta Platforms Inc. META could soar to $800. That’s a 10% increase on top of the stock’s 24% gain so far in 2025. It’s a big move, but Miller pointed out why the analysts are so bullish on the stock.

Although they do nothing to change a company’s fundamentals, stock splits tend to make investors bullish. This week, Miller highlighted three companies that recently announced stock splits and pointed out one standout name for investors.

Articles by Nathan Reiff

Defense stocks are on fire in 2025, and that includes drone stocks. This week, Nathan Reiff noted that the entire sector is moving higher, but one drone stock is likely to soar above the rest.

When investors think about technology stocks to buy, Astera Labs Inc. ALAB may not be on their list. But with ALAB stock up 46% and backed by bullish analyst sentiment, Reiff explained why Astera is a strong momentum play on AI infrastructure.

Spotify Technology SA SPOT is up nearly 75% in 2025 and has achieved a new all-time high. But can it go higher? That’s the question that Reiff addressed. In this week’s article, Reiff explained the bullish catalysts that could keep the momentum going and why regulatory risks may be a headwind on SPOT stock in the short term.

Articles by Dan Schmidt

Costco Wholesale Corp. COST appears to be an unstoppable stock. However, Dan Schmidt explained why COST stock is at a crossroads. Schmidt provides investors with three reasons the stock could go higher and three bearish signs that highlight the challenges posed by its high valuation.

Schmidt also pointed out that many companies in the travel and leisure sector downplayed guidance in their quarterly earnings reports. However, if the economy is gaining momentum, Schmidt gives investors three travel stocks that may be ready to surprise to the upside.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now…

See The Five Stocks Here