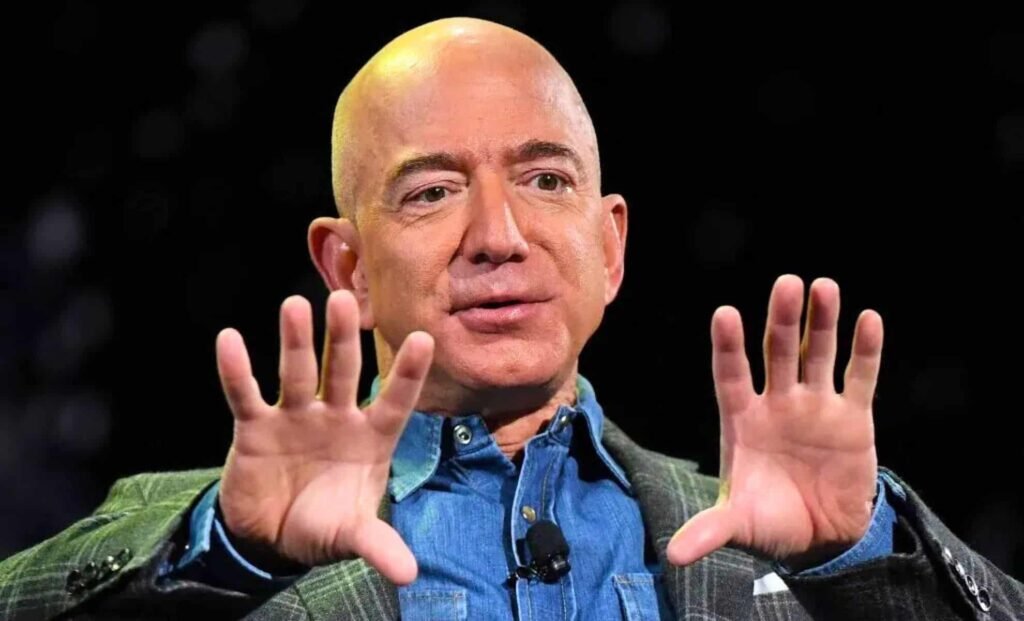

A total of 6.6 million shares, valued at roughly $1.5 billion, were sold on 21 and 22 July. The transactions were disclosed in a filing with the US Securities and Exchange Commission (SEC), as reported by Barron’s. The sale was carried out under a prearranged trading plan known as Rule 10b5-1.

The timing and structure of the sale are entirely legal under US financial regulations, as the trades were planned in advance.

How rule 10b5-1 Works

Rule 10b5-1 is a regulation from the SEC that allows company insiders to set up a trading plan in advance for buying or selling shares. This rule provides a legal safeguard against accusations of insider trading.

These plans only work if they’re created and executed in good faith, and long before the insider has access to any material non-public information.

Live Events

“Insiders use the plans, which automatically execute trades when preset conditions, such as price, volume, and timing, are met, to remove the appearance that they might benefit from their access to nonpublic information,” according to Barron’s.The rule itself is meant to clarify a broader anti-fraud provision under the Securities Exchange Act of 1934, known as Rule 10b-5.

More sales on the horizon

Bezos is far from done. According to the same SEC filing, the Amazon founder still holds 4.6 million shares, valued at around $1 billion, and has outlined plans to sell up to 25 million shares by 29 May 2026. The filing refers to this as a plan “intended to satisfy Rule 10b5-1(c)”.

As Barron’s put it plainly: “Bezos isn’t done.”

This is his fourth such trading plan in the past 18 months.

A steady offload since June

Bezos has been selling shares aggressively in recent weeks. Since his wedding in late June, he’s sold nearly $5.7 billion worth of Amazon stock.

Earlier this month alone, he offloaded shares worth $737 million.

These sales are part of a broader trend. In total, Bezos has now sold 95 million Amazon shares across 2024 and 2025, totalling $18.2 billion. Since 2002, his total cashouts have exceeded $50 billion.

In contrast, Bezos has only bought Amazon stock once on record: a single share two years ago at $114.77.

Still holding a stake, still giving it away

Despite the recent sell-off, Bezos still owns a sizeable chunk of Amazon. His remaining shares are valued at approximately $232 billion.

Alongside selling, he’s been donating. Over 2024 and 2025, Bezos gave away 4.5 million shares to charity, with a combined value of about $1 billion.

This latest sale lands just ahead of Amazon’s Q2 earnings announcement. Analysts expect the company to report earnings of $1.32 per share and revenue of $162 billion.

That’s an increase of 4 percent and 9 percent, respectively, compared to the same quarter last year. However, Amazon’s performance is still trailing behind other big tech firms in the so-called “Magnificent Seven”.

According to market forecasts, Meta, Microsoft and Nvidia are leading the S&P 500 growth into 2025. Apple is lagging, primarily due to uncertainty around its AI strategy.

Bezos’s stock sales, while substantial, fit a well-documented pattern. He’s gradually pulling back his personal stake while funding new ventures and philanthropic projects, using a legally sound structure that limits any speculation of insider advantage.