South Korea’s benchmark stock index closed at a record high on Wednesday, lifted by strong foreign and institutional demand for financial and blue-chip tech stocks on expectations for government market stimulus.

Analysts say the rally could extend through year-end, supported by Seoul’s push to upgrade its capital markets and prospects of US Federal Reserve rate cuts.

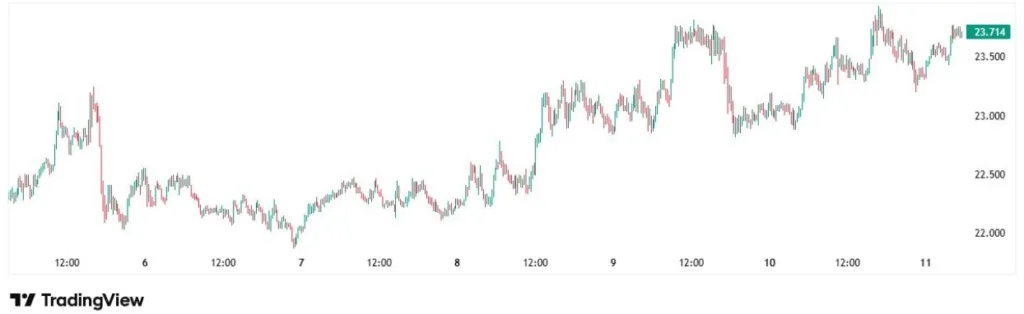

The Kospi climbed 1.7% to end at 3,314.53, its highest level in 45 years and surpassing the previous peak of 3,305.21 set on July 6, 2021.

During the session, it also topped the previous intraday peak of 3,316.08 set on June 25, 2021.

Thanks to the bull run, the Kospi has surged 38.1% year to date, the strongest gain among 42 major benchmarks in 32 countries.

Market analysts attribute the gains to expectations for the Lee Jae Myung administration’s push for capital market reforms and a weaker US dollar after the Fed’s rate cuts.

“The Kospi has finally caught up to global peers on expectations the government will keep the capital gains tax threshold for large shareholders at the current 5 billion won ($3.6 million),” said Lee Han-young, head of equities at Vogo Fund Asset Management Co.

“If Korea manages to lift the value of listed companies as Japan has, the Kospi could climb to around 4,500, equivalent to 1.5 times its price-to-book ratio.”

The Korean stock market has lately trailed behind its counterparts in Japan and the US after investors dumped Korean stocks on concerns over the government’s tax overhaul unveiled in early August, which proposed raising the top corporate tax rate to 25% from 24% and cutting the capital gains threshold for large shareholders to 1 billion won.

President Lee is expected to unveil a package of capital market reforms at a press conference marking his 100th day in office, including a plan to keep the shareholder tax threshold unchanged.

FINANCIAL AND CHIP STOCKS LEAD

Both foreign and institutional investors piled into Kospi-listed stocks, scooping up financial and blue-chip tech stocks like semiconductor shares on Wednesday.

Offshore investors were net buyers of 1.5 trillion won of equities, while institutions bought 1.1 trillion won. Foreigners also picked up 333.7 billion won worth of Kospi200 futures.

Retail investors, by contrast, booked profits, selling 2.5 trillion won worth of shares.

Foreign investors appear to be betting on a longer rally in Korean stocks, said Park Sung-chul, an analyst at Yuanta Securities, citing a shift in their strategy toward semiconductor shares.

“When the market hovered, they often traded Samsung Electronics and SK Hynix in pairs, buying one while selling the other,” he said.

“Today, however, they bought both, signaling stronger bets on a broader Kospi advance and driving heavy net purchases in large chipmakers.”

SK Hynix Inc. rose 5.6% to end at 304,000 won, while Samsung Electronics Co. closed up 1.5% at 72,600 won.

Other semiconductor stocks also zoomed – Wonik IPS Co. up 9.3%, DB HiTek Co. 8.6% and Hanmi Semiconductor Co. 3.9%.

Investor sentiment improved especially after Oracle Corp. issued upbeat guidance and Taiwan’s TSMC reported a surge in demand for its chip packaging services.

Investors also showed a voracious appetite for financial and securities stocks.

KB Financial Group jumped 7.0%, followed by Hana Financial Group up 4.6%, Woori Financial Group 4.3% and Shinhan Financial Group 3.4%.

Kiwoom Securities Co. climbed 7.8%, while Eugene Investment & Securities Co. and Korea Investment Holdings Co. advanced 6.3% and 6.2%, respectively.

IS THE RALLY SUSTAINABLE?

Market analysts say Korean stocks could keep climbing after outperforming global peers this year.

The Kospi has surged 38.1% so far this year, the best performance among major indexes, according to Investing.com. The junior Kosdaq, heavy in biotech and tech shares, has also gained 22.8% after extending gains for the past seven consecutive sessions.

The Kospi’s advance has outpaced Hong Kong’s Hang Seng with 30.7%, Vietnam’s VN30 34.8%, Japan’s Nikkei 225 9.9%, the Nasdaq 13.3% and the S&P 500 10.7%

Easing political uncertainty at home, government measures to support the market and a rebound in global liquidity have helped turn the Kospi from one of the world’s weakest indexes into its strongest this year, said analysts.

“The stagnant Korean market has turned upward on shareholder-friendly policies and ample global liquidity,” said the head of a local asset manager. “If the trend continues, the Kospi could finish the year as the top-performing major index.”

Still, analysts caution that Korea, Asia’s fourth-largest economy, must address structural hurdles to shed the long-standing Korea discount factors.

“Beyond maintaining the large shareholder tax threshold, the government needs to lower dividend tax rates, ease inheritance taxes and relax restrictions on management stock options to usher in a true ‘Korea premium’ era,” said Kang Dae-gyun, CEO of Life Asset Management.

Write to Sung-Mi Shim, Cho Ara and Han-Shin Park at smshim@hankyung.com

Sookyung Seo edited this article.