Key Facts

- Japan’s Nikkei hits record highs: Tokyo’s Nikkei 225 notched a third straight record close on Sep 25, rising 0.3% near ¥45,755 as investors rotated into lagging stocks [1]. One strategist noted that “stocks that had been left behind [in] the latest rally” were being snapped up, a healthy rotation that bodes well for further gains [2].

- China leads tech surge: Mainland Chinese and Hong Kong markets rebounded strongly on Sep 24, with Hong Kong’s Hang Seng +1.4% and Shanghai’s SSE +0.8% as AI and semiconductor shares jumped [3] [4]. Alibaba’s stock soared ~9% to its highest since 2021 after the company pledged $53+ billion for AI and announced new overseas data centers [5] [6].

- India pressured by U.S. policy: India’s Sensex extended a multi-session slide (falling ~0.5% on Sep 25) amid foreign investor outflows and news of a fresh $100,000 U.S. fee on H-1B visas, which could raise costs for Indian IT giants [7] [8]. “Markets remain weighed down by U.S. tariffs, visa reforms, and relentless foreign selling,” explained one analyst, noting upside will be capped until banking and IT stocks recover [9].

- Mixed Southeast Asia, Philippines hit hard: Thailand’s SET index climbed toward 1,290 on stimulus hopes despite Fitch cutting the country’s credit outlook to “negative” over fiscal risks [10] [11]. Vietnam’s VN-Index rallied for a third day, up 0.5% to ~1,666, led by a +6% surge in Vingroup shares [12] [13]. Indonesia and Malaysia were subdued amid a weak rupiah and cautious mood [14] [15]. Singapore’s STI slipped ~0.7% over two days after Fed Chair Jerome Powell warned of “fairly highly valued” equity prices [16]. In Manila, the PSE index plunged ~1% to 6,042, a 6-month low, as a corruption scandal in public works and a weak peso (₱58/$) spooked investors [17] [18].

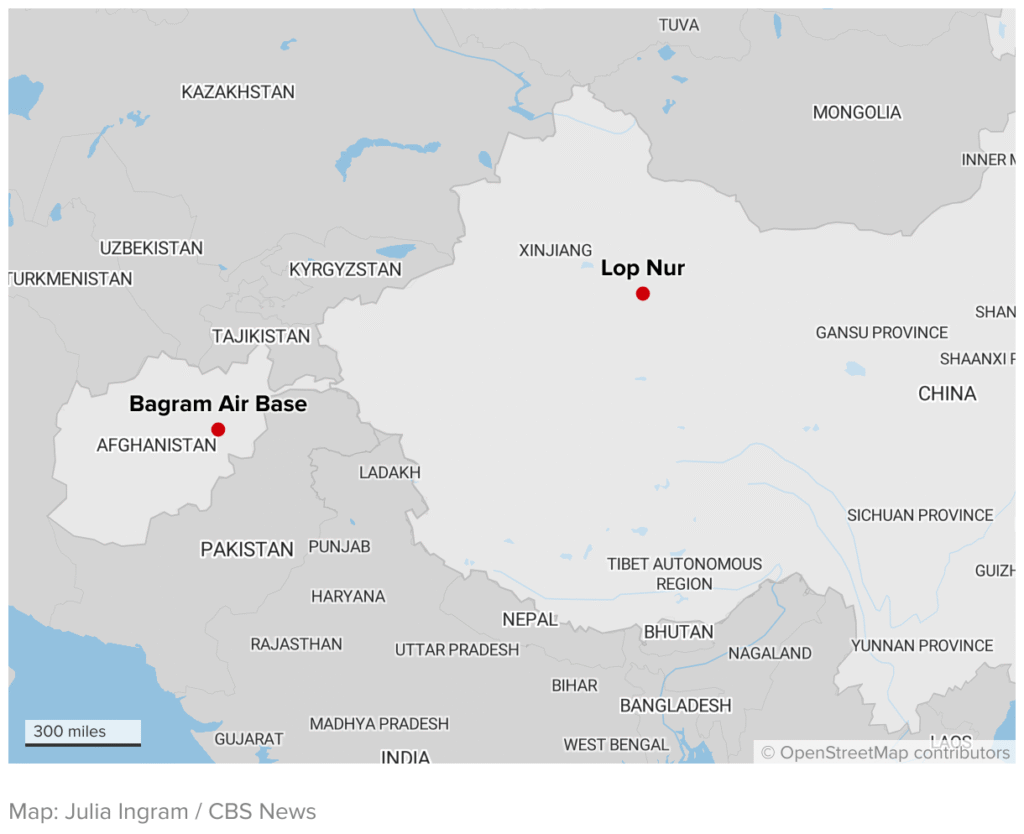

- Global influences: A bond-yield uptick and looming Fed speeches saw global markets pause their rally [19] [20]. Oil prices held near 7-week highs (~$64 WTI, $69 Brent) after a mid-week 2% jump on supply concerns [21] [22], boosting Asian energy stocks. Easing U.S.-China trade frictions also lifted sentiment – Beijing’s decision to forego certain WTO privileges was seen as “removing a point of contention” and a sign of improving ties [23] [24]. Meanwhile, Typhoon Ragasa briefly threatened Hong Kong (over 500 flights canceled) but had limited market impact [25].

Japan: Record Highs Amid Sector Rotation

Japan’s Nikkei 225 extended its remarkable 2025 rally, closing Sep 25 at ¥45,754.93, up 0.27% and marking a third consecutive record finish [26]. The broader TOPIX gained 0.47% to reach 3,185 [27]. Investors piled into previously lagging sectors – notably non-ferrous metals, which jumped 3.2% [28] – betting that broader participation will sustain the bull run. “These days, the stocks that lead the market’s gain rotate, which is a good sign for … further gains,” observed Shoichi Arisawa of IwaiCosmo Securities [29].

Cyclical and value plays outperformed: Sumitomo Metal Mining rocketed +11.3% after strength in copper prices [30]. Oil’s rise lifted energy stocks, with refiners up ~1.8% and Inpex +0.9% [31]. Utilities also climbed (Tokyo Electric Power +5.2% [32]) on rotation into defensives. In IPO news, Okinawa-based brewer Orion Breweries more than doubled its IPO price in debut, reflecting exuberant demand for new listings [33].

Not all high-fliers prospered – chip equipment maker Advantest fell 2.4% on profit-taking [34]. Still, market breadth was strong (nearly two-thirds of TSE prime stocks rose [35]). Analysts cautioned that rich valuations (the Nikkei is up ~13% this quarter [36]) and global yield pressures could spur volatility, but so far domestic dip-buying and robust earnings have kept Japan’s uptrend intact.

China & Hong Kong: Tech Stocks Jump, Policy Tailwinds

Chinese equities resumed their uptrend mid-week, powered by tech euphoria and hints of policy support. On Sep 24, the Shanghai Composite rose +0.83% (to 3,853.64) and CSI 300 blue-chip index +1.0%, while Hong Kong’s Hang Seng leapt +1.37% [37] [38]. Big technology and chipmakers led the charge: China’s STAR Market index surged ~3.5%, and a semiconductor sub-index soared +4.7% [39] on AI optimism. In Hong Kong, the Hang Seng Tech Index jumped 2.5%, tracking gains in mainland peers [40].

Alibaba was a standout driver. The e-commerce giant’s Hong Kong shares spiked 9.16% on Wednesday – their highest level since 2021 – after Alibaba announced plans to open its first data centers in Europe and Brazil and invest heavily in artificial intelligence [41]. Fellow Chinese tech names rallied in sympathy: JD.com climbed 3.6% and Meituan 0.9% on reports of new rules to foster competition in food delivery [42]. Investor sentiment also got a boost from a U.S.-China trade détente signal: Beijing said it would relinquish some WTO developing-nation benefits, a goodwill gesture “provid[ing] some sign of [the] two sides trying to improve relations,” according to Maybank analysts [43] [44].

By Sep 25, Chinese markets paused slightly after the sharp rally. The Shanghai index edged up ~0.1% to 3,856, while the Hang Seng added ~0.2% to around 26,540 (its highest in two weeks) before stabilizing [45]. Chinese equities have been among Asia’s top performers this quarter – the CSI 300 is up ~9% over the last three months [46] – fueled by hopes of looser monetary policy and a “money-making effect” drawing household savings into stocks [47]. State-backed funds have reportedly been accumulating shares, reinforcing the bull run [48]. With Chinese AI stocks on an eight-week winning streak [49], some traders cautioned that signs of fatigue are emerging after such a steep climb. Nevertheless, the combination of policy tweaks (e.g. softer stance on tech regulation, stimulus for property debt restructuring [50]) and improving U.S. ties has underpinned a cautiously optimistic outlook for China’s markets going forward.

India: Outflows and U.S. Visa Fees Temper Optimism

Indian stocks struggled to gain traction amid a mix of global and local headwinds. The benchmark BSE Sensex fell for a fifth straight session on Sep 25, ending around 81,630 (roughly –0.1% intraday, and about –0.5% for the full session) [51] [52]. The Nifty 50 similarly slipped to 25,032. Investors were unnerved by persistent foreign selling – overseas funds have pulled over $1.3 billion from Indian equities month-to-date [53] – and recent U.S. policy moves that could hit India’s key industries. In particular, Washington’s announcement of a new $100,000 fee for H-1B work visas raised concern for India’s flagship IT services sector, which relies on U.S. tech talent placement [54] [55]. Tech heavyweights like Infosys and TCS lagged on fears higher visa costs may crimp margins.

Broader sentiment was also dampened by the overhang of U.S. trade measures (the White House is reportedly maintaining tariffs in some areas) and rising U.S. yields which make emerging markets less attractive. “Markets remain weighed down by U.S. tariffs, visa reforms, and relentless foreign selling,” explained Ajit Mishra, research VP at Religare Broking, adding that while a short-term relief rally is possible, “any upside looks capped until private banks and IT show real recovery” [56]. Indeed, Indian bank stocks have struggled to advance lately, and the Nifty IT index is down about 1.4% over the past week [57].

There were a few bright spots. Oil & gas shares rose (~+0.4%) as global crude hit multi-week highs – state-run ONGC climbed +1.2% and Oil India +3.1%, a direct earnings boon for these upstream producers [58]. Consumer staples also got a lift after HSBC upgraded majors Britannia Industries and Nestlé India, citing an earnings rebound aided by recent tax cuts [59]. On the downside, auto makers extended losses after racing to record highs earlier in the week. Tata Motors sank –2.5% after reports of a major cyberattack at its Jaguar Land Rover unit, which could cost the company more than its entire FY25 profit [60].

Looking ahead, India’s market observers are watching for any pause in Fed tightening or domestic policy support (the central bank has eased rates this year) to revive risk appetite. For now, the mood remains cautious as the Sensex hovers just below all-time peaks, navigating a challenging environment of higher global rates and sector-specific hurdles.

South Korea: Trade Worries Weigh on Kospi

South Korea’s KOSPI index saw a mild pullback, reflecting unease over trade competitiveness and global tech softness. The index slipped ~0.2% on Sep 25 to around 3,467 [61], extending a modest losing streak. One immediate concern was a U.S.–EU trade deal that slashed American tariffs on European auto imports from 25% to 15%, leaving Korean automakers still facing the higher U.S. tariff. This disadvantage for Seoul’s car exporters hurt sentiment in Korea, where autos are a major industry [62]. Shares of Hyundai Motor and Kia drifted lower on the development.

Additionally, investors are digesting ongoing U.S.–Korea frictions around industrial policy. South Korean officials this week complained about U.S. visa hurdles for Korean engineers, which have disrupted operations (hundreds of Korean workers at an EV battery plant in Georgia were sent home due to visa issues) [63]. The Korean won also hovered near a one-year low against the dollar (~₩1,489/USD), which can inflate costs for importers but conversely helps exporters.

On the positive side, South Korea’s chip sector has shown signs of stabilizing as memory prices rebound, and foreign investors turned net buyers of some Korean tech stocks after heavy selling earlier in the year. Nonetheless, with external uncertainties—from U.S. trade policy to China’s economic trajectory—Korean equities have moved cautiously. The Bank of Korea’s recent rate pauses and hints of eventual policy easing have provided some support, but eyes are on global demand trends (especially for chips and cars) for the next catalyst. Seoul will also host a visit by U.S. officials soon, which could bring clarity on trade and visa issues. Until then, the Kospi’s advances may be limited by these overhangs.

Taiwan: AI Boom Meets Profit-Taking

Taiwan’s TAIEX stock index has been on a tear in recent weeks, repeatedly breaking record highs on the back of its world-class semiconductor sector and an AI investment boom. Earlier this week the Taiex surged past the 26,000 mark for the first time ever [64], with bellwether TSMC hitting an intraday record high (NT$1,355/share) before settling unchanged [65]. Robust liquidity and fervor for AI-related plays have fueled the rally. “The index has repeatedly set new highs this month, supported by liquidity and interest in AI-related shares,” noted Tsai Ming-han, a manager at Cathay Securities Investment Consulting [66]. Companies tied to AI hardware saw explosive demand – for instance, contract manufacturer Compal Electronics closed limit-up on Wednesday after reportedly winning a massive NT$100 billion order for AI server equipment [67] [68]. Dozens of Taipei-listed tech firms (from server makers to chip test equipment suppliers) have hit 52-week highs, buoyed by Nvidia’s $100B investment in OpenAI and other big-cap AI spending plans [69].

By Thursday Sep 25, however, profit-taking set in. The Taiex “fluctuated…before profit-taking brought the index lower” [70]. After reaching a fresh intraday peak above 26,390, the index retreated ~0.7% from those highs to close around 26,197 [71]. Market breadth turned mixed as traders locked in gains from the AI frenzy. High-flyers like MediaTek fell over 3% [72], and the number of stocks trading above NT$1,000 per share ticked down as some momentum names pulled back [73]. Still, the uptrend remains intact – the Taiex is up double-digits percentage-wise in 2025, and foreign investors have been net buyers of Taiwanese shares amid confidence in its chip giants.

Analysts caution that any upside surprises in U.S. inflation or a slower pace of Fed rate cuts could pose a risk to Taiwan’s lofty valuations [74]. But for now, the island’s equity story is one of innovation-driven growth: strong tech earnings, anticipated policy stability ahead of January’s elections, and global AI demand are underpinning optimism (tempered by healthy bouts of profit-taking after big runs).

Southeast Asia: Diverging Fortunes in Emerging Markets

Across ASEAN markets, performance was mixed during Sep 24–25, with local factors driving each bourse:

- Thailand: The SET Index climbed on both days, nearing the 1,290 level with a weekly gain of about +1%. This resilience came despite Fitch Ratings revising Thailand’s outlook to “negative” on Sep 24 (citing rising public debt and political uncertainty) [75]. The new Prime Minister responded by meeting market regulators and pledging confidence-boosting measures. Investors are “monitoring…economic-centric cabinet” meetings that could deliver stimulus for the capital market, which “buoyed the stock market” in anticipation [76]. Energy stocks provided a tailwind as well, thanks to higher oil prices [77]. In all, Thai shares appear to be looking past the credit warning toward potential short-term fiscal boosts.

- Vietnam: Vietnam’s VN-Index extended its bull run, rising +1.36% on Sep 24 and another +0.5% on Sep 25 to around 1,666 [78]. This marked a third straight rally, putting the index at fresh multi-year highs. The charge was led by the “Vin” family of stocks – real estate giant Vinhomes (VHM) rebounded late Thursday to +1.5%, and parent Vingroup (VIC) rocketed +6.0%, adding over 8.5 points to the index by itself [79] [80]. Mid-cap and small-cap shares also saw heavy trading and solid gains, even as foreign investors net sold Vietnamese equities (local buyers readily absorbed the supply) [81] [82]. Market strategists note that Vietnam’s equity boom (VN-Index >30% YTD) has been fueled by abundant liquidity and retail investor enthusiasm, though valuations are becoming stretched.

- Malaysia: Malaysia’s FTSE KLCI hovered flat to slightly lower, essentially straddling the 1,600 milestone. After a small uptick on Sep 24, the KLCI eased 0.07% on Sep 25 to 1,598.5 [83]. Investors stayed mostly cautious on the sidelines, awaiting new catalysts while regional peers saw bigger moves [84]. Mild losses in bank heavyweights (CIMB, Maybank) and telcos offset gains in energy and plantation stocks. Local institutions were net buyers, lending some support [85]. Overall sentiment in Kuala Lumpur is one of consolidation; the market is looking toward Malaysia’s upcoming budget and any policy changes for direction.

- Indonesia: Jakarta’s JCI (Composite Index) was range-bound but with a slight downside bias. The index was virtually flat on Sep 24 (+0.02% to 8,126) [86], then edged down ~0.5% on Sep 25 to just under 8,090 [87]. Indonesian stocks have struggled recently (the JCI is Southeast Asia’s laggard, down ~2% YTD [88]), and pressure on the rupiah is a big factor. The rupiah slid to five-month lows near 16,650 per USD amid fiscal worries – Indonesia’s parliament approved a 2024 budget with a wider deficit, raising concerns about debt supply [89]. That currency weakness and a surprise rate cut by Bank Indonesia last week have foreign investors wary, even as lower rates could eventually support growth. On the ground, Indonesia’s commodity stocks (coal, palm oil) saw some buying thanks to firm prices, but it wasn’t enough to lift the broad market. Eyes are on whether BI will intervene to stabilize the rupiah or if any pre-election spending will stimulate the exchange.

- Philippines: The PSEi in Manila was Asia’s worst performer, tumbling ~1.1% on Sep 25 to 6,042.28, its lowest close in over six months [90] [91]. This marked the third straight daily drop for Philippine equities [92]. A confluence of negatives hit sentiment: Ongoing Senate hearings have uncovered a web of alleged corruption in government flood control projects, reviving governance concerns [93]. At the same time, the peso weakened past ₱58 per USD (a ~2% monthly drop), stoking inflation worries for the import-dependent economy [94] [95]. The mining & oil sector plunged 2.8%, leading a market-wide decline with decliners outnumbering advancers 2-to-1 [96] [97]. Foreign investors, interestingly, were small net buyers on the day, suggesting local institutions were the ones selling amid the negative headlines [98]. The Philippine central bank has signaled readiness to support the peso (to curb imported inflation), and the government is attempting to address the corruption allegations swiftly. Until there’s clarity, however, Philippine stocks may remain under pressure near the psychological 6,000 level – which, if breached, would intensify bearish sentiment.

Outlook: Cautious Optimism vs. Global Uncertainties

As the third quarter of 2025 closes, Asia’s markets present a tapestry of robust rallies and emerging risks. Many regional indices – Japan’s Nikkei, China’s CSI 300, Taiwan’s Taiex – are near multi-year or record highs, reflecting confidence in post-pandemic growth engines like technology and AI. Even some laggards (Thailand, Vietnam) are seeing renewed investor interest as new governments roll out pro-market policies or as valuations look attractive.

Yet, the risks are equally prominent. Global macro factors are flashing mixed signals: U.S. Federal Reserve policy remains a key overhang, with traders parsing every Fed speaker’s comments for clues on rate cuts or a pause. Rising U.S. bond yields have begun to temper risk appetite worldwide [99]. Geopolitically, the return of U.S. tariffs and trade friction (under the Trump administration) is casting a shadow – from India’s IT visa fees to Thailand’s slower export outlook [100]. Any escalation in Sino-U.S. tensions, despite recent improvements, could quickly derail the tech-led optimism in Chinese markets.

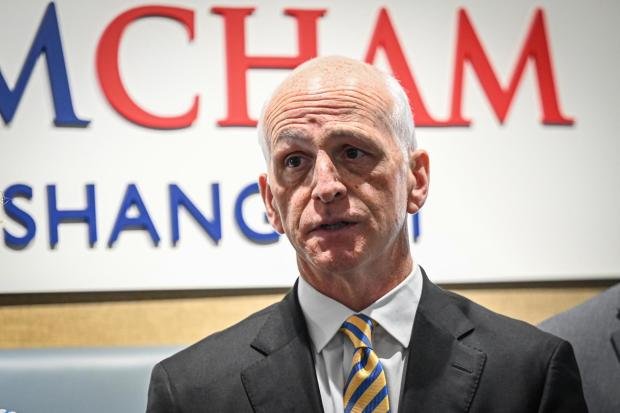

Market strategists advise selectivity going forward. “For retail investors there are a few more reasons to be concerned about equities at the moment than be confident,” noted Richard Flynn of Charles Schwab UK, after Fed Chair Powell’s valuation warning [101]. Indeed, pockets of exuberance (such as the AI stock surge) may face corrections. On the other hand, Asia’s fundamentals – moderating inflation, rate cuts in places like China, India, and Thailand, and still-resilient corporate earnings – provide a buffer. Major institutions like the IMF continue to forecast decent growth for Asia into 2026, albeit with downside risks if global conditions deteriorate.

For now, investors in Asian equities are navigating a delicate balance. Opportunity lies in transformative sectors (technology, renewable energy, consumer upgrades) and in markets with reform momentum. Caution is warranted where debts are mounting or politics are unsettled. The coming days will bring crucial data (U.S. inflation, China PMIs) and policy signals that could sway sentiment. After a volatile two-day period that saw records broken in some markets and confidence shaken in others, one thing is clear: Asia’s market narrative is increasingly divergent by country, making regional diversification and diligent research more important than ever for investors seeking to ride the next wave while guarding against pitfalls.

Sources: Official market data and news reports from Reuters, AP, Bloomberg, Saxo Bank, and local financial media [102] [103] [104] [105] [106] (see citations throughout).

Asian Market Chaos@farhanefendi-ai

References

1. www.tradingview.com, 2. www.tradingview.com, 3. www.brecorder.com, 4. www.brecorder.com, 5. www.brecorder.com, 6. www.home.saxo, 7. www.reuters.com, 8. www.reuters.com, 9. www.reuters.com, 10. www.reuters.com, 11. www.kaohooninternational.com, 12. vietnamnews.vn, 13. vietnamnews.vn, 14. tradingeconomics.com, 15. www.businesstoday.com.my, 16. www.reuters.com, 17. tribune.net.ph, 18. tribune.net.ph, 19. www.reuters.com, 20. www.reuters.com, 21. www.reuters.com, 22. www.reuters.com, 23. www.brecorder.com, 24. www.brecorder.com, 25. www.home.saxo, 26. www.tradingview.com, 27. www.tradingview.com, 28. www.tradingview.com, 29. www.tradingview.com, 30. www.tradingview.com, 31. www.tradingview.com, 32. www.tradingview.com, 33. www.tradingview.com, 34. www.tradingview.com, 35. www.tradingview.com, 36. www.reuters.com, 37. www.brecorder.com, 38. www.brecorder.com, 39. www.brecorder.com, 40. www.brecorder.com, 41. www.brecorder.com, 42. www.home.saxo, 43. www.brecorder.com, 44. www.brecorder.com, 45. www.ctpost.com, 46. www.reuters.com, 47. www.brecorder.com, 48. www.scmp.com, 49. www.reuters.com, 50. www.home.saxo, 51. www.reuters.com, 52. www.livemint.com, 53. www.reuters.com, 54. www.reuters.com, 55. www.reuters.com, 56. www.reuters.com, 57. www.reuters.com, 58. www.reuters.com, 59. www.reuters.com, 60. www.reuters.com, 61. www.ctpost.com, 62. www.ctpost.com, 63. www.bloomberg.com, 64. www.taiwannews.com.tw, 65. www.taiwannews.com.tw, 66. www.taiwannews.com.tw, 67. www.taiwannews.com.tw, 68. www.taiwannews.com.tw, 69. www.taiwannews.com.tw, 70. www.taiwannews.com.tw, 71. www.taiwannews.com.tw, 72. www.taiwannews.com.tw, 73. www.taiwannews.com.tw, 74. www.taiwannews.com.tw, 75. www.reuters.com, 76. www.kaohooninternational.com, 77. www.kaohooninternational.com, 78. www.investing.com, 79. vietnamnews.vn, 80. vietnamnews.vn, 81. vietnamnews.vn, 82. vietnamnews.vn, 83. www.businesstoday.com.my, 84. www.businesstoday.com.my, 85. www.businesstoday.com.my, 86. databoks.katadata.co.id, 87. www.investing.com, 88. www.reuters.com, 89. www.forsythbarr.co.nz, 90. business.inquirer.net, 91. tribune.net.ph, 92. www.philstar.com, 93. tribune.net.ph, 94. tribune.net.ph, 95. tribune.net.ph, 96. tribune.net.ph, 97. tribune.net.ph, 98. tribune.net.ph, 99. www.reuters.com, 100. www.reuters.com, 101. www.reuters.com, 102. www.tradingview.com, 103. www.brecorder.com, 104. www.reuters.com, 105. www.reuters.com, 106. tribune.net.ph