The facts speak for themselves. On June 9, the Hang Seng China Enterprises Index (HSCEI), a gauge of mainland Chinese stocks listed in Hong Kong, entered a bull market after having risen 22 per cent since its recent low on April 7. The HSCEI and the MSCI China Index, which tracks Chinese companies listed at home and abroad, have largely outperformed all other major equity markets this year.

That the sharp rally in Chinese shares occurred against the backdrop of deflationary pressures that show no sign of easing, low consumer confidence, a festering crisis in the property sector and a dramatic escalation in the US-China trade war makes the gains all the more remarkable.

Several factors are at work. One of them, as Morgan Stanley noted in a report on May 20, is global investors’ “deeply underweight” position in Chinese equities following years of extremely bearish sentiment. This has created a “sizeable allocation upside potential in moving from [an underweight to a neutral position]”, Morgan Stanley said.

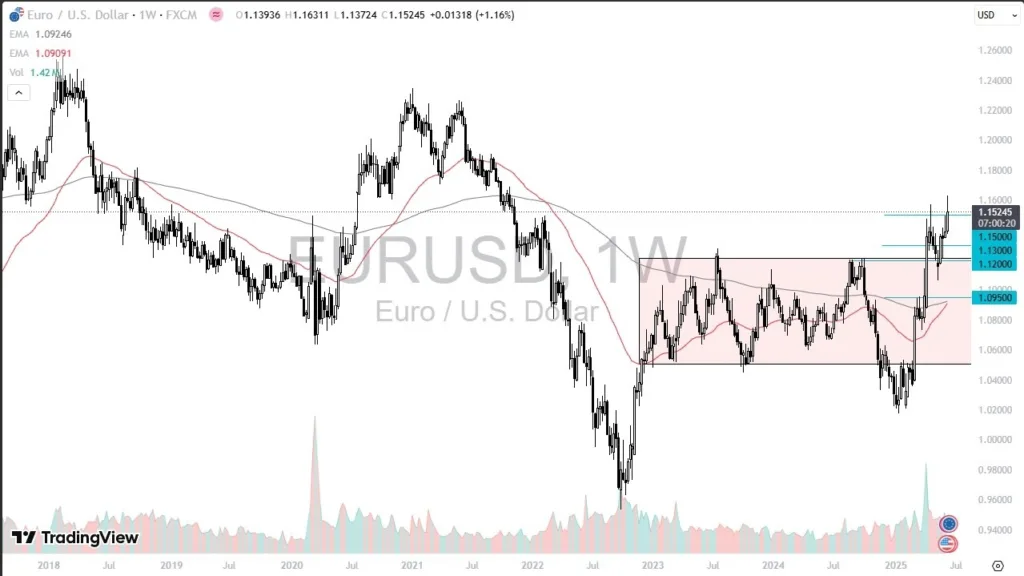

A more important factor – and the most unexpected one – is the strong conviction on the part of many investors that the long period of US exceptionalism in markets has come to an end. US President Donald Trump’s ruinous trade policies, blatant disregard for the rule of law and planned reckless tax cuts that add to America’s ballooning public debt have cast doubt over the perceived safe haven status of US assets, especially the US dollar.

The mantra of “Tina” – There Is No Alternative – to US equities has given way to diversification as investors seek to rebalance their portfolios away from the United States. While there is intense debate about the pace and consequences of diversification, the waning appeal of US assets is a boon to Chinese stocks.

Morgan Stanley says there is a “higher willingness to add more positions in Chinese equities, fuelled by global diversification demand”. Nomura says “the fading of the ‘US exceptionalism’ theme could help Asian equities”, with China, India and Japan best placed to capture “reallocation flows” given the depth and breadth of their stock markets. Goldman Sachs, meanwhile, notes that Chinese stocks tend to perform well when the yuan strengthens versus the US dollar.

01:44

China’s largest EV battery maker CATL celebrates strong debut at Hong Kong stock market

China’s largest EV battery maker CATL celebrates strong debut at Hong Kong stock market

Visited 1 times, 1 visit(s) today