Foreign investors are flooding back into Korean equities, turning the country from one of the most heavily sold markets earlier this year into the most actively bought since September.

A world-leading rally in the benchmark Kospi index and the resurgence of semiconductor stocks are drawing global money managers, analysts said.

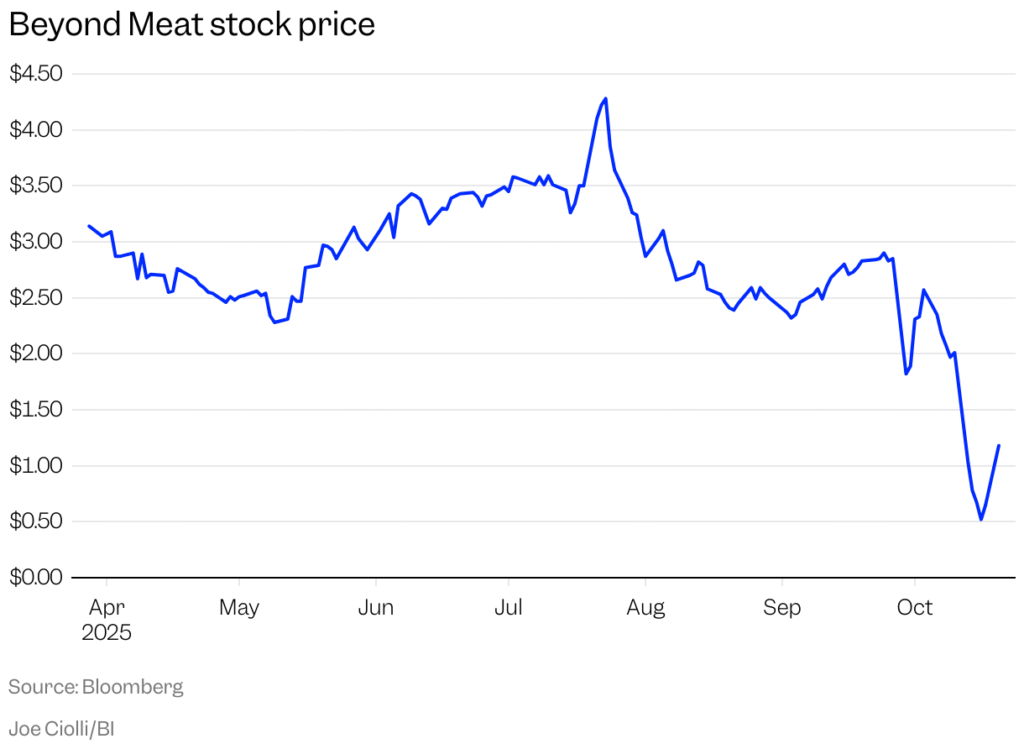

According to data compiled by The Korea Economic Daily with Daishin Securities Co. and Bloomberg News, Korea swung from being the No. 1 net-sold market among 10 major emerging economies in the first half to the No. 1 net-bought market since September.

After dumping some $10.5 billion worth of Korean shares earlier this year, offshore investors have purchased about $9.2 billion since the start of the autumn – the largest inflow among all surveyed markets.

Taiwan was the only other country to post net foreign inflows with $5.4 billion over the period, while overseas investors pulled money from Japan as much as $2 billion, Vietnam with an outflow of $1.6 billion and $800 million from India.

SURGE IN EUROPEAN BUYING

The securities industry cites high returns as a reason for foreign investors flocking to the Korean stock market.

This year, the Kospi has risen 59%, the highest in the world. It has delivered an overwhelming return, more than double that of Hong Kong’s Hang Seng, which posted a 32.6% gain, followed by Japan’s Nikkei at 25.5%, Italy’s FTSE MIB at 24.1%, Taiwan’s Chia Quan at 21.6%, Germany’s DAX at 21.5% and China’s Shanghai Composite at 20.0%. Kospi also outperformed the US Nasdaq, which returned a 19.5% gain and the S&P with 14.8%.

What is striking this time is the surge in European buying.

In September, investors from the UK, Ireland, France and Luxembourg poured a combined 4.6 trillion won ($3.2 billion) into Korean stocks: 2.2 trillion won from the UK, 1.3 trillion won from Ireland, 700 billion won from France and 430 billion won from Luxembourg.

Countries previously less interested in the Korean market, including Germany, Kuwait and Malaysia, purchased a combined 1.4 trillion won worth of Korean stocks.

The steepest year-on-year increases in Korean equity holdings came from the UK, which saw an increase of 64.2%, followed by Ireland at 62.6% and China at 61.5%.

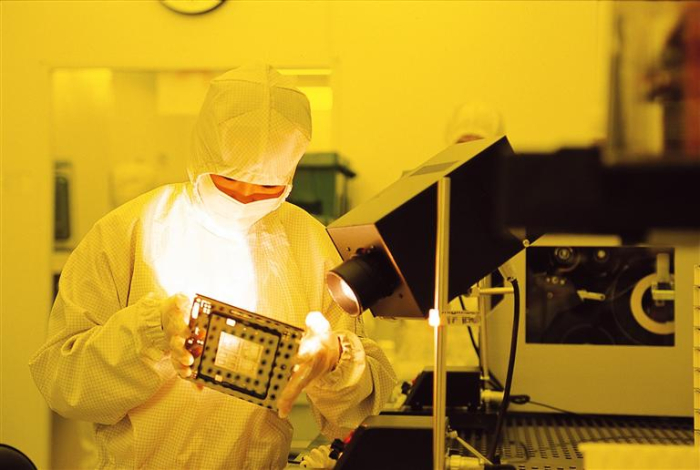

BUYING SPREE ON CHIPMAKERS

The buying spree has been highly concentrated in chipmakers.

Of the 13 trillion won in shares purchased by foreigners since September, about 10.1 trillion won went into common and preferred shares of Samsung Electronics Co.

Foreign demand has boosted SK Hynix Inc.’s share price by 88% and Samsung’s by 46% since September.

“Korean equities have become a must-own trade again,” said a Seoul-based investor relations executive at a major semiconductor firm. “We’ve seen a surge of inquiries, not just from US and European funds but from South America, the Nordics and even African financial institutions.”

UNDETERED BY TRUMP POLITICS

The reversal is dramatic.

In April, when US President Donald Trump’s tariff threats rattled global markets, foreigners offloaded some $10 billion in Korean shares – more than the total combined sell-off across other key emerging markets.

By the third quarter, Korea had become the top destination for foreign inflows, outpacing Taiwan two-to-one.

Demand has broadened beyond chips.

Offshore investors have snapped up industrial and energy names.

Since September, they have bought 672 billion won worth of shares in Doosan Enerbility Co., 457 billion won in Samsung Electro-Mechanics Co., 436 billion won in Korea Electric Power Corp., alongside LG Chem Ltd., HD Hyundai Heavy Industries Co. and Hanwha Aerospace Co., each seeing more than 300 billion won in net foreign buying.

K-beauty, K-culture and medical tourism stocks such as APR Co. and CJ Corp. have also attracted over 100 billion won apiece.

Franklin Templeton, a global asset manager, said in a recent research note that “Korea is leading the emerging-market rally. The country’s diversified growth engines, from semiconductors and defense to shipbuilding, beauty and culture, make it one of the most compelling investment cases globally.”

Financial Supervisory Service data show that British investors were the single largest foreign buyers in September, acquiring 2.2 trillion won of local equities, followed by Ireland at 1.3 trillion won and the US at 944 billion won.

“European hedge funds are rotating out of overvalued US Big Tech firms and into what they view as undervalued Asia-Pacific assets – with Korea at the top of that list,” said Jeong Ji-tae, head of international sales at Korea Investment & Securities Co.

‘K-CHIP STOCKS STILL CHEAP’

Despite the rally, analysts see further room to run.

According to financial data firm FnGuide Inc., Samsung Electronics and SK Hynix trade at next year’s projected price-to-book ratios of 1.43 and 2.25 times, respectively – well below Micron Technology’s 3.1.

Samsung’s PBR multiple is even lower than Intel’s 1.5.

On a price-to-earnings basis, SK Hynix’s forward PER of 8.39 is the cheapest among major memory chipmakers, compared with 12.7 for Samsung and 12.1 for Micron.

“Even after accounting for the US premium on Micron, Korean chipmakers remain deeply undervalued given their stronger fundamentals and larger scale,” said Kim Dong-won, head of research at KB Securities Co.

Global investment banks are also turning more bullish.

Citigroup raised its target price for Samsung Electronics to 145,000 won from 133,000 won. It also hiked SK Hynix’s target to 640,000 won from 480,000 won, citing Korea’s dominant position in the memory recovery cycle.

Adding further tailwinds, Micron’s retreat from China’s data-center market amid US-China tensions could hand additional share gains to Samsung and Hynix – the only other global suppliers capable of producing high-value server memory chips.

“Long-term capital such as mutual funds, pension funds and sovereign wealth funds has yet to move decisively,” said Korea Investment’s Jeong. “That means there’s still substantial dry powder that could flow into Korean equities in the coming quarters.”

Write to Ye-Jin Jun and Jin-Gyu Maeng at ace@hankyung.com

In-Soo Nam edited this article.