Published: 09 Jun. 2025, 10:36

![The display board at the Hana Bank dealing room in Jung District, central Seoul, shows the Kospi index and other indicators on June 9. [YONHAP]](https://koreajoongangdaily.joins.com/data/photo/2025/06/09/c2d16ac7-e806-4d27-be52-f60ba0825392.jpg)

The display board at the Hana Bank dealing room in Jung District, central Seoul, shows the Kospi index and other indicators on June 9. [YONHAP]

Korean stocks opened sharply higher Monday on stronger-than-expected U.S. jobs data and expectations over the planned resumption of high-level trade talks between the United States and China.

The Kospi gained 49.27 points, or 1.75 percent, to 2,861.32 in the first 15 minutes of trading, continuing last week’s bullish momentum.

The Kospi tracked Wall Street’s rally on Friday, sparked by better-than-expected U.S. jobs data, which relieved investors’ concerns of economic slowdown in the world’s largest economy.

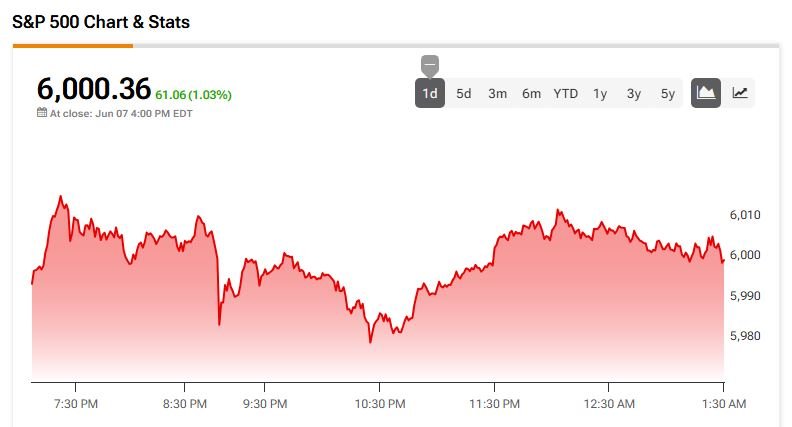

The Dow Jones Industrial Average rose 1.05 percent, the tech-heavy Nasdaq composite added 1.2 percent and the S&P 500 grew 1.03 percent.

Investors’ eyes are on the second round of high-level trade negotiations between Washington and Beijing set to kick off later in the day in London.

Market bellwether Samsung Electronics increased 1.61 percent, while its chipmaking rival SK hynix surged 3.56 percent.

Top automaker Hyundai Motor jumped 3.11 percent and its auto-parts making affiliate Hyundai Mobis shot up 7.87 percent.

Major nuclear power plant constructor Doosan Enerbility also soared 4.68 percent, and internet operator Naver climbed 2.3 percent.

Financial shares were also strong, with KB Financial up 1.32 percent and Hana Financial advancing 3.27 percent.

On the other hand, major defense firm Hanwha Aerospace dipped 3.31 percent and leading shipbuilder Hanwha Ocean lost 1.67 percent.

The local currency was trading at 1,361.4 won against the greenback at 9:15 a.m., down 3.0 won from the previous session.

Yonhap